Instructions For Arizona Form 319 - Credit For Solar Hot Water Heater Plumbing Stub Outs And Electric Vehicle Recharge Outlets - 2014

ADVERTISEMENT

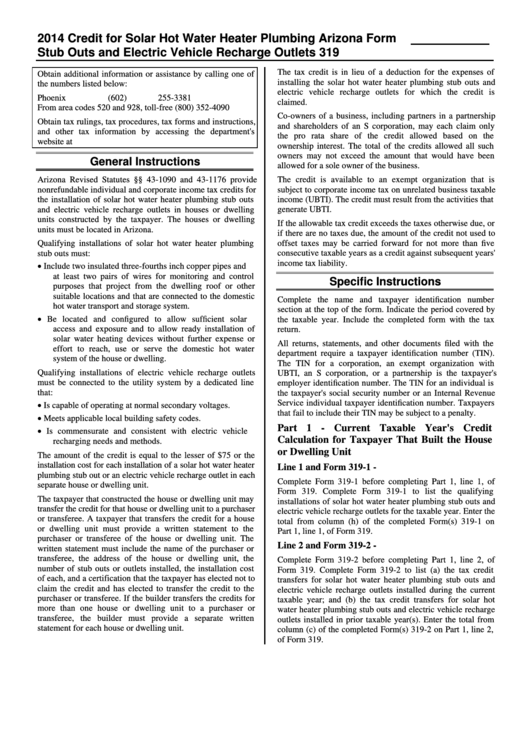

2014 Credit for Solar Hot Water Heater Plumbing

Arizona Form

Stub Outs and Electric Vehicle Recharge Outlets

319

The tax credit is in lieu of a deduction for the expenses of

Obtain additional information or assistance by calling one of

installing the solar hot water heater plumbing stub outs and

the numbers listed below:

electric vehicle recharge outlets for which the credit is

Phoenix

(602) 255-3381

claimed.

From area codes 520 and 928, toll-free

(800) 352-4090

Co-owners of a business, including partners in a partnership

Obtain tax rulings, tax procedures, tax forms and instructions,

and shareholders of an S corporation, may each claim only

and other tax information by accessing the department's

the pro rata share of the credit allowed based on the

website at

ownership interest. The total of the credits allowed all such

owners may not exceed the amount that would have been

General Instructions

allowed for a sole owner of the business.

Arizona Revised Statutes §§ 43-1090 and 43-1176 provide

The credit is available to an exempt organization that is

nonrefundable individual and corporate income tax credits for

subject to corporate income tax on unrelated business taxable

the installation of solar hot water heater plumbing stub outs

income (UBTI). The credit must result from the activities that

generate UBTI.

and electric vehicle recharge outlets in houses or dwelling

units constructed by the taxpayer. The houses or dwelling

If the allowable tax credit exceeds the taxes otherwise due, or

units must be located in Arizona.

if there are no taxes due, the amount of the credit not used to

offset taxes may be carried forward for not more than five

Qualifying installations of solar hot water heater plumbing

stub outs must:

consecutive taxable years as a credit against subsequent years'

income tax liability.

Include two insulated three-fourths inch copper pipes and

at least two pairs of wires for monitoring and control

Specific Instructions

purposes that project from the dwelling roof or other

suitable locations and that are connected to the domestic

Complete the name and taxpayer identification number

hot water transport and storage system.

section at the top of the form. Indicate the period covered by

Be located and configured to allow sufficient solar

the taxable year. Include the completed form with the tax

access and exposure and to allow ready installation of

return.

solar water heating devices without further expense or

All returns, statements, and other documents filed with the

effort to reach, use or serve the domestic hot water

department require a taxpayer identification number (TIN).

system of the house or dwelling.

The TIN for a corporation, an exempt organization with

Qualifying installations of electric vehicle recharge outlets

UBTI, an S corporation, or a partnership is the taxpayer's

must be connected to the utility system by a dedicated line

employer identification number. The TIN for an individual is

that:

the taxpayer's social security number or an Internal Revenue

Service individual taxpayer identification number. Taxpayers

Is capable of operating at normal secondary voltages.

that fail to include their TIN may be subject to a penalty.

Meets applicable local building safety codes.

Part 1 - Current Taxable Year's Credit

Is commensurate and consistent with electric vehicle

Calculation for Taxpayer That Built the House

recharging needs and methods.

or Dwelling Unit

The amount of the credit is equal to the lesser of $75 or the

installation cost for each installation of a solar hot water heater

Line 1 and Form 319-1 -

plumbing stub out or an electric vehicle recharge outlet in each

Complete Form 319-1 before completing Part 1, line 1, of

separate house or dwelling unit.

Form 319. Complete Form 319-1 to list the qualifying

The taxpayer that constructed the house or dwelling unit may

installations of solar hot water heater plumbing stub outs and

transfer the credit for that house or dwelling unit to a purchaser

electric vehicle recharge outlets for the taxable year. Enter the

or transferee. A taxpayer that transfers the credit for a house

total from column (h) of the completed Form(s) 319-1 on

or dwelling unit must provide a written statement to the

Part 1, line 1, of Form 319.

purchaser or transferee of the house or dwelling unit. The

Line 2 and Form 319-2 -

written statement must include the name of the purchaser or

transferee, the address of the house or dwelling unit, the

Complete Form 319-2 before completing Part 1, line 2, of

number of stub outs or outlets installed, the installation cost

Form 319. Complete Form 319-2 to list (a) the tax credit

of each, and a certification that the taxpayer has elected not to

transfers for solar hot water heater plumbing stub outs and

claim the credit and has elected to transfer the credit to the

electric vehicle recharge outlets installed during the current

purchaser or transferee. If the builder transfers the credits for

taxable year; and (b) the tax credit transfers for solar hot

more than one house or dwelling unit to a purchaser or

water heater plumbing stub outs and electric vehicle recharge

transferee, the builder must provide a separate written

outlets installed in prior taxable year(s). Enter the total from

statement for each house or dwelling unit.

column (c) of the completed Form(s) 319-2 on Part 1, line 2,

of Form 319.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3