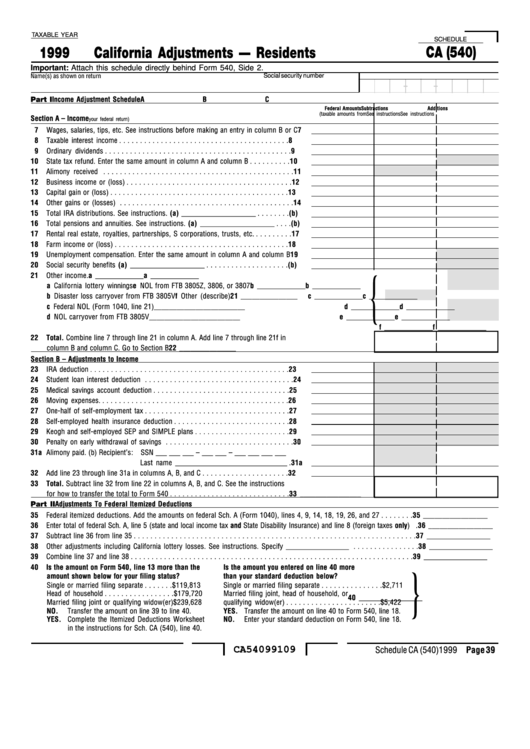

Schedule Ca (540) - California Adjustments - Residents (1999)

ADVERTISEMENT

TAXABLE YEAR

SCHEDULE

CA (540)

1999

California Adjustments — Residents

Important: Attach this schedule directly behind Form 540, Side 2.

Name(s) as shown on return

Social security number

-

-

Part I Income Adjustment Schedule

A

B

C

Federal Amounts

Subtractions

Additions

(taxable amounts from

See instructions

See instructions

Section A – Income

your federal return)

7

Wages, salaries, tips, etc. See instructions before making an entry in column B or C

7

8

Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10

State tax refund. Enter the same amount in column A and column B . . . . . . . . . .

10

11

Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14

Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15

Total IRA distributions. See instructions. (a) ____________________ . . . . . . . . (b)

16

Total pensions and annuities. See instructions. (a) ____________________ . . . . (b)

17

Rental real estate, royalties, partnerships, S corporations, trusts, etc. . . . . . . . . .

17

18

Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19

Unemployment compensation. Enter the same amount in column A and column B

19

20

Social security benefits (a) ____________________ . . . . . . . . . . . . . . . . . . . . (b)

21

Other income.

a _____________ a _____________

{

a California lottery winnings

e NOL from FTB 3805Z, 3806, or 3807

b _____________ b _____________

b Disaster loss carryover from FTB 3805V f Other (describe)

21 _______________

c _____________

c _____________

c Federal NOL (Form 1040, line 21)

________________________

d _____________ d _____________

d NOL carryover from FTB 3805V

________________________

e _____________ e _____________

f _____________

f _____________

22

Total. Combine line 7 through line 21 in column A. Add line 7 through line 21f in

column B and column C. Go to Section B

22 _______________

Section B – Adjustments to Income

23

IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24

Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25

Medical savings account deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26

Moving expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

27

One-half of self-employment tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28

Self-employed health insurance deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29

Keogh and self-employed SEP and SIMPLE plans . . . . . . . . . . . . . . . . . . . . . . .

29

30

Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

31a Alimony paid. (b) Recipient’s: SSN ___ ___ ___ – ___ ___ – ___ ___ ___ ___

Last name ______________________________ . 31a

32

Add line 23 through line 31a in columns A, B, and C . . . . . . . . . . . . . . . . . . . . .

32

33

Total. Subtract line 32 from line 22 in columns A, B, and C. See the instructions

for how to transfer the total to Form 540 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33 ________________

Part II Adjustments To Federal Itemized Deductions

35

Federal itemized deductions. Add the amounts on federal Sch. A (Form 1040), lines 4, 9, 14, 18, 19, 26, and 27 . . . . . . . . 35 _________________

36

Enter total of federal Sch. A, line 5 (state and local income tax and State Disability Insurance) and line 8 (foreign taxes only) . 36 _________________

37

Subtract line 36 from line 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37 _________________

38

Other adjustments including California lottery losses. See instructions. Specify _________________ . . . . . . . . . . . . . . . . 38 _________________

39

Combine line 37 and line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39 _________________

40

Is the amount on Form 540, line 13 more than the

Is the amount you entered on line 40 more

}

amount shown below for your filing status?

than your standard deduction below?

Single or married filing separate . . . . . . . $119,813

Single or married filing separate . . . . . . . . . . . . . . . $2,711

Head of household . . . . . . . . . . . . . . . . . $179,720

Married filing joint, head of household, or

40 _________________

Married filing joint or qualifying widow(er) $239,628

qualifying widow(er) . . . . . . . . . . . . . . . . . . . . . . . $5,422

NO.

Transfer the amount on line 39 to line 40.

YES. Transfer the amount on line 40 to Form 540, line 18.

YES. Complete the Itemized Deductions Worksheet

NO.

Enter your standard deduction on Form 540, line 18.

in the instructions for Sch. CA (540), line 40.

CA54099109

Schedule CA (540) 1999 Page 39

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2