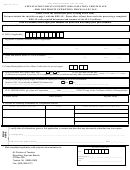

NEW JERSEY DIVISION OF TAXATION

REG-1E (04-16)

APPLICATION FOR ST-5 EXEMPT ORGANIZATION CERTIFICATE

- FOR NONPROFIT EXEMPTION FROM SALES TAX -

Please review the instructions prior to filling in this form.

You must include the checklist on page 1 with the REG-1E. Please allow at least three weeks for processing a completed

REG-1E with required documents and issuance of the ST-5 Certificate.

Click in a shaded area to type your answers OR print form and neatly print your answers.

A. Organization Name

-

B. FEIN (if applicable)

C. Registered Corporate Alternate Name (if applicable)

D. Physical Location (an officer’s address may be used)

Street

City

State

Zip

E. Name and address where ST-5 is to be mailed

Name

Street

City

State

Zip

F. County/Municipality/or Out-of-State Code(codes are on next page)

G. Will you collect New Jersey Sales Tax?

Yes

No

If yes, give date of first sale _________/_________/________

Month

Day

(Collection not required if you have ST-5 exempt organization certificate and only make occasional sales)

H. Will you soon begin paying wages or salaries to employees working in NJ or to NJ residents?

(Answer “No” if you already withhold NJ income tax)

Yes

No

If yes, give date of first wage or salary payment ________/________/________and give date that gross payroll will exceed $1,000 ______/______/______

I. IF A CORPORATION, give State of Corporation _______, date ____/____/____ ATTACH copy of the Certificate/Articles of Incorporation.

J. Contact Person

Email Address

Daytime Phone

K. Provide the following information for 2 responsible officers.

NAME (Last Name, First, MI)

TITLE

HOME ADDRESS (Street, City, State, Zip)

I certify that all information given in this application is correct and also that any documents submitted are true copies.

Your Signature______________________________________________________________________________________________

Name and Title (please print)_______________________________________________________________ Date____/____/_____

Mail completed application with required documentation to:

OFFICIAL USE ONLY

DLN

NJ Division of Taxation

Regulatory Services Branch

Determination __________________________________

PO Box 269

Effective

Trenton, NJ 08695-0269

Date

__________________________________

Fax: (609) 989-0113

1

1 2

2