Instructions For Your 1999 Insurance Company Annual Return For Sbt And Retaliatory Tax (Form 1366 (Formerly C-8463))

ADVERTISEMENT

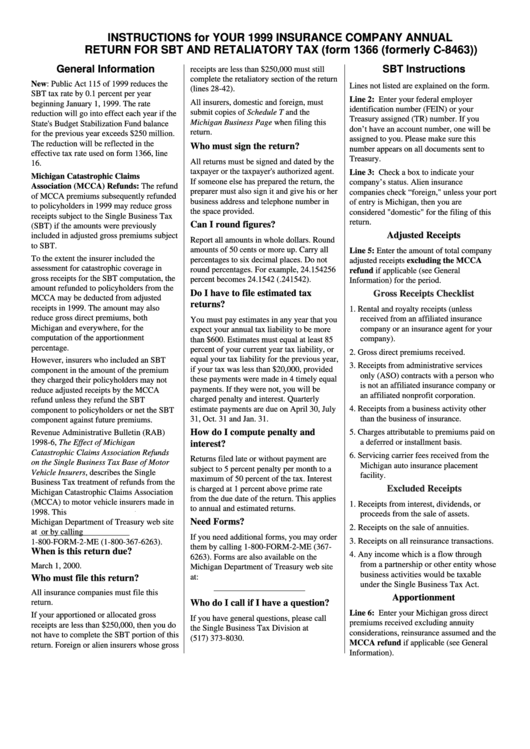

INSTRUCTIONS for YOUR 1999 INSURANCE COMPANY ANNUAL

RETURN FOR SBT AND RETALIATORY TAX (form 1366 (formerly C-8463))

General Information

SBT Instructions

receipts are less than $250,000 must still

complete the retaliatory section of the return

New: Public Act 115 of 1999 reduces the

Lines not listed are explained on the form.

(lines 28-42).

SBT tax rate by 0.1 percent per year

Line 2: Enter your federal employer

All insurers, domestic and foreign, must

beginning January 1, 1999. The rate

identification number (FEIN) or your

submit copies of Schedule T and the

reduction will go into effect each year if the

Treasury assigned (TR) number. If you

Michigan Business Page when filing this

State's Budget Stabilization Fund balance

don’t have an account number, one will be

return.

for the previous year exceeds $250 million.

assigned to you. Please make sure this

The reduction will be reflected in the

Who must sign the return?

number appears on all documents sent to

effective tax rate used on form 1366, line

Treasury.

All returns must be signed and dated by the

16.

taxpayer or the taxpayer's authorized agent.

Line 3: Check a box to indicate your

Michigan Catastrophic Claims

If someone else has prepared the return, the

company’s status. Alien insurance

Association (MCCA) Refunds: The refund

preparer must also sign it and give his or her

companies check “foreign," unless your port

of MCCA premiums subsequently refunded

business address and telephone number in

of entry is Michigan, then you are

to policyholders in 1999 may reduce gross

the space provided.

considered "domestic" for the filing of this

receipts subject to the Single Business Tax

return.

Can I round figures?

(SBT) if the amounts were previously

Adjusted Receipts

included in adjusted gross premiums subject

Report all amounts in whole dollars. Round

to SBT.

amounts of 50 cents or more up. Carry all

Line 5: Enter the amount of total company

To the extent the insurer included the

percentages to six decimal places. Do not

adjusted receipts excluding the MCCA

assessment for catastrophic coverage in

round percentages. For example, 24.154256

refund if applicable (see General

gross receipts for the SBT computation, the

percent becomes 24.1542 (.241542).

Information) for the period.

amount refunded to policyholders from the

Do I have to file estimated tax

Gross Receipts Checklist

MCCA may be deducted from adjusted

returns?

receipts in 1999. The amount may also

1. Rental and royalty receipts (unless

reduce gross direct premiums, both

received from an affiliated insurance

You must pay estimates in any year that you

Michigan and everywhere, for the

company or an insurance agent for your

expect your annual tax liability to be more

computation of the apportionment

company).

than $600. Estimates must equal at least 85

percentage.

percent of your current year tax liability, or

2. Gross direct premiums received.

equal your tax liability for the previous year,

However, insurers who included an SBT

3. Receipts from administrative services

if your tax was less than $20,000, provided

component in the amount of the premium

only (ASO) contracts with a person who

these payments were made in 4 timely equal

they charged their policyholders may not

is not an affiliated insurance company or

payments. If they were not, you will be

reduce adjusted receipts by the MCCA

an affiliated nonprofit corporation.

charged penalty and interest. Quarterly

refund unless they refund the SBT

estimate payments are due on April 30, July

4. Receipts from a business activity other

component to policyholders or net the SBT

31, Oct. 31 and Jan. 31.

than the business of insurance.

component against future premiums.

How do I compute penalty and

Revenue Administrative Bulletin (RAB)

5. Charges attributable to premiums paid on

a deferred or installment basis.

1998-6, The Effect of Michigan

interest?

Catastrophic Claims Association Refunds

6. Servicing carrier fees received from the

Returns filed late or without payment are

on the Single Business Tax Base of Motor

Michigan auto insurance placement

subject to 5 percent penalty per month to a

Vehicle Insurers, describes the Single

facility.

maximum of 50 percent of the tax. Interest

Business Tax treatment of refunds from the

Excluded Receipts

is charged at 1 percent above prime rate

Michigan Catastrophic Claims Association

from the due date of the return. This applies

(MCCA) to motor vehicle insurers made in

1. Receipts from interest, dividends, or

to annual and estimated returns.

1998. This R.A.B. is available on the

proceeds from the sale of assets.

Need Forms?

Michigan Department of Treasury web site

2. Receipts on the sale of annuities.

at or by calling

If you need additional forms, you may order

3. Receipts on all reinsurance transactions.

1-800-FORM-2-ME (1-800-367-6263).

them by calling 1-800-FORM-2-ME (367-

When is this return due?

4. Any income which is a flow through

6263). Forms are also available on the

from a partnership or other entity whose

March 1, 2000.

Michigan Department of Treasury web site

business activities would be taxable

at:

Who must file this return?

under the Single Business Tax Act.

All insurance companies must file this

Apportionment

return.

Who do I call if I have a question?

Line 6: Enter your Michigan gross direct

If your apportioned or allocated gross

If you have general questions, please call

premiums received excluding annuity

receipts are less than $250,000, then you do

the Single Business Tax Division at

considerations, reinsurance assumed and the

not have to complete the SBT portion of this

(517) 373-8030.

MCCA refund if applicable (see General

return. Foreign or alien insurers whose gross

Information).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2