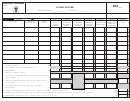

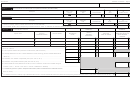

Schedule F Individual - Other Income - 2012 Page 3

ADVERTISEMENT

Schedule F Individual - Page 3

Rev. Feb 19 13

Taxpayer's name

Social Security Number

Part V

Distributions from Deferred Compensation Plans (Non Qualified)

(A)

Fill in if you

Distribution

(B)

(C)

Description

Total Distribution

Prepaid

Date

Basis

Taxable Amount

1. Taxable as ordinary income (Transfer to Part VII, línea 4 of this Schedule) ..............................................

00

00

00

(22)

(21)

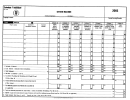

Part VI

Distributions from Qualified Retirement Plans (Partial or Lump - Sum Not due to Separation from Service or Plan Termination)

(A)

Fill in if you

Distribution

(B)

(C)

Description

Total Distribution

Prepaid

Date

Basis

Taxable Amount

00

00

00

(24)

1. Taxable as ordinary income (Transfer to Part VII, line 5 of this Schedule) ...............................................

(23)

00

2. Tax withheld (Submit the corresponding Informative Returns. Enter on Schedule B Individual, Part III, line 16) .............................................................................................................

(25)

Column A

Column C

Part VII

Miscellaneous Income

Column B

Column D

Income from Major League

Judicial or

Employer

Income from

Baseball teams and the U.S.

Miscellaneous

Payer's name

Account Number

Extrajudicial

Identification Number

Prizes and Contests

National Basketball

Income

Indemnification

Association

00

00

00

00

(26)

00

00

00

00

(27)

00

00

00

00

(28)

00

00

00

00

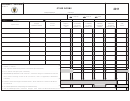

Amount received ....................................................................................................................................

(29)

(34)

(38)

(41)

1.

00

00

00

2.

Less: Expenses related to the production of these income (See instructions) ....................................................

(30)

(35)

(39)

3.

Subtotal (Subtract line 2 from line 1. Transfer the total in Column D to line 4(g), Columns A and B of Schedule A2

00

00

00

00

Individual) ......................................................................................................................................................

(31)

(36)

(40)

(42)

00

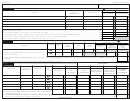

4.

(32)

Distributions from deferred compensation plans (From Part V, line 1) ...............................................................

00

5.

qualified retirement plans

.........................................................................

(33)

Distributions from

(From Part VI, line 1)

6.

Total miscellaneous income (Add the total of lines 3, 4 and 5 of Column A and line 3 of Columns B through D.

(42)

00

Transfer to Part 1, line 2G of the return or

) ............................................................................................

line 3G of Schedule CO Individual

(43)

7.

Tax withheld on payments for judicial or extrajudicial indemnification (Submit Form 480.6B. Enter on Schedule B Individual,

00

Part III, line 9)…………………………………………………………………...........................................................................................…..…

(37)

8.

Tax withheld on income from Major League Baseball teams and the U.S. National Basketball Association (Submit the corresponding Informative Returns. Enter on Schedule B Individual, Part III, line 18) ….

00

(44)

Retention Period: Ten (10) Years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3