RESET FORM

F

KE-1 (R

. 11/03)

ORM

EV

E

D

V

STIMATED

ECLARATION

OUCHER

P.O. B

293100 / K

, O

45429-9100

OX

ETTERING

HIO

P

: (937) 296-2502 • F

: (937) 296-3242

HONE

AX

N

E

T

Y

A

#

ET

STIMATED

AX

EAR

CCOUNT

T

Y

$

AX FOR THE

EAR

L

: P

P

Q

SS#

FID#

ESS

REVIOUS

AYMENTS

UARTER

OR

T

D

$

O

ATE

A

MENDED

❏ Y

❏ N

B

D

D

D

ALANCE

UE

UE

ATE

ES

O

F

?

ILING

O

R

Q

.

$

VER

EMAINING

TRS

Name ______________________________________________

Q

A

E

$

UARTERLY

MOUNT

NCLOSED

Address ____________________________________________

M

:

AKE CHECK OR MONEY ORDER PAYABLE TO

C

K

— T

D

ITY OF

ETTERING

AX

IVISION

City/State/Zip _________________________________________

SUBMIT THIS COPY

F

KE-1 (R

. 11/03)

ORM

EV

E

D

V

STIMATED

ECLARATION

OUCHER

P.O. B

293100 / K

, O

45429-9100

OX

ETTERING

HIO

P

: (937) 296-2502 • F

: (937) 296-3242

HONE

AX

N

E

T

Y

A

#

ET

STIMATED

AX

EAR

CCOUNT

T

Y

$

AX FOR THE

EAR

L

: P

P

Q

SS#

FID#

ESS

REVIOUS

AYMENTS

UARTER

OR

T

D

$

O

ATE

A

MENDED

❏ Y

❏ N

B

D

D

D

ALANCE

UE

UE

ATE

F

?

ES

O

ILING

O

R

Q

.

$

VER

EMAINING

TRS

Name ______________________________________________

Q

A

E

$

UARTERLY

MOUNT

NCLOSED

Address ____________________________________________

M

:

AKE CHECK OR MONEY ORDER PAYABLE TO

C

K

— T

D

ITY OF

ETTERING

AX

IVISION

City/State/Zip _________________________________________

KEEP THIS COPY

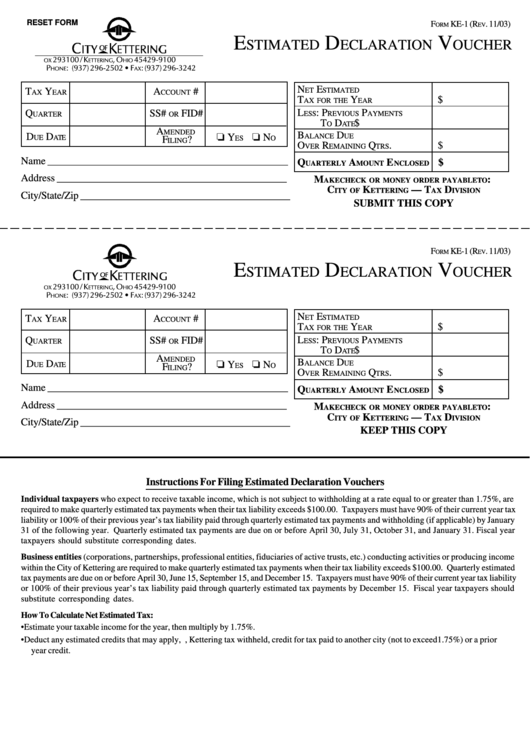

Instructions For Filing Estimated Declaration Vouchers

Individual taxpayers who expect to receive taxable income, which is not subject to withholding at a rate equal to or greater than 1.75%, are

required to make quarterly estimated tax payments when their tax liability exceeds $100.00. Taxpayers must have 90% of their current year tax

liability or 100% of their previous year’s tax liability paid through quarterly estimated tax payments and withholding (if applicable) by January

31 of the following year. Quarterly estimated tax payments are due on or before April 30, July 31, October 31, and January 31. Fiscal year

taxpayers should substitute corresponding dates.

Business entities (corporations, partnerships, professional entities, fiduciaries of active trusts, etc.) conducting activities or producing income

within the City of Kettering are required to make quarterly estimated tax payments when their tax liability exceeds $100.00. Quarterly estimated

tax payments are due on or before April 30, June 15, September 15, and December 15. Taxpayers must have 90% of their current year tax liability

or 100% of their previous year’s tax liability paid through quarterly estimated tax payments by December 15. Fiscal year taxpayers should

substitute corresponding dates.

How To Calculate Net Estimated Tax:

• Estimate your taxable income for the year, then multiply by 1.75%.

• Deduct any estimated credits that may apply, i.e., Kettering tax withheld, credit for tax paid to another city (not to exceed 1.75%) or a prior

year credit.

1

1