Form 502e - Virginia Pass Through Entity Filing Extension Request - 2004

ADVERTISEMENT

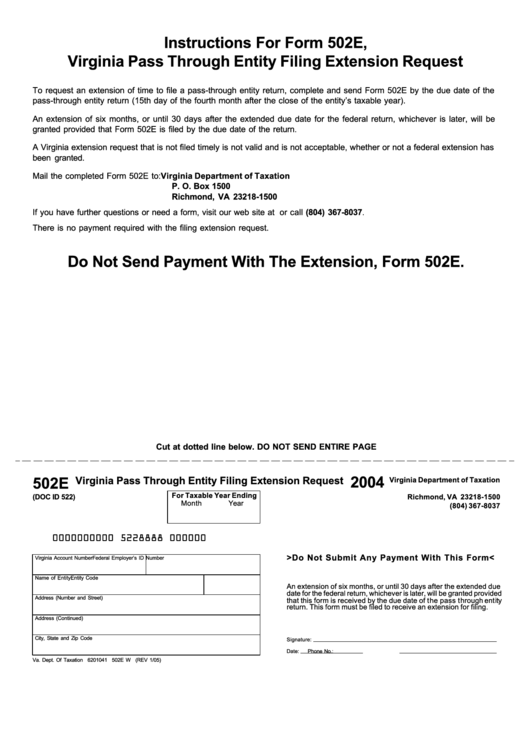

Instructions For Form 502E,

Virginia Pass Through Entity Filing Extension Request

To request an extension of time to file a pass-through entity return, complete and send Form 502E by the due date of the

pass-through entity return (15th day of the fourth month after the close of the entity’s taxable year).

An extension of six months, or until 30 days after the extended due date for the federal return, whichever is later, will be

granted provided that Form 502E is filed by the due date of the return.

A Virginia extension request that is not filed timely is not valid and is not acceptable, whether or not a federal extension has

been granted.

Mail the completed Form 502E to:

Virginia Department of Taxation

P. O. Box 1500

Richmond, VA 23218-1500

If you have further questions or need a form, visit our web site at or call (804) 367-8037.

There is no payment required with the filing extension request.

Do Not Send Payment With The Extension, Form 502E.

Cut at dotted line below. DO NOT SEND ENTIRE PAGE

2004

502E

Virginia Pass Through Entity Filing Extension Request

Virginia Department of Taxation

P.O. Box 1500

For Taxable Year Ending

(DOC ID 522)

Richmond, VA 23218-1500

Month

Year

(804) 367-8037

0000000000 5228888 000000

>Do Not Submit Any Payment With This Form<

Virginia Account Number

Federal Employer’s ID Number

Name of Entity

Entity Code

An extension of six months, or until 30 days after the extended due

date for the federal return, whichever is later, will be granted provided

Address (Number and Street)

that this form is received by the due date of the pass through entity

return. This form must be filed to receive an extension for filing.

Address (Continued)

City, State and Zip Code

Signature:

Date:

Phone No.:

Va. Dept. Of Taxation

6201041

502E W

(REV 1/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1