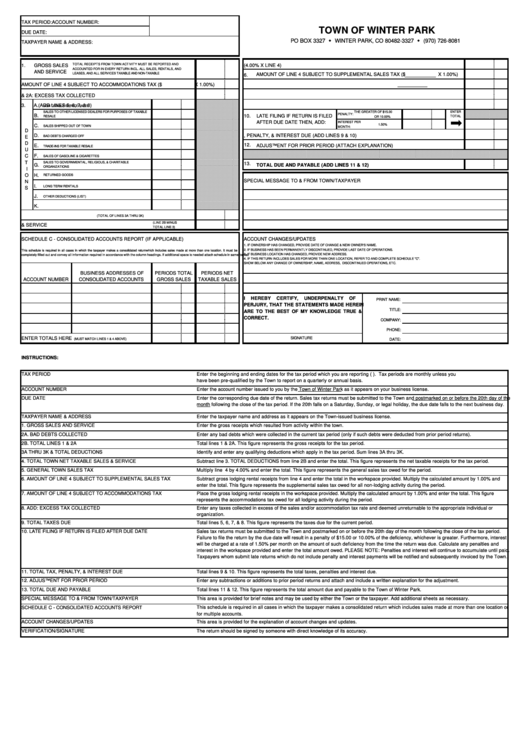

Town Of Winter Park Tax Declaration

ADVERTISEMENT

TAX PERIOD:

ACCOUNT NUMBER:

TOWN OF WINTER PARK

DUE DATE:

PO BOX 3327

WINTER PARK, CO 80482-3327

(970) 726-8081

TAXPAYER NAME & ADDRESS:

TOTAL RECEIPTS FROM TOWN ACTIVITY MUST BE REPORTED AND

5.

GENERAL TOWN SALES TAX (4.00% X LINE 4)

1.

GROSS SALES

ACCOUNTED FOR IN EVERY RETURN INCL. ALL SALES, RENTALS, AND

AND SERVICE

LEASES, AND ALL SERVICES TAXABLE AND NON-TAXABLE

AMOUNT OF LINE 4 SUBJECT TO SUPPLEMENTAL SALES TAX ($

X 1.00%)

6.

AMOUNT OF LINE 4 SUBJECT TO ACCOMMODATIONS TAX ($

X 1.00%)

2A.

BAD DEBTS COLLECTED

7.

2B.

TOTAL LINES 1 & 2A

8.

ADD: EXCESS TAX COLLECTED

3.

A.

9.

TOTAL TAXES DUE (ADD LINES 5, 6, 7, & 8)

NON-TAXABLE SERVICE SALES

SALES TO OTHER LICENSED DEALERS FOR PURPOSES OF TAXABLE

ENTER

THE GREATER OF $15.00

PENALTY:

B.

10.

LATE FILING IF RETURN IS FILED

TOTAL

RESALE

OR 10.00%

AFTER DUE DATE THEN, ADD:

INTEREST PER

1.50%

C.

SALES SHIPPED OUT OF TOWN

MONTH:

D

D.

11.

TOTAL TAX, PENALTY, & INTEREST DUE (ADD LINES 9 & 10)

BAD DEBTS CHARGED OFF

E

D

12.

E.

ADJUSTMENT FOR PRIOR PERIOD (ATTACH EXPLANATION)

TRADE-INS FOR TAXABLE RESALE

U

C

F.

SALES OF GASOLINE & CIGARETTES

T

SALES TO GOVERNMENTAL, RELIGIOUS, & CHARITABLE

13.

G.

TOTAL DUE AND PAYABLE (ADD LINES 11 & 12)

ORGANIZATIONS

I

O

H.

RETURNED GOODS

SPECIAL MESSAGE TO & FROM TOWN/TAXPAYER

N

I.

LONG TERM RENTALS

S

J.

OTHER DEDUCTIONS (LIST)

K.

3.

TOTAL DEDUCTIONS

(TOTAL OF LINES 3A THRU 3K)

(LINE 2B MINUS

4.

TOTAL TOWN NET TAXABLE SALES & SERVICE

TOTAL LINE 3)

SCHEDULE C - CONSOLIDATED ACCOUNTS REPORT (IF APPLICABLE)

ACCOUNT CHANGES/UPDATES

1. IF OWNERSHIP HAS CHANGED, PROVIDE DATE OF CHANGE & NEW OWNER'S NAME.

2. IF BUSINESS HAS BEEN PERMANENTLY DISCONTINUED, PROVIDE LAST DATE OF OPERATIONS.

This schedule is required in all cases in which the taxpayer makes a consolidated return which includes sales made at more than one location. It must be

3. IF BUSINESS LOCATION HAS CHANGED, PROVIDE NEW ADDRESS.

completely filled out and convey all information required in accordance with the column headings. If additional space is needed attach schedule in same format.

