BOE-501-OA (FRONT) REV. 9 (7-14)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

OIL SPILL PREVENTION AND ADMINISTRATION FEE RETURN

BOE USE ONLY

RA-B/A

AUD

REG

DUE ON OR BEFORE

RR-QS

FILE

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

PO BOX 942879

SACRAMENTO CA 94279-6147

READ INSTRUCTIONS

BEFORE PREPARING

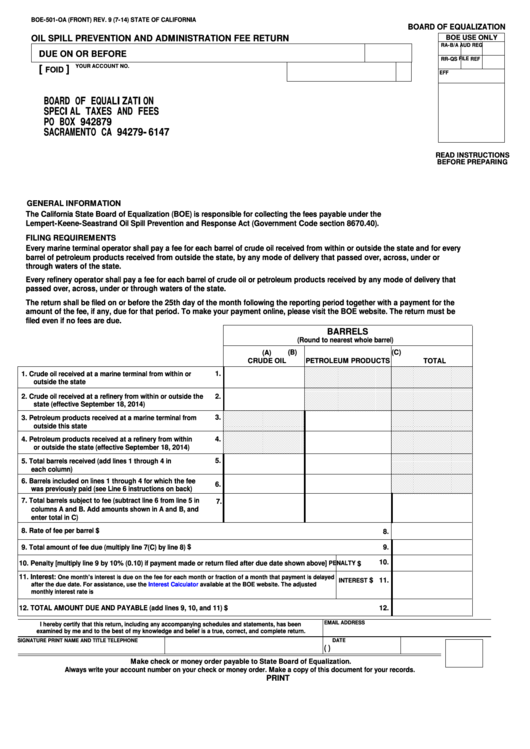

GENERAL INFORMATION

The California State Board of Equalization (BOE) is responsible for collecting the fees payable under the

Lempert-Keene-Seastrand Oil Spill Prevention and Response Act (Government Code section 8670.40).

FILING REQUIREMENTS

Every marine terminal operator shall pay a fee for each barrel of crude oil received from within or outside the state and for every

barrel of petroleum products received from outside the state, by any mode of delivery that passed over, across, under or

through waters of the state.

Every refinery operator shall pay a fee for each barrel of crude oil or petroleum products received by any mode of delivery that

passed over, across, under or through waters of the state.

The return shall be filed on or before the 25th day of the month following the reporting period together with a payment for the

amount of the fee, if any, due for that period. To make your payment online, please visit the BOE website. The return must be

filed even if no fees are due.

BARRELS

(Round to nearest whole barrel)

(A)

(B)

(C)

CRUDE OIL

PETROLEUM PRODUCTS

TOTAL

1.

1. Crude oil received at a marine terminal from within or

outside the state

2. Crude oil received at a refinery from within or outside the

2.

state (effective September 18, 2014)

3.

3. Petroleum products received at a marine terminal from

outside this state

4. Petroleum products received at a refinery from within

4.

or outside the state (effective September 18, 2014)

5. Total barrels received (add lines 1 through 4 in

5.

each column)

6. Barrels included on lines 1 through 4 for which the fee

6.

was previously paid (see Line 6 instructions on back)

7. Total barrels subject to fee (subtract line 6 from line 5 in

7.

columns A and B. Add amounts shown in A and B, and

enter total in C)

8. Rate of fee per barrel

$

8.

9. Total amount of fee due (multiply line 7(C) by line 8)

9.

$

10.

10. Penalty [multiply line 9 by 10% (0.10) if payment made or return filed after due date shown above]

PENALTY

$

11. Interest:

One month's interest is due on the fee for each month or fraction of a month that payment is delayed

11.

$

INTEREST

after the due date. For assistance, use the

Interest Calculator

available at the BOE website. The adjusted

monthly interest rate is

12. TOTAL AMOUNT DUE AND PAYABLE (add lines 9, 10, and 11)

12.

$

EMAIL ADDRESS

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

SIGNATURE

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

Make check or money order payable to State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document for your records.

CLEAR

PRINT

1

1