00-957

(Rev.12-11/4)

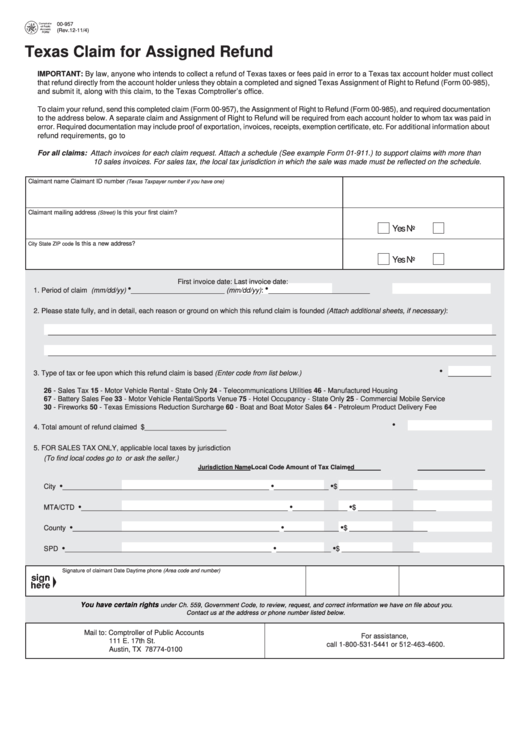

Texas Claim for Assigned Refund

IMPORTANT: By law, anyone who intends to collect a refund of Texas taxes or fees paid in error to a Texas tax account holder must collect

that refund directly from the account holder unless they obtain a completed and signed Texas Assignment of Right to Refund (Form 00-985),

and submit it, along with this claim, to the Texas Comptroller’s office.

To claim your refund, send this completed claim (Form 00-957), the Assignment of Right to Refund (Form 00-985), and required documentation

to the address below. A separate claim and Assignment of Right to Refund will be required from each account holder to whom tax was paid in

error. Required documentation may include proof of exportation, invoices, receipts, exemption certificate, etc. For additional information about

refund requirements, go to

For all claims: Attach invoices for each claim request. Attach a schedule (See example Form 01-911.) to support claims with more than

10 sales invoices. For sales tax, the local tax jurisdiction in which the sale was made must be reflected on the schedule.

Claimant name

Claimant ID number

(Texas Taxpayer number if you have one)

Claimant mailing address

Is this your first claim?

(Street)

Yes

No

Is this a new address?

City State ZIP code

Yes

No

First invoice date:

Last invoice date:

•

•

1. Period of claim ............................................ (mm/dd/yy)

________________________

(mm/dd/yy):

__________________________

2. Please state fully, and in detail, each reason or ground on which this refund claim is founded (Attach additional sheets, if necessary):

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

•

3. Type of tax or fee upon which this refund claim is based (Enter code from list below.) ........................................................................ .

___________

26 - Sales Tax

15 - Motor Vehicle Rental - State Only

24 - Telecommunications Utilities

46 - Manufactured Housing

67 - Battery Sales Fee

33 - Motor Vehicle Rental/Sports Venue

75 - Hotel Occupancy - State Only

25 - Commercial Mobile Service

30 - Fireworks

50 - Texas Emissions Reduction Surcharge

60 - Boat and Boat Motor Sales

64 - Petroleum Product Delivery Fee

•

4. Total amount of refund claimed ......................................................................................................................................... $ _____________________

5. FOR SALES TAX ONLY, applicable local taxes by jurisdiction

(To find local codes go to or ask the seller.)

Jurisdiction Name

Local Code

Amount of Tax Claimed

•

•

•

City .........................

_____________________________________________________

______________

$ ____________________

•

•

•

MTA/CTD ...............

_____________________________________________________

______________

$ ____________________

•

•

•

County ....................

_____________________________________________________

______________

$ ____________________

•

•

•

SPD ........................

_____________________________________________________

______________

$ ____________________

Signature of claimant

Date

Daytime phone (Area code and number)

You have certain rights

under Ch. 559, Government Code, to review, request, and correct information we have on file about you.

Contact us at the address or phone number listed below.

Mail to: Comptroller of Public Accounts

For assistance,

111 E. 17th St.

call 1-800-531-5441 or 512-463-4600.

Austin, TX 78774-0100

1

1