4. IF THIS RETURN INCLUDES SALES FOR MORE THAN ONE LOCATION, REFER TO AND COMPLETE SCHEDULE "C".

SHOW BELOW ANY CHANGE OF OWNERSHIP, NAME, ADDRESS, DISCONTINUED OPERATIONS, ETC.

BUSINESS ADDRESSES OF

PERIODS TOTAL

PERIODS NET

ACCOUNT NUMBER

CONSOLIDATED ACCOUNTS

GROSS SALES

TAXABLE SALES

I

HEREBY

CERTIFY,

UNDER

PENALTY

OF

PRINT NAME:

PERJURY, THAT THE STATEMENTS MADE HEREIN

TITLE:

ARE TO THE BEST OF MY KNOWLEDGE TRUE &

CORRECT.

COMPANY:

COMPANY:

PHONE:

ENTER TOTALS HERE

SIGNATURE

(MUST MATCH LINES 1 & 4 ABOVE)

DATE:

INSTRUCTIONS:

TAX PERIOD

Enter the beginning and ending dates for the tax period which you are reporting (i.e. 01/01/09 - 01/31/09). Tax periods are monthly unless you

have been pre-qualified by the Town to report on a quarterly or annual basis.

ACCOUNT NUMBER

Enter the account number issued to you by the Town of Winter Park as it appears on your business license.

DUE DATE

Enter the corresponding due date of the return. Sales tax returns must be submitted to the Town and postmarked on or before the 20th day of the

month following the close of the tax period. If the 20th falls on a Saturday, Sunday, or legal holiday, the due date falls to the next business day.

TAXPAYER NAME & ADDRESS

Enter the taxpayer name and address as it appears on the Town-issued business license.

1. GROSS SALES AND SERVICE

Enter the gross receipts which resulted from activity within the town.

2A. BAD DEBTS COLLECTED

Enter any bad debts which were collected in the current tax period (only if such debts were deducted from prior period returns).

2B. TOTAL LINES 1 & 2A

Total lines 1 & 2A. This figure represents the gross receipts for the tax period.

3A THRU 3K & TOTAL DEDUCTIONS

Identify and enter any qualifying deductions which apply in the tax period. Sum lines 3A thru 3K.

4. TOTAL TOWN NET TAXABLE SALES & SERVICE

Subtract line 3. TOTAL DEDUCTIONS from line 2B and enter the total. This figure represents the net taxable receipts for the tax period.

5. GENERAL TOWN SALES TAX

Multiply line 4 by 4.00% and enter the total. This figure represents the general sales tax owed for the period.

6. AMOUNT OF LINE 4 SUBJECT TO SUPPLEMENTAL SALES TAX

Subtract gross lodging rental receipts from line 4 and enter the total in the workspace provided. Multiply the calculated amount by 1.00% and

enter the total. This figure represents the supplemental sales tax owed for all non-lodging activity during the period.

7. AMOUNT OF LINE 4 SUBJECT TO ACCOMMODATIONS TAX

Place the gross lodging rental receipts in the workspace provided. Multiply the calculated amount by 1.00% and enter the total. This figure

represents the accommodations tax owed for all lodging activity during the period.

8. ADD: EXCESS TAX COLLECTED

Enter any taxes collected in excess of the sales and/or accommodation tax rate and deemed unreturnable to the appropriate individual or

organization.

9. TOTAL TAXES DUE

Total lines 5, 6, 7, & 8. This figure represents the taxes due for the current period.

10. LATE FILING IF RETURN IS FILED AFTER DUE DATE

Sales tax returns must be submitted to the Town and postmarked on or before the 20th day of the month following the close of the tax period.

Failure to file the return by the due date will result in a penalty of $15.00 or 10.00% of the deficiency, whichever is greater. Furthermore, interest

will be charged at a rate of 1.50% per month on the amount of such deficiency from the time the return was due. Calculate any penalties and

interest in the workspace provided and enter the total amount owed. PLEASE NOTE: Penalties and interest will continue to accumulate until paid.

Taxpayers whom submit late returns which do not include penalty and interest payments will be notified and subsequently invoiced by the Town.

11. TOTAL TAX, PENALTY, & INTEREST DUE

Total lines 9 & 10. This figure represents the total taxes, penalties and interest due.

12. ADJUSTMENT FOR PRIOR PERIOD

Enter any subtractions or additions to prior period returns and attach and include a written explanation for the adjustment.

13. TOTAL DUE AND PAYABLE

Total lines 11 & 12. This figure represents the total amount due and payable to the Town of Winter Park.

SPECIAL MESSAGE TO & FROM TOWN/TAXPAYER

This area is provided for brief notes and may be used by either the Town or the taxpayer. Add additional sheets as necessary.

SCHEDULE C - CONSOLIDATED ACCOUNTS REPORT

This schedule is required in all cases in which the taxpayer makes a consolidated return which includes sales made at more than one location or

for multiple accounts.

ACCOUNT CHANGES/UPDATES

This area is provided for the explanation of account changes and updates.

VERIFICATION/SIGNATURE

The return should be signed by someone with direct knowledge of its accuracy.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1