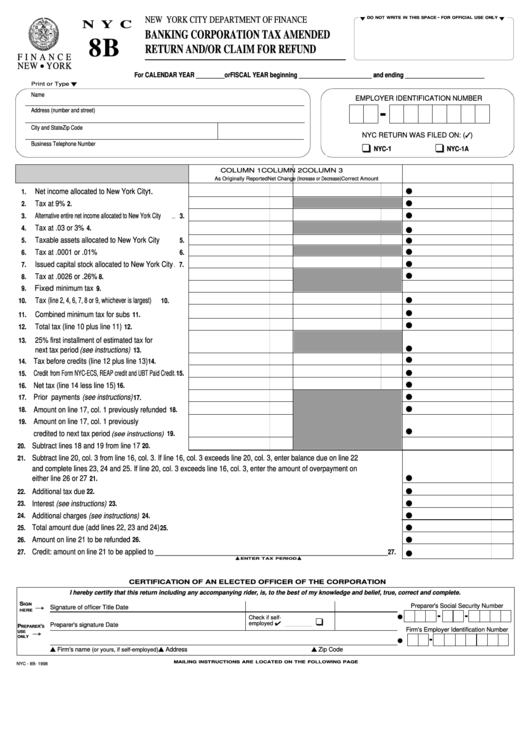

Form Nyc 8b - Banking Corporation Tax Amended Return And/or Claim For Refund

ADVERTISEMENT

-

t

t

NEW YORK CITY DEPARTMENT OF FINANCE

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

N Y C

BANKING CORPORATION TAX AMENDED

8B

RETURN AND/OR CLAIM FOR REFUND

F I N A N C E

NEW

YORK

l

For CALENDAR YEAR _________or FISCAL YEAR beginning _______________________ and ending _________________________

Print or Type t

Name

EMPLOYER IDENTIFICATION NUMBER

Address (number and street)

City and State

Zip Code

NYC RETURN WAS FILED ON: (3)

q

q

Business Telephone Number

NYC-1

NYC-1A

COLUMN 1

COLUMN 2

COLUMN 3

As Originally Reported

Net Change (Increase or Decrease)

Correct Amount

l

Net income allocated to New York City

1.

1.

.......................

l

Tax at 9%

2.

2.

..........................................................................................

l

Alternative entire net income allocated to New York City

3.

3.

...

Tax at .03 or 3%

4.

4.

l

..........................................................................

l

Taxable assets allocated to New York City

5.

5.

.............

l

Tax at .0001 or .01%

6.

6.

................................................................

l

Issued capital stock allocated to New York City

7.

7.

.

l

Tax at .0026 or .26%

8.

8.

................................................................

Fixed minimum tax

9.

9.

..................................................................

l

Tax (line 2, 4, 6, 7, 8 or 9, whichever is largest)

10.

10.

............

l

Combined minimum tax for subs

11.

11.

....................................

l

Total tax (line 10 plus line 11)

12.

12.

...........................................

25% first installment of estimated tax for

13.

l

next tax period (see instructions)

13.

...................................

l

Tax before credits (line 12 plus line 13)

14.

14.

.......................

l

Credit from Form NYC-ECS, REAP credit and UBT Paid Credit

15.

15.

..

l

Net tax (line 14 less line 15)

16.

16.

.................................................

l

Prior payments (see instructions)

17.

17.

...................................

l

Amount on line 17, col. 1 previously refunded

18.

18.

.....

19.

Amount on line 17, col. 1 previously

l

credited to next tax period

(see instructions)

19.

.......

Subtract lines 18 and 19 from line 17

20.

20.

............................

Subtract line 20, col. 3 from line 16, col. 3. If line 16, col. 3 exceeds line 20, col. 3, enter balance due on line 22

21.

and complete lines 23, 24 and 25. If line 20, col. 3 exceeds line 16, col. 3, enter the amount of overpayment on

l

either line 26 or 27

21.

....................................................................................................................................................................................................................................................

l

Additional tax due

22.

22.

......................................................................................................................................................................................................................................................

l

Interest (see instructions)

23.

23.

....................................................................................................................................................................................................................................

l

Additional charges (see instructions)

24.

24.

.........................................................................................................................................................................................................

l

Total amount due (add lines 22, 23 and 24)

25.

25.

..........................................................................................................................................................................................

l

Amount on line 21 to be refunded

26.

26.

................................................................................................................................................................................................................

Credit: amount on line 21 to be applied to ___________________________________________________________

l

27.

27.

s

s

ENTER TAX PERIOD

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

I hereby certify that this return including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

S

Õ

IGN

Preparer's Social Security Number

Signature of officer

Title

Date

HERE

l

Check if self-

q

employed 4

Preparer's signature

Date

P

'

REPARER

S

Firm's Employer Identification Number

Õ

USE

ONLY

l

s Firm's name

s Address

s Zip Code

(or yours, if self-employed)

MAILING INSTRUCTIONS ARE LOCATED ON THE FOLLOWING PAGE

NYC - 8B- 1998

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1