Instructions For General Information For Business Entities - City Of Dayton Income Tax Department

ADVERTISEMENT

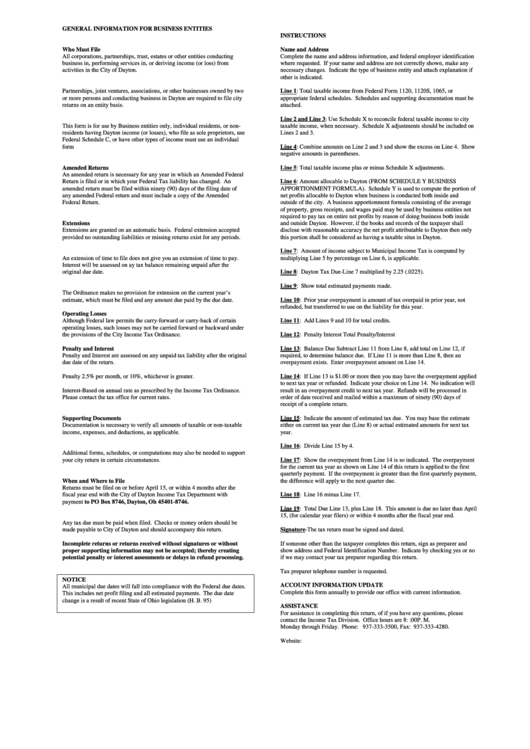

GENERAL INFORMATION FOR BUSINESS ENTITIES

INSTRUCTIONS

Who Must File

Name and Address

All corporations, partnerships, trust, estates or other entities conducting

Complete the name and address information, and federal employer identification

business in, performing services in, or deriving income (or loss) from

where requested. If your name and address are not correctly shown, make any

activities in the City of Dayton.

necessary changes. Indicate the type of business entity and attach explanation if

other is indicated.

Partnerships, joint ventures, associations, or other businesses owned by two

Line 1: Total taxable income from Federal Form 1120, 1120S, 1065, or

or more persons and conducting business in Dayton are required to file city

appropriate federal schedules. Schedules and supporting documentation must be

returns on an entity basis.

attached.

Line 2 and Line 3: Use Schedule X to reconcile federal taxable income to city

This form is for use by Business entities only, individual residents, or non-

taxable income, when necessary. Schedule X adjustments should be included on

residents having Dayton income (or losses), who file as sole proprietors, use

Lines 2 and 3.

Federal Schedule C, or have other types of income must use an individual

form

Line 4: Combine amounts on Line 2 and 3 and show the excess on Line 4. Show

negative amounts in parentheses.

Line 5: Total taxable income plus or minus Schedule X adjustments.

Amended Returns

An amended return is necessary for any year in which an Amended Federal

Return is filed or in which your Federal Tax liability has changed. An

Line 6: Amount allocable to Dayton (FROM SCHEDULE Y BUSINESS

amended return must be filed within ninety (90) days of the filing date of

APPORTIONMENT FORMULA). Schedule Y is used to compute the portion of

any amended Federal return and must include a copy of the Amended

net profits allocable to Dayton when business is conducted both inside and

Federal Return.

outside of the city. A business apportionment formula consisting of the average

of property, gross receipts, and wages paid may be used by business entities not

required to pay tax on entire net profits by reason of doing business both inside

Extensions

and outside Dayton. However, if the books and records of the taxpayer shall

Extensions are granted on an automatic basis. Federal extension accepted

disclose with reasonable accuracy the net profit attributable to Dayton then only

provided no outstanding liabilities or missing returns exist for any periods.

this portion shall be considered as having a taxable situs in Dayton.

Line 7: Amount of income subject to Municipal Income Tax is computed by

An extension of time to file does not give you an extension of time to pay.

multiplying Line 5 by percentage on Line 6, is applicable.

Interest will be assessed on ay tax balance remaining unpaid after the

original due date.

Line 8: Dayton Tax Due-Line 7 multiplied by 2.25 (.0225).

Line 9: Show total estimated payments made.

The Ordinance makes no provision for extension on the current year’s

estimate, which must be filed and any amount due paid by the due date.

Line 10: Prior year overpayment is amount of tax overpaid in prior year, not

refunded, but transferred to use on the liability for this year.

Operating Losses

Although Federal law permits the carry-forward or carry-back of certain

Line 11: Add Lines 9 and 10 for total credits.

operating losses, such losses may not be carried forward or backward under

the provisions of the City Income Tax Ordinance.

Line 12: Penalty Interest Total Penalty/Interest

Line 13: Balance Due Subtract Line 11 from Line 8, add total on Line 12, if

Penalty and Interest

Penalty and Interest are assessed on any unpaid tax liability after the original

required, to determine balance due. If Line 11 is more than Line 8, then an

due date of the return.

overpayment exists. Enter overpayment amount on Line 14.

Penalty 2.5% per month, or 10%, whichever is greater.

Line 14: If Line 13 is $1.00 or more then you may have the overpayment applied

to next tax year or refunded. Indicate your choice on Line 14. No indication will

Interest-Based on annual rate as prescribed by the Income Tax Ordinance.

result in an overpayment credit to next tax year. Refunds will be processed in

Please contact the tax office for current rates.

order of date received and mailed within a maximum of ninety (90) days of

receipt of a complete return.

Supporting Documents

Line 15: Indicate the amount of estimated tax due. You may base the estimate

Documentation is necessary to verify all amounts of taxable or non-taxable

either on current tax year due (Line 8) or actual estimated amounts for next tax

income, expenses, and deductions, as applicable.

year.

Line 16: Divide Line 15 by 4.

Additional forms, schedules, or computations may also be needed to support

your city return in certain circumstances.

Line 17: Show the overpayment from Line 14 is so indicated. The overpayment

for the current tax year as shown on Line 14 of this return is applied to the first

quarterly payment. If the overpayment is greater than the first quarterly payment,

the difference will apply to the next quarter due.

When and Where to File

Returns must be filed on or before April 15, or within 4 months after the

fiscal year end with the City of Dayton Income Tax Department with

Line 18: Line 16 minus Line 17.

payment to PO Box 8746, Dayton, Oh 45401-8746.

Line 19: Total Due Line 13, plus Line 18. This amount is due no later than April

15, (for calendar year filers) or within 4 months after the fiscal year end.

Any tax due must be paid when filed. Checks or money orders should be

made payable to City of Dayton and should accompany this return.

Signature-The tax return must be signed and dated.

If someone other than the taxpayer completes this return, sign as preparer and

Incomplete returns or returns received without signatures or without

show address and Federal Identification Number. Indicate by checking yes or no

proper supporting information may not be accepted; thereby creating

if we may contact your tax preparer regarding this return.

potential penalty or interest assessments or delays in refund processing.

Tax preparer telephone number is requested.

NOTICE

ACCOUNT INFORMATION UPDATE

All municipal due dates will fall into compliance with the Federal due dates.

Complete this form annually to provide our office with current information.

This includes net profit filing and all estimated payments. The due date

change is a result of recent State of Ohio legislation (H. B. 95)

ASSISTANCE

For assistance in completing this return, of if you have any questions, please

contact the Income Tax Division. Office hours are 8:00A.M. to 5:00P. M.

Monday through Friday. Phone: 937-333-3500, Fax: 937-333-4280.

Website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1