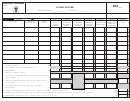

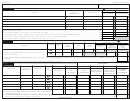

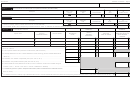

Schedule F Individual - Other Income - 2012 Page 2

ADVERTISEMENT

Schedule F Individual - Page 2

Rev. Feb 19 13

Taxpayer's name

Social Security Number

Part II

Corporate Dividends

34

Column A

Column B

Employer

Payer's name

Account Number

Not subject to withholding

Identification Number

Subject to withholding

00

00

(01)

00

00

(02)

00

00

(03)

00

00

(04)

00

00

(05)

00

00

Dividends distributed amount ....................................

(11)

1.

......................................................................................................................................................................................................................

(06)

00

00

2. Less: Expenses related to the purchase of investments (See instructions) .....................................................................................................................................

(12)

(07)

00

00

3. Subtotal (Subtract line 2 from line 1, Columns A and B. Transfer the total of Column A to line 4(f), Columns A and D of Schedule A2 Individual) ...........................................................

(13)

(08)

00

4. Total (Add line 3, Columns A and B and transfer to Part 1, line 2D of the return or line 3D of Schedule CO Individual) ...............................................................................................................

(09)

5. Tax withheld (Submit Form 480.6B. Enter on Schedule B Individual, Part III, line 5) ...................................................................................................................

00

(10)

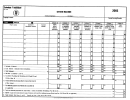

Part III

Distributions and Transfers from Governmental Plans

40

Taxable Amount - Savings Account

Fill in if

(A)

(B)

(C)

(E)

(F)

Distribution

(D)

you Prepaid

Description

Basis

Taxable

Total

Lump-sum

Transfers under

Distributions under

Date

distributions

Section

Amount

$10,000

Distribution

($10,000 or more)

1081.03

1.

Taxable as ordinary income ..........................................................................

00

00

00

00

(01)

(03)

(04)

2.

Taxable at 10% (Transfer Columns E and F to line 4(i), Columns A and D of

00

00

00

00

(02)

(05)

(06)

Schedule A2 Individual) .............................................................................

3.

Total distributions or transfers from governmental plans (Add line 1, Columns C and D and line 2, Columns E and F. Transfer to Part 1, line 2E of the return or line 3E, Column B or C of Schedule CO Individual, as

applicable) .....................................................................................................................................................................................................................................................................................

(07)

00

4.

Tax withheld (Submit applicable Informative Returns. Enter on Schedule B Individual, Part III, line 17) ..........................................................................................................................................................

00

(08)

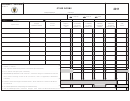

Part IV

Distributions from Individual Retirement Accounts and Educational Contribution Accounts

Taxable Amount

Column C

Column D

Column E

Column F

Column A

Column B

Payer's name

Employer

Fill in if

Account Number

IRA Distributions to

IRA or Educational

IRA or Educational

Identification Number

you Prepaid

Government Pensioners

Contribution Accounts

Basis

Interest

Contribution

Total Distribution

(excluding contributions)

Distributions of Income from

(See instructions)

(Transfer to Part I)

Accounts Distributions

(10%)

Sources Within P.R. (17%)

00

00

00

00

00

00

(09)

00

00

00

00

00

00

(10)

00

00

00

00

00

00

(11)

00

00

00

00

00

00

(12)

00

00

00

00

00

00

(13)

1.

Subtotal (Transfer the total of Columns D and E to line 4(i), Columns A, C and D, as applicable,

00

00

00

00

00

00

(14)

(15)

(16)

(17)

(18)

of Schedule A2 Individual) .....................................................................................

2.

Total distributions from Individual Retirement Accounts and Educational Contribution Accounts (Add the total of Columns D through F. Transfer to Part 1, line 2F of the return or line 3F,

00

Column B or C of Schedule CO Individual, as applicable) ........................................................................................................................................................................................................

(19)

Retention Period: Ten (10) Years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3