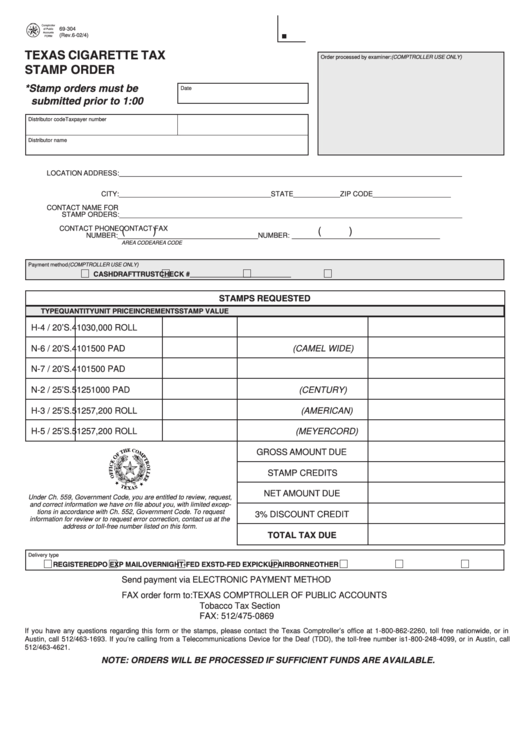

69-304

(Rev.6-02/4)

TEXAS CIGARETTE TAX

Order processed by examiner: (COMPTROLLER USE ONLY)

STAMP ORDER

* Stamp orders must be

Date

submitted prior to 1:00 p.m.

Distributor code

Taxpayer number

Distributor name

LOCATION ADDRESS: ________________________________________________________________________________________

CITY: _______________________________________ STATE ____________ ZIP CODE ____________________

CONTACT NAME FOR

STAMP ORDERS: ________________________________________________________________________________________

CONTACT PHONE

CONTACT FAX

(

)

(

)

NUMBER: ____________________________________

NUMBER: ______________________________________

AREA CODE

AREA CODE

Payment method (COMPTROLLER USE ONLY)

CASH

DRAFT

TRUST

CHECK # __________________________

STAMPS REQUESTED

TYPE

QUANTITY

UNIT PRICE

INCREMENTS

STAMP VALUE

H-4 / 20’S

.410

30,000 ROLL

N-6 / 20’S

.410

1500 PAD (CAMEL WIDE)

N-7 / 20’S

.410

1500 PAD

1000 PAD (CENTURY)

N-2 / 25’S

.5125

7,200 ROLL (AMERICAN)

H-3 / 25’S

.5125

H-5 / 25’S

.5125

7,200 ROLL (MEYERCORD)

GROSS AMOUNT DUE

STAMP CREDITS

NET AMOUNT DUE

Under Ch. 559, Government Code, you are entitled to review, request,

and correct information we have on file about you, with limited excep-

tions in accordance with Ch. 552, Government Code. To request

3% DISCOUNT CREDIT

information for review or to request error correction, contact us at the

address or toll-free number listed on this form.

TOTAL TAX DUE

Delivery type

REGISTERED

PO EXP MAIL

OVERNIGHT-FED EX

STD-FED EX

PICKUP

AIRBORNE

OTHER

Send payment via ELECTRONIC PAYMENT METHOD

FAX order form to: TEXAS COMPTROLLER OF PUBLIC ACCOUNTS

Tobacco Tax Section

FAX: 512/475-0869

If you have any questions regarding this form or the stamps, please contact the Texas Comptroller’s office at 1-800-862-2260, toll free nationwide, or in

Austin, call 512/463-1693. If you’re calling from a Telecommunications Device for the Deaf (TDD), the toll-free number is1-800-248-4099, or in Austin, call

512/463-4621.

NOTE: ORDERS WILL BE PROCESSED IF SUFFICIENT FUNDS ARE AVAILABLE.

1

1