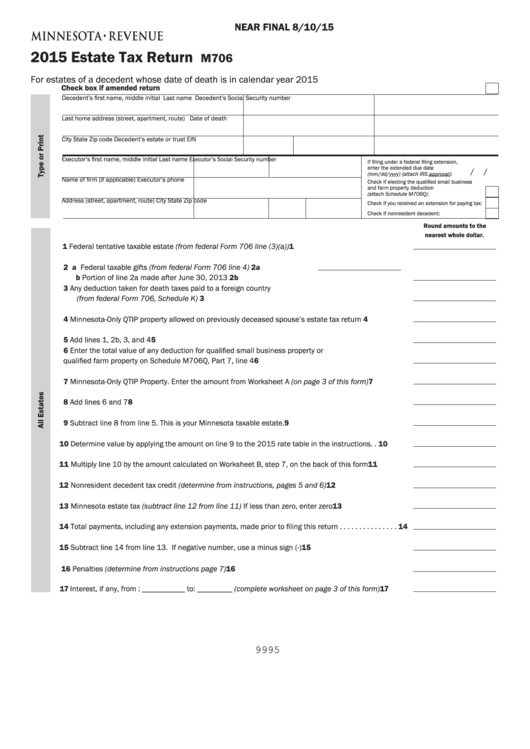

Form M706 - Estate Tax Return - 2015

ADVERTISEMENT

NEAR FINAL 8/10/15

2015 Estate Tax Return

M706

For estates of a decedent whose date of death is in calendar year 2015

Check box if amended return

Decedent’s first name, middle initial

Last name

Decedent’s Social Security number

Last home address (street, apartment, route)

Date of death

City

State

Zip code

Decedent’s estate or trust EIN

Executor’s first name, middle initial

Last name

Executor’s Social Security number

If filing under a federal filing extension,

enter the extended due date

/

/

(mm/dd/yyyy) (attach IRS approval):

Name of firm (if applicable)

Executor’s phone

Check if electing the qualified small business

and farm property deduction

(attach Schedule M706Q):

Address (street, apartment, route)

City

State

Zip code

Check if you received an extension for paying tax:

Check if nonresident decedent:

Round amounts to the

nearest whole dollar.

1 Federal tentative taxable estate (from federal Form 706 line (3)(a)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 a Federal taxable gifts (from federal Form 706 line 4) . . . . . . . . . . . . 2a

b Portion of line 2a made after June 30, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

3 Any deduction taken for death taxes paid to a foreign country

(from federal Form 706, Schedule K) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Minnesota-Only QTIP property allowed on previously deceased spouse’s estate tax return . . . . . . . . . 4

5 Add lines 1, 2b, 3, and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Enter the total value of any deduction for qualified small business property or

qualified farm property on Schedule M706Q, Part 7, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Minnesota-Only QTIP Property. Enter the amount from Worksheet A (on page 3 of this form) . . . . . . . . 7

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Subtract line 8 from line 5. This is your Minnesota taxable estate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Determine value by applying the amount on line 9 to the 2015 rate table in the instructions. . . . . . . 10

11 Multiply line 10 by the amount calculated on Worksheet B, step 7, on the back of this form . . . . . . . 11

12 Nonresident decedent tax credit (determine from instructions, pages 5 and 6) . . . . . . . . . . . . . . . . . . 12

13 Minnesota estate tax (subtract line 12 from line 11) If less than zero, enter zero . . . . . . . . . . . . . . . . 13

14 Total payments, including any extension payments, made prior to filing this return . . . . . . . . . . . . . . . 14

15 Subtract line 14 from line 13. If negative number, use a minus sign (-) . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Penalties (determine from instructions page 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Interest, if any, from : ___________ to: _________ (complete worksheet on page 3 of this form) . . . . 17

9995

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3