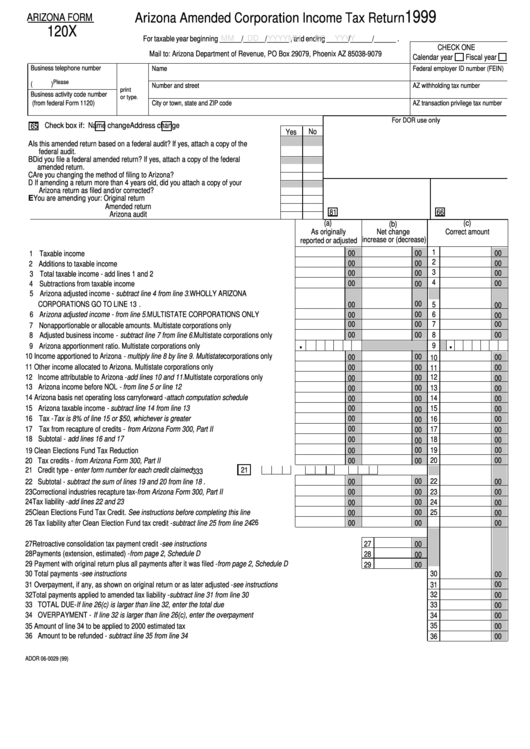

Arizona Form 120x - Amended Corporation Income Tax Return - 1999

ADVERTISEMENT

1999

Arizona Amended Corporation Income Tax Return

ARIZONA FORM

120X

For taxable year beginning ______/______/______ , and ending ______/______/______ .

MM

DD

YYYY

MM

DD

YYYY

CHECK ONE

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

Calendar year

Fiscal year

Business telephone number

Name

Federal employer ID number (FEIN)

Please

(

)

Number and street

AZ withholding tax number

print

Business activity code number

or type.

(from federal Form 1120)

City or town, state and ZIP code

AZ transaction privilege tax number

For DOR use only

Check box if:

Name change

Address change

65

No

Yes

A Is this amended return based on a federal audit? If yes, attach a copy of the

federal audit.

B Did you file a federal amended return? If yes, attach a copy of the federal

amended return.

C Are you changing the method of filing to Arizona?

D If amending a return more than 4 years old, did you attach a copy of your

Arizona return as filed and/or corrected?

E You are amending your: Original return ......................................................................

Amended return ...................................................................

81

66

Arizona audit ........................................................................

(a)

(c)

(b)

Net change

Correct amount

As originally

increase or (decrease)

reported or adjusted

1

00

00

00

1 Taxable income ....................................................................................................................

2

2 Additions to taxable income .................................................................................................

00

00

00

3

00

00

00

3 Total taxable income - add lines 1 and 2 .............................................................................

4

00

00

4 Subtractions from taxable income ........................................................................................

00

5 Arizona adjusted income - subtract line 4 from line 3. WHOLLY ARIZONA

CORPORATIONS GO TO LINE 13 ......................................................................................

00

00

5

00

6 Arizona adjusted income - from line 5. MULTISTATE CORPORATIONS ONLY ................

00

6

00

00

00

00

7

00

7 Nonapportionable or allocable amounts. Multistate corporations only .................................

00

00

00

8 Adjusted business income - subtract line 7 from line 6. Multistate corporations only .........

8

·

·

9

9 Arizona apportionment ratio. Multistate corporations only ...................................................

10 Income apportioned to Arizona - multiply line 8 by line 9. Multistate corporations only .......

00

00

00

10

11 Other income allocated to Arizona. Multistate corporations only .........................................

00

00

00

11

12 Income attributable to Arizona - add lines 10 and 11. Multistate corporations only .............

12

00

00

00

13 Arizona income before NOL - from line 5 or line 12 .............................................................

13

00

00

00

14 Arizona basis net operating loss carryforward - attach computation schedule ....................

14

00

00

00

15 Arizona taxable income - subtract line 14 from line 13 ........................................................

00

15

00

00

16 Tax - Tax is 8% of line 15 or $50, whichever is greater........................................................

00

00

16

00

17 Tax from recapture of credits - from Arizona Form 300, Part II ...........................................

00

17

00

00

18 Subtotal - add lines 16 and 17 ..............................................................................................

00

18

00

00

19

00

00

00

19 Clean Elections Fund Tax Reduction ...................................................................................

20

00

20 Tax credits - from Arizona Form 300, Part II ........................................................................

00

00

21 Credit type - enter form number for each credit claimed ..................

21

3

3

3

00

00

22

00

22 Subtotal - subtract the sum of lines 19 and 20 from line 18 .................................................

23 Correctional industries recapture tax - from Arizona Form 300, Part II ................................

00

00

23

00

24 Tax liability - add lines 22 and 23 .........................................................................................

00

00

24

00

25 Clean Elections Fund Tax Credit. See instructions before completing this line ..................

00

00

25

00

26

26 Tax liability after Clean Election Fund tax credit - subtract line 25 from line 24 ...................

00

00

00

27 Retroactive consolidation tax payment credit - see instructions ................................................................................

27

00

28 Payments (extension, estimated) - from page 2, Schedule D ...................................................................................

28

00

29 Payment with original return plus all payments after it was filed - from page 2, Schedule D ...................................

29

00

30 Total payments - see instructions ...................................................................................................................................................................

30

00

31 Overpayment, if any, as shown on original return or as later adjusted - see instructions ..............................................................................

31

00

32 Total payments applied to amended tax liability - subtract line 31 from line 30 .............................................................................................

32

00

33 TOTAL DUE - If line 26(c) is larger than line 32, enter the total due ..............................................................................................................

33

00

34 OVERPAYMENT - If line 32 is larger than line 26(c), enter the overpayment ................................................................................................

34

00

35 Amount of line 34 to be applied to 2000 estimated tax ...................................................................................................................................

35

00

36 Amount to be refunded - subtract line 35 from line 34 ...................................................................................................... . .............................

36

00

ADOR 06-0029 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2