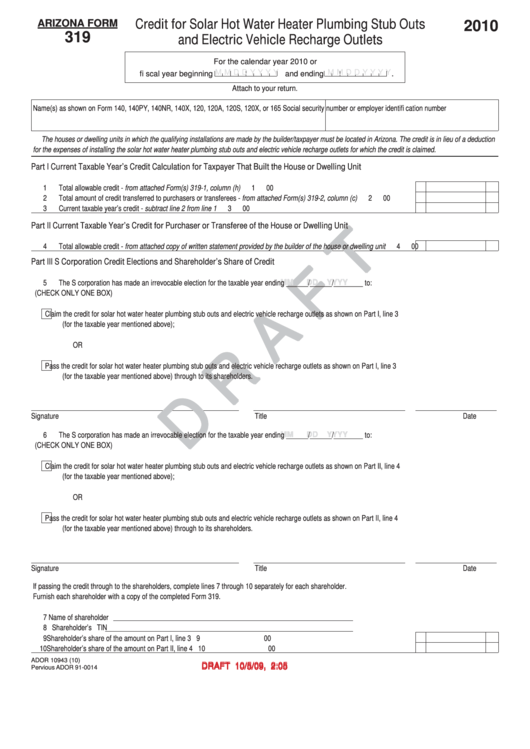

Arizona Form 319 Draft - Credit For Solar Hot Water Heater Plumbing Stub Outs And Electric Vehicle Recharge Outlets - 2010

ADVERTISEMENT

Credit for Solar Hot Water Heater Plumbing Stub Outs

ARIZONA FORM

2010

319

and Electric Vehicle Recharge Outlets

For the calendar year 2010 or

M M D D Y Y Y Y

M M D D Y Y Y Y

fi scal year beginning

and ending

.

Attach to your return.

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X, or 165

Social security number or employer identifi cation number

The houses or dwelling units in which the qualifying installations are made by the builder/taxpayer must be located in Arizona. The credit is in lieu of a deduction

for the expenses of installing the solar hot water heater plumbing stub outs and electric vehicle recharge outlets for which the credit is claimed.

Part I

Current Taxable Year’s Credit Calculation for Taxpayer That Built the House or Dwelling Unit

1 Total allowable credit - from attached Form(s) 319-1, column (h)....................................................................................................

1

00

2 Total amount of credit transferred to purchasers or transferees - from attached Form(s) 319-2, column (c) ..................................

2

00

3 Current taxable year’s credit - subtract line 2 from line 1 ................................................................................................................

3

00

Part II

Current Taxable Year’s Credit for Purchaser or Transferee of the House or Dwelling Unit

4 Total allowable credit - from attached copy of written statement provided by the builder of the house or dwelling unit ..................

4

00

Part III

S Corporation Credit Elections and Shareholder’s Share of Credit

5 The S corporation has made an irrevocable election for the taxable year ending ______/______/________ to:

MM

MM

DD

DD

YYYY

YYYY

(CHECK ONLY ONE BOX)

Claim the credit for solar hot water heater plumbing stub outs and electric vehicle recharge outlets as shown on Part I, line 3

(for the taxable year mentioned above);

OR

Pass the credit for solar hot water heater plumbing stub outs and electric vehicle recharge outlets as shown on Part I, line 3

(for the taxable year mentioned above) through to its shareholders.

Signature

Title

Date

6 The S corporation has made an irrevocable election for the taxable year ending ______/______/________ to:

MM

MM

DD

DD

YYYY

YYYY

(CHECK ONLY ONE BOX)

Claim the credit for solar hot water heater plumbing stub outs and electric vehicle recharge outlets as shown on Part II, line 4

(for the taxable year mentioned above);

OR

Pass the credit for solar hot water heater plumbing stub outs and electric vehicle recharge outlets as shown on Part II, line 4

(for the taxable year mentioned above) through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 7 through 10 separately for each shareholder.

Furnish each shareholder with a copy of the completed Form 319.

7 Name of shareholder

8 Shareholder’s TIN

9 Shareholder’s share of the amount on Part I, line 3 .......................................................................................................................

9

00

10 Shareholder’s share of the amount on Part II, line 4 ......................................................................................................................

10

00

ADOR 10943 (10)

DRAFT 10/5/09, 2:05 p.m.

DRAFT 10/5/09, 2:05 p.m.

Pervious ADOR 91-0014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5