Schedule I-1040-Py - Individual Income Tax - City Of Ionia, 2000

ADVERTISEMENT

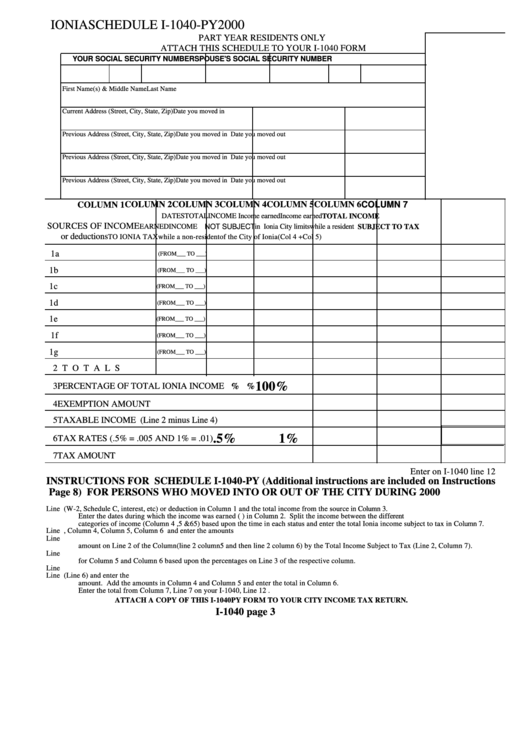

IONIA

SCHEDULE I-1040-PY

2000

PART YEAR RESIDENTS ONLY

ATTACH THIS SCHEDULE TO YOUR I-1040 FORM

YOUR SOCIAL SECURITY NUMBER

SPOUSE'S SOCIAL SECURITY NUMBER

First Name(s) & Middle Name

Last Name

Current Address (Street, City, State, Zip)

Date you moved in

Previous Address (Street, City, State, Zip)

Date you moved in

Date you moved out

Previous Address (Street, City, State, Zip)

Date you moved in

Date you moved out

Previous Address (Street, City, State, Zip)

Date you moved in

Date you moved out

COLUMN 2COLUMN 3 COLUMN 4

COLUMN 1

COLUMN 5

COLUMN 6

COLUMN 7

DATES

TOTAL

INCOME

Income earned

Income earned

TOTAL INCOME

SOURCES OF INCOME

EARNED

INCOME NOT SUBJECT

in Ionia City limits while a resident

SUBJECT TO TAX

or deductions

TO IONIA TAX

while a non-resident of the City of Ionia

(Col 4 +Col 5)

1a

(FROM___ TO ___)

1b

(FROM___ TO ___)

1c

(FROM___ TO ___)

1d

(FROM___ TO ___)

1e

(FROM___ TO ___)

1f

(FROM___ TO ___)

1g

(FROM___ TO ___)

2 TOTALS

100%

3 PERCENTAGE OF TOTAL IONIA INCOME

%

%

4 EXEMPTION AMOUNT

5 TAXABLE INCOME (Line 2 minus Line 4)

.5%

1%

6 TAX RATES (.5% = .005 AND 1% = .01)

7 TAX AMOUNT

Enter on I-1040 line 12

INSTRUCTIONS FOR SCHEDULE I-1040-PY (Additional instructions are included on Instructions

Page 8) FOR PERSONS WHO MOVED INTO OR OUT OF THE CITY DURING 2000

Line 1.

List each source of income (W-2, Schedule C, interest, etc) or deduction in Column 1 and the total income from the source in Column 3.

Enter the dates during which the income was earned (e.g. from 1/1/00 - 3/12/00) in Column 2. Split the income between the different

categories of income (Column 4 ,5 &65) based upon the time in each status and enter the total Ionia income subject to tax in Column 7.

Line 2.

Total Column 3, Column 4, Column 5, Column 6 and enter the amounts

Line 3.

Compute and enter in Column 5 and Column6 the percentage of Total Income Subject to Tax by dividing the

amount on Line 2 of the Column(line 2 column5 and then line 2 column 6) by the Total Income Subject to Tax (Line 2, Column 7).

Line 4.

Enter in Column 7 the total exemption credit from the I-1040 Line 10 and compute the exemption credit

for Column 5 and Column 6 based upon the percentages on Line 3 of the respective column.

Line 5.

Subtract Line 4 from Line 2 and enter the difference.

Line 7.

Multiply Line 5 of Column 5 and Column 6 by the tax rate for the column (Line 6) and enter the

amount. Add the amounts in Column 4 and Column 5 and enter the total in Column 6.

Enter the total from Column 7, Line 7 on your I-1040, Line 12 .

ATTACH A COPY OF THIS I-1040PY FORM TO YOUR CITY INCOME TAX RETURN.

I-1040 page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1