2001 Eastlake Income Tax Return Form - Cleveland, Ohio Income Tax Department

ADVERTISEMENT

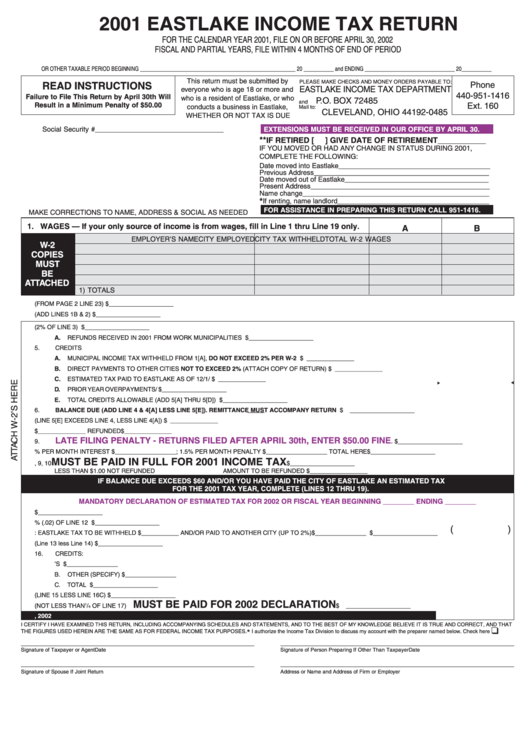

2001 EASTLAKE INCOME TAX RETURN

FOR THE CALENDAR YEAR 2001, FILE ON OR BEFORE APRIL 30, 2002

FISCAL AND PARTIAL YEARS, FILE WITHIN 4 MONTHS OF END OF PERIOD

OR OTHER TAXABLE PERIOD BEGINNING _________________________________________________________ 20 ___________ and ENDING _________________________________ 20___________

This return must be submitted by

PLEASE MAKE CHECKS AND MONEY ORDERS PAYABLE TO:

READ INSTRUCTIONS

Phone

EASTLAKE INCOME TAX DEPARTMENT

everyone who is age 18 or more and

440-951-1416

Failure to File This Return by April 30th Will

who is a resident of Eastlake, or who

P.O. BOX 72485

and

Result in a Minimum Penalty of $50.00

Ext. 160

conducts a business in Eastlake,

Mail to:

CLEVELAND, OHIO 44192-0485

WHETHER OR NOT TAX IS DUE

Social Security #_________________________________

EXTENSIONS MUST BE RECEIVED IN OUR OFFICE BY APRIL 30.

**

IF RETIRED [

] GIVE DATE OF RETIREMENT ___________

IF YOU MOVED OR HAD ANY CHANGE IN STATUS DURING 2001,

COMPLETE THE FOLLOWING:

Date moved into Eastlake _______________________________________

Previous Address _____________________________________________

Date moved out of Eastlake _____________________________________

Present Address ______________________________________________

Name change ________________________________________________

*

If renting, name landlord _______________________________________

FOR ASSISTANCE IN PREPARING THIS RETURN CALL 951-1416.

MAKE CORRECTIONS TO NAME, ADDRESS & SOCIAL AS NEEDED

1. WAGES — If your only source of income is from wages, fill in Line 1 thru Line 19 only.

A

B

EMPLOYER’S NAME

CITY EMPLOYED

CITY TAX WITHHELD TOTAL W-2 WAGES

W-2

COPIES

MUST

BE

ATTACHED

1) TOTALS

2.

PROFIT FROM ANY BUSINESS OWNED/RENTAL INCOME (FROM PAGE 2 LINE 23) ....................................................................................... $

___________________

3.

TAXABLE INCOME (ADD LINES 1B & 2) ................................................................................................................................................................ $

___________________

4.

EASTLAKE CITY TAX (2% OF LINE 3) .................................................................................................................................................................... $

___________________

A.

REFUNDS RECEIVED IN 2001 FROM WORK MUNICIPALITIES ................................................................................................................... $

___________________

5.

CREDITS

A.

