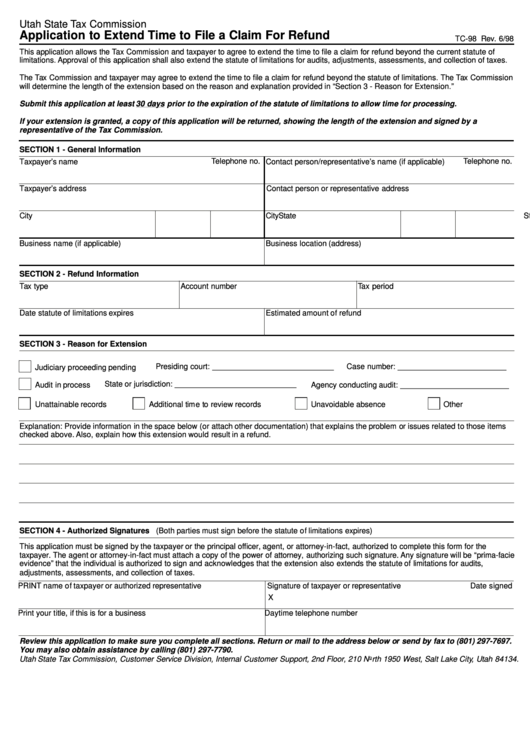

Utah State Tax Commission

Application to Extend Time to File a Claim For Refund

TC-98 Rev. 6/98

This application allows the Tax Commission and taxpayer to agree to extend the time to file a claim for refund beyond the current statute of

limitations. Approval of this application shall also extend the statute of limitations for audits, adjustments, assessments, and collection of taxes.

The Tax Commission and taxpayer may agree to extend the time to file a claim for refund beyond the statute of limitations. The Tax Commission

will determine the length of the extension based on the reason and explanation provided in “ Section 3 - Reason for Extension.”

Submit this application at least

30 days

prior to the expiration of the statute of limitations to allow time for processing.

If your extension is granted, a copy of this application will be returned, showing the length of the extension and signed by a

representative of the Tax Commission.

SECTION 1 - General Information

Telephone no.

Telephone no.

Taxpayer’ s name

Contact person/representative’ s name (if applicable)

Taxpayer’ s address

Contact person or representative address

City

State

Zip code

City

State

Zip code

Business name (if applicable)

Business location (address)

SECTION 2 - Refund Information

Tax type

Account number

Tax period

Date statute of limitations expires

Estimated amount of refund

SECTION 3 - Reason for Extension

Presiding court: ____________________________

Case number: _________________________

Judiciary proceeding pending

State or jurisdiction: ____________________________

Audit in process

Agency conducting audit: _________________________

Unattainable records

Additional time to review records

Unavoidable absence

Other

Explanation: Provide information in the space below (or attach other documentation) that explains the problem or issues related to those items

checked above. Also, explain how this extension would result in a refund.

SECTION 4 - Authorized Signatures (Both parties must sign before the statute of limitations expires)

This application must be signed by the taxpayer or the principal officer, agent, or attorney-in-fact, authorized to complete this form for the

taxpayer. The agent or attorney-in-fact must attach a copy of the power of attorney, authorizing such signature. Any signature will be “ prima-facie

evidence”that the individual is authorized to sign and acknowledges that the extension also extends the statute of limitations for audits,

adjustments, assessments, and collection of taxes.

PRINT name of taxpayer or authorized representative

Signature of taxpayer or representative

Date signed

X

Print your title, if this is for a business

Daytime telephone number

Review this application to make sure you complete all sections. Return or mail to the address below or send by fax to (801) 297-7697.

You may also obtain assistance by calling (801) 297-7790.

Utah State Tax Commission, Customer Service Division, Internal Customer Support, 2nd Floor, 210 North 1950 West, Salt Lake City, Utah 84134.

1

1 2

2