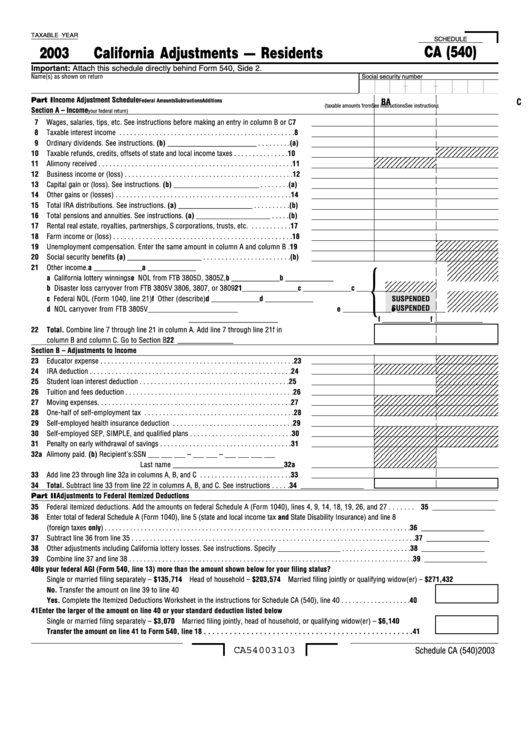

Schedule Ca (540) - California Adjustments Residents - 2003

ADVERTISEMENT

TAXABLE YEAR

SCHEDULE

CA (540)

2003

California Adjustments — Residents

Important: Attach this schedule directly behind Form 540, Side 2.

Name(s) as shown on return

Social security number

-

-

Part I Income Adjustment Schedule

A

Federal Amounts

B

Subtractions

C

Additions

(taxable amounts from

See instructions

See instructions

Section A – Income

your federal return)

7

Wages, salaries, tips, etc. See instructions before making an entry in column B or C

7

8

Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

Ordinary dividends. See instructions. (b) ________________________ . . . . . . . . . (a)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

10

Taxable refunds, credits, offsets of state and local income taxes . . . . . . . . . . . . . . .

10

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

11

Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

12

Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

Capital gain or (loss). See instructions. (b) _______________________ . . . . . . . . (a)

14

Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15

Total IRA distributions. See instructions. (a) ____________________ . . . . . . . . . . (b)

16

Total pensions and annuities. See instructions. (a) ____________________ . . . . . (b)

17

Rental real estate, royalties, partnerships, S corporations, trusts, etc. . . . . . . . . . . .

17

18

Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

19

Unemployment compensation. Enter the same amount in column A and column B .

19

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

20

Social security benefits (a) ____________________ . . . . . . . . . . . . . . . . . . . . . . . . (b)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3

21

Other income.

a _____________

a _____________

1 2 3 4 5 6 7 8 9 0 1 2 3

{

1 2 3 4 5 6 7 8 9 0 1 2 3

a California lottery winnings

e NOL from FTB 3805D, 3805Z,

b _____________

b _____________

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3

b Disaster loss carryover from FTB 3805V

3806, 3807, or 3809

21 _______________

c _____________

c _____________

1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3

c Federal NOL (Form 1040, line 21)

f Other (describe)

d _____________

SUSPENDED

d _____________

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3

SUSPENDED

d NOL carryover from FTB 3805V

________________________

e _____________ e _____________

1 2 3 4 5 6 7 8 9 0 1 2 3

________________________

f _____________

f _____________

22

Total. Combine line 7 through line 21 in column A. Add line 7 through line 21f in

column B and column C. Go to Section B

22 _______________

Section B – Adjustments to Income

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

23

Educator expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

24

IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

25

Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

26

Tuition and fees deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

27

Moving expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

28

One-half of self-employment tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

29

Self-employed health insurance deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

30

Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

31

Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

32a Alimony paid. (b) Recipient’s: SSN ___ ___ ___ – ___ ___ – ___ ___ ___ ___

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

Last name ______________________________

32a

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

33

Add line 23 through line 32a in columns A, B, and C . . . . . . . . . . . . . . . . . . . . . . . . . 33

34

Total. Subtract line 33 from line 22 in columns A, B, and C. See instructions . . . . . 34 _________________

Part II Adjustments to Federal Itemized Deductions

35

Federal itemized deductions. Add the amounts on federal Schedule A (Form 1040), lines 4, 9, 14, 18, 19, 26, and 27 . . . . . . . 35 _________________

36

Enter total of federal Schedule A (Form 1040), line 5 (state and local income tax and State Disability Insurance) and line 8

(foreign taxes only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36 _________________

37

Subtract line 36 from line 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37 _________________

38

Other adjustments including California lottery losses. See instructions. Specify _________________ . . . . . . . . . . . . . . . . . . . 38 _________________

39

Combine line 37 and line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39 _________________

40

Is your federal AGI (Form 540, line 13) more than the amount shown below for your filing status?

Single or married filing separately – $135,714 Head of household – $203,574 Married filing jointly or qualifying widow(er) – $271,432

No. Transfer the amount on line 39 to line 40

Yes. Complete the Itemized Deductions Worksheet in the instructions for Schedule CA (540), line 40 . . . . . . . . . . . . . . . . . . . 40

41

Enter the larger of the amount on line 40 or your standard deduction listed below

Single or married filing separately – $3,070 Married filing jointly, head of household, or qualifying widow(er) – $6,140

Transfer the amount on line 41 to Form 540, line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

CA54003103

Schedule CA (540) 2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1