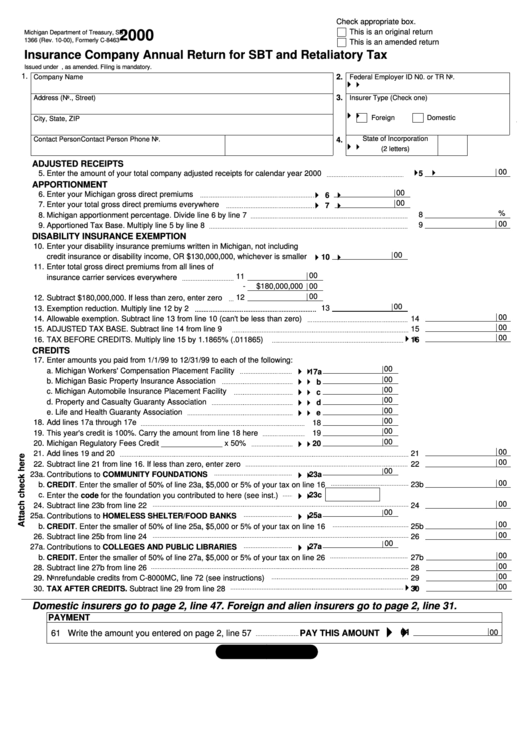

Form 1366 - Insurance Company Annual Return For Sbt And Retaliatory Tax - 2000

ADVERTISEMENT

Check appropriate box.

This is an original return

2000

Michigan Department of Treasury, SBT

1366 (Rev. 10-00), Formerly C-8463

This is an amended return

Insurance Company Annual Return for SBT and Retaliatory Tax

Issued under P.A. 228 of 1975, as amended. Filing is mandatory.

1.

2.

Company Name

Federal Employer ID N0. or TR No.

3.

Address (No., Street)

Insurer Type (Check one)

Foreign

Domestic

City, State, ZIP

State of Incorporation

Contact Person

Contact Person Phone No.

4.

(2 letters)

ADJUSTED RECEIPTS

00

5.

Enter the amount of your total company adjusted receipts for calendar year 2000

5

APPORTIONMENT

00

6.

Enter your Michigan gross direct premiums

6

00

7.

Enter your total gross direct premiums everywhere

7

%

8.

Michigan apportionment percentage. Divide line 6 by line 7

8

00

9

9.

Apportioned Tax Base. Multiply line 5 by line 8

DISABILITY INSURANCE EXEMPTION

10.

Enter your disability insurance premiums written in Michigan, not including

00

credit insurance or disability income, OR $130,000,000, whichever is smaller

10

11.

Enter total gross direct premiums from all lines of

00

11

insurance carrier services everywhere

-

$180,000,000

00

00

12

12.

Subtract $180,000,000. If less than zero, enter zero

00

13.

Exemption reduction. Multiply line 12 by 2

13

00

14.

Allowable exemption. Subtract line 13 from line 10 (can't be less than zero)

14

00

15.

ADJUSTED TAX BASE. Subtract line 14 from line 9

15

00

16.

TAX BEFORE CREDITS. Multiply line 15 by 1.1865% (.011865)

16

CREDITS

17.

Enter amounts you paid from 1/1/99 to 12/31/99 to each of the following:

00

a. Michigan Workers' Compensation Placement Facility

17a

00

b. Michigan Basic Property Insurance Association

b

00

c. Michigan Automobile Insurance Placement Facility

c

00

d. Property and Casualty Guaranty Association

d

00

e. Life and Health Guaranty Association

e

00

18.

Add lines 17a through 17e

18

00

19.

This year's credit is 100%. Carry the amount from line 18 here

19

00

20.

Michigan Regulatory Fees Credit ______________ x 50%

20

00

21.

Add lines 19 and 20

21

00

22.

Subtract line 21 from line 16. If less than zero, enter zero

22

00

23a

23a.

Contributions to COMMUNITY FOUNDATIONS

00

b.

CREDIT. Enter the smaller of 50% of line 23a, $5,000 or 5% of your tax on line 16

23b

c.

Enter the code for the foundation you contributed to here (see inst.)

23c

00

24.

Subtract line 23b from line 22

24

00

25a

25a.

Contributions to HOMELESS SHELTER/FOOD BANKS

00

b.

CREDIT. Enter the smaller of 50% of line 25a, $5,000 or 5% of your tax on line 16

25b

00

26.

Subtract line 25b from line 24

26

00

27a

27a.

Contributions to COLLEGES AND PUBLIC LIBRARIES

00

b.

CREDIT. Enter the smaller of 50% of line 27a, $5,000 or 5% of your tax on line 26

27b

00

28.

Subtract line 27b from line 26

28

00

29.

Nonrefundable credits from C-8000MC, line 72 (see instructions)

29

00

30.

TAX AFTER CREDITS. Subtract line 29 from line 28

30

Domestic insurers go to page 2, line 47. Foreign and alien insurers go to page 2, line 31.

PAYMENT

61

00

61 Write the amount you entered on page 2, line 57

PAY THIS AMOUNT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2