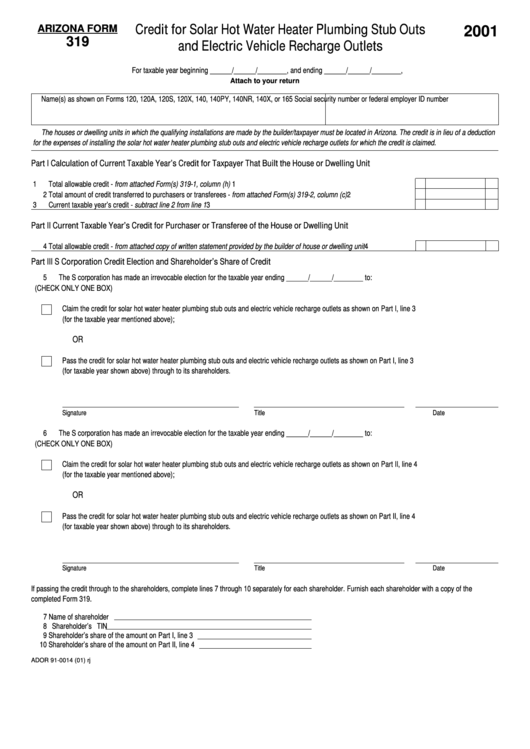

Credit for Solar Hot Water Heater Plumbing Stub Outs

ARIZONA FORM

2001

319

and Electric Vehicle Recharge Outlets

For taxable year beginning ______/______/________, and ending ______/______/________,

Attach to your return

Name(s) as shown on Forms 120, 120A, 120S, 120X, 140, 140PY, 140NR, 140X, or 165

Social security number or federal employer ID number

The houses or dwelling units in which the qualifying installations are made by the builder/taxpayer must be located in Arizona. The credit is in lieu of a deduction

for the expenses of installing the solar hot water heater plumbing stub outs and electric vehicle recharge outlets for which the credit is claimed.

Part I

Calculation of Current Taxable Year’s Credit for Taxpayer That Built the House or Dwelling Unit

1 Total allowable credit - from attached Form(s) 319-1, column (h) ...................................................................................................

1

2 Total amount of credit transferred to purchasers or transferees - from attached Form(s) 319-2, column (c) ..................................

2

3 Current taxable year’s credit - subtract line 2 from line 1 ................................................................................................................

3

Part II

Current Taxable Year’s Credit for Purchaser or Transferee of the House or Dwelling Unit

4 Total allowable credit - from attached copy of written statement provided by the builder of house or dwelling unit ........................

4

Part III

S Corporation Credit Election and Shareholder’s Share of Credit

5 The S corporation has made an irrevocable election for the taxable year ending ______/______/________ to:

(CHECK ONLY ONE BOX)

Claim the credit for solar hot water heater plumbing stub outs and electric vehicle recharge outlets as shown on Part I, line 3

(for the taxable year mentioned above);

OR

Pass the credit for solar hot water heater plumbing stub outs and electric vehicle recharge outlets as shown on Part I, line 3

(for taxable year shown above) through to its shareholders.

Signature

Title

Date

6 The S corporation has made an irrevocable election for the taxable year ending ______/______/________ to:

(CHECK ONLY ONE BOX)

Claim the credit for solar hot water heater plumbing stub outs and electric vehicle recharge outlets as shown on Part II, line 4

(for the taxable year mentioned above);

OR

Pass the credit for solar hot water heater plumbing stub outs and electric vehicle recharge outlets as shown on Part II, line 4

(for taxable year shown above) through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 7 through 10 separately for each shareholder. Furnish each shareholder with a copy of the

completed Form 319.

7 Name of shareholder

8 Shareholder’s TIN

9 Shareholder’s share of the amount on Part I, line 3

10 Shareholder’s share of the amount on Part II, line 4

ADOR 91-0014 (01) rj

1

1 2

2 3

3 4

4 5

5