MUNICIPAL INCOME TAX WITHHELD FROM 1[A], DO NOT EXCEED 2% PER W-2 .................................................

$ ______________

B.

DIRECT PAYMENTS TO OTHER CITIES NOT TO EXCEED 2% (ATTACH COPY OF RETURN) ................................

$ ______________

C.

ESTIMATED TAX PAID TO EASTLAKE AS OF 12/1/01 ................................................................................................

$ ______________

D.

PRIOR YEAR OVERPAYMENTS/CREDITS ..................................................................................................................................................... $

___________________

E.

TOTAL CREDITS ALLOWABLE (ADD 5[A] THRU 5[D]) ................................................................................................................................... $

___________________

6.

BALANCE DUE (ADD LINE 4 & 4[A] LESS LINE 5[E]). REMITTANCE MUST ACCOMPANY RETURN ............................................................. $

___________________

7.

OVERPAYMENT CLAIMED (LINE 5[E] EXCEEDS LINE 4, LESS LINE 4[A]) ......................................................................

$ ______________

8.

ENTER AMOUNT OF LINE 7 YOU WANT CREDITED TO YOUR 2002 ESTIMATED TAX $______________ REFUNDED

$ ______________

LATE FILING PENALTY - RETURNS FILED AFTER APRIL 30th, ENTER $50.00 FINE

9.

.

......................... $

___________________

10.

ASSESSMENT 1.5% PER MONTH INTEREST $__________________; 1.5% PER MONTH PENALTY $__________________ TOTAL HERE $

___________________

MUST BE PAID IN FULL FOR 2001 INCOME TAX

11.

TOTAL AMOUNT DUE - ADD LINES 6, 9, 10

............... $

___________________

LESS THAN $1.00 NOT REFUNDED

AMOUNT TO BE REFUNDED $_________________

IF BALANCE DUE EXCEEDS $60 AND/OR YOU HAVE PAID THE CITY OF EASTLAKE AN ESTIMATED TAX

FOR THE 2001 TAX YEAR, COMPLETE (LINES 12 THRU 19).

MANDATORY DECLARATION OF ESTIMATED TAX FOR 2002 OR FISCAL YEAR BEGINNING ________ ENDING ________

12.

ESTIMATED TAXABLE INCOME FOR 2002 ............................................................................................................................................................ $

___________________

13.

ESTIMATED TAX DUE 2% (.02) OF LINE 12 ........................................................................................................................................................... $

___________________

(

)

14.

LESS: EASTLAKE TAX TO BE WITHHELD $___________ AND/OR PAID TO ANOTHER CITY (UP TO 2%) $_______________ ..................... $

___________________

15.

BALANCE OF ESTIMATED EASTLAKE TAX (Line 13 less Line 14) ....................................................................................................................... $

___________________

16.

CREDITS:

A.

OVERPAYMENT CLAIMED ON PREVIOUS YEAR’S RETURN ................................................................ $_______________

B.

OTHER (SPECIFY) .................................................................................................................................... $_______________

C.

TOTAL CREDITS .............................................................................................................................................................................................. $

___________________

17.

NET TAX DUE (LINE 15 LESS LINE 16C) ............................................................................................................................................................... $

___________________

MUST BE PAID FOR 2002 DECLARATION ............

18.

AMOUNT PAID (NOT LESS THAN

1

/

OF LINE 17)

$

___________________

4

19.

TOTAL TAX DUE - ADD LINES 11 AND 18 - REMIT THIS AMOUNT ON OR BEFORE APRIL 30, 2002 .............................................................

$

___________________

I CERTIFY I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE BELIEVE IT IS TRUE AND CORRECT, AND THAT

❑

THE FIGURES USED HEREIN ARE THE SAME AS FOR FEDERAL INCOME TAX PURPOSES.

*

I authorize the Income Tax Division to discuss my account with the preparer named below. Check here

Signature of Taxpayer or Agent

Date

Signature of Person Preparing If Other Than Taxpayer

Date

Signature of Spouse If Joint Return

Address or Name and Address of Firm or Employer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2