Quarterly Sales Tax Return Instructions - Iowa Department Of Revenue And Finance

ADVERTISEMENT

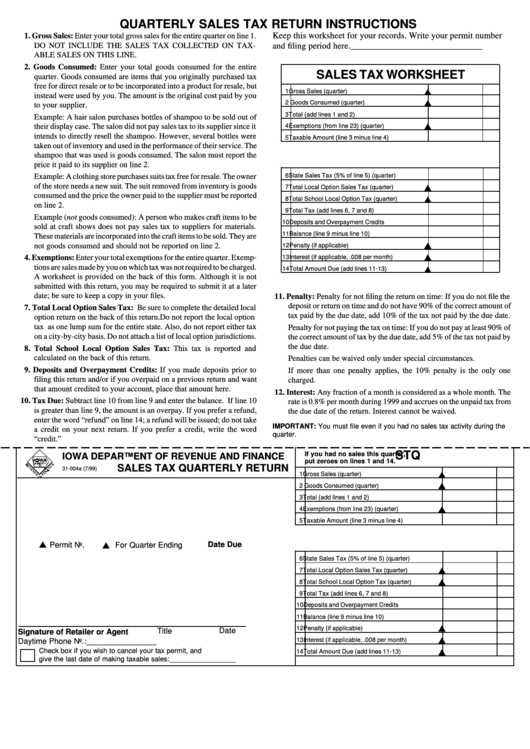

QUARTERLY SALES TAX RETURN INSTRUCTIONS

Keep this worksheet for your records. Write your permit number

1. Gross Sales: Enter your total gross sales for the entire quarter on line 1.

DO NOT INCLUDE THE SALES TAX COLLECTED ON TAX-

and filing period here. ______________________________

ABLE SALES ON THIS LINE.

2. Goods Consumed: Enter your total goods consumed for the entire

SALES TAX WORKSHEET

quarter. Goods consumed are items that you originally purchased tax

free for direct resale or to be incorporated into a product for resale, but

1 Gross Sales (quarter)

instead were used by you. The amount is the original cost paid by you

2 Goods Consumed (quarter)

to your supplier.

3 Total (add lines 1 and 2)

Example: A hair salon purchases bottles of shampoo to be sold out of

their display case. The salon did not pay sales tax to its supplier since it

4 Exemptions (from line 23) (quarter)

intends to directly resell the shampoo. However, several bottles were

5 Taxable Amount (line 3 minus line 4)

taken out of inventory and used in the performance of their service. The

shampoo that was used is goods consumed. The salon must report the

price it paid to its supplier on line 2.

Example: A clothing store purchases suits tax free for resale. The owner

6 State Sales Tax (5% of line 5) (quarter)

of the store needs a new suit. The suit removed from inventory is goods

7 Total Local Option Sales Tax (quarter)

consumed and the price the owner paid to the supplier must be reported

8 Total School Local Option Tax (quarter)

on line 2.

9 Total Tax (add lines 6, 7 and 8)

Example (not goods consumed): A person who makes craft items to be

10 Deposits and Overpayment Credits

sold at craft shows does not pay sales tax to suppliers for materials.

11 Balance (line 9 minus line 10)

These materials are incorporated into the craft items to be sold. They are

not goods consumed and should not be reported on line 2.

12 Penalty (if applicable)

4. Exemptions: Enter your total exemptions for the entire quarter. Exemp-

13 Interest (if applicable, .008 per month)

tions are sales made by you on which tax was not required to be charged.

14 Total Amount Due (add lines 11-13)

A worksheet is provided on the back of this form. Although it is not

submitted with this return, you may be required to submit it at a later

date; be sure to keep a copy in your files.

11. Penalty: Penalty for not filing the return on time: If you do not file the

deposit or return on time and do not have 90% of the correct amount of

7. Total Local Option Sales Tax: Be sure to complete the detailed local

tax paid by the due date, add 10% of the tax not paid by the due date.

option return on the back of this return. Do not report the local option

tax as one lump sum for the entire state. Also, do not report either tax

Penalty for not paying the tax on time: If you do not pay at least 90% of

on a city-by-city basis. Do not attach a list of local option jurisdictions.

the correct amount of tax by the due date, add 5% of the tax not paid by

the due date.

8. Total School Local Option Sales Tax: This tax is reported and

calculated on the back of this return.

Penalties can be waived only under special circumstances.

9. Deposits and Overpayment Credits: If you made deposits prior to

If more than one penalty applies, the 10% penalty is the only one

filing this return and/or if you overpaid on a previous return and want

charged.

that amount credited to your account, place that amount here.

12. Interest: Any fraction of a month is considered as a whole month. The

10. Tax Due: Subtract line 10 from line 9 and enter the balance. If line 10

rate is 0.8% per month during 1999 and accrues on the unpaid tax from

is greater than line 9, the amount is an overpay. If you prefer a refund,

the due date of the return. Interest cannot be waived.

enter the word “refund” on line 14; a refund will be issued; do not take

IMPORTANT: You must file even if you had no sales tax activity during the

a credit on your next return. If you prefer a credit, write the word

quarter.

“credit.”

STQ

If you had no sales this quarter,

IOWA DEPARTMENT OF REVENUE AND FINANCE

put zeroes on lines 1 and 14.

SALES TAX QUARTERLY RETURN

31-004a (7/99)

1 Gross Sales (quarter)

2 Goods Consumed (quarter)

3 Total (add lines 1 and 2)

4 Exemptions (from line 23) (quarter)

5 Taxable Amount (line 3 minus line 4)

Date Due

Permit No.

For Quarter Ending

6 State Sales Tax (5% of line 5) (quarter)

7 Total Local Option Sales Tax (quarter)

8 Total School Local Option Tax (quarter)

9 Total Tax (add lines 6, 7 and 8)

10 Deposits and Overpayment Credits

11 Balance (line 9 minus line 10)

12 Penalty (if applicable)

Date

Title

Signature of Retailer or Agent

13 Interest (if applicable, .008 per month)

Daytime Phone No.: ________________

Check box if you wish to cancel your tax permit, and

14 Total Amount Due (add lines 11-13)

give the last date of making taxable sales: _________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2