Form 51a280 (7-13) - Out-Of-State Purchase-Use Tax Affidavit

ADVERTISEMENT

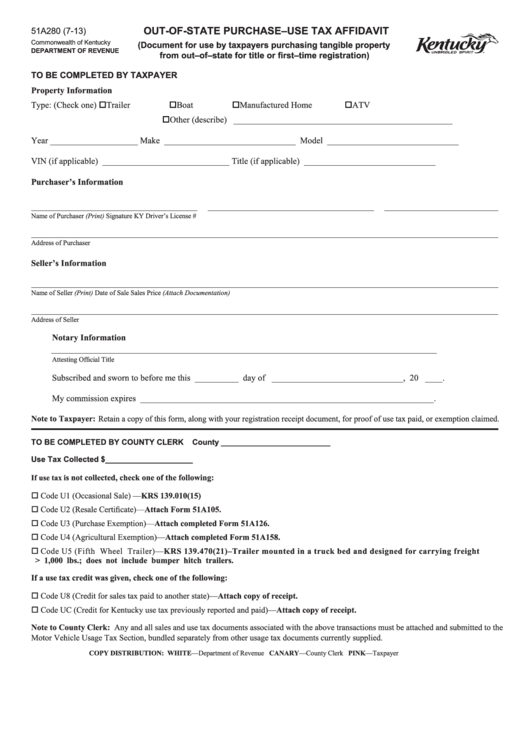

OUT-OF-STATE PURCHASE–USE TAX AFFIDAVIT

51A280 (7-13)

Commonwealth of Kentucky

(Document for use by taxpayers purchasing tangible property

DEPARTMENT OF REVENUE

from out–of–state for title or first–time registration)

TO BE COMPLETED BY TAXPAYER

Property Information

Type: (Check one)

Trailer

Boat

Manufactured Home

ATV

Other (describe) __________________________________________________

Year ____________________ Make ______________________________

Model ______________________________

VIN (if applicable) _____________________________ Title (if applicable) ______________________________

Purchaser’s Information

Name of Purchaser (Print)

Signature

KY Driver’s License #

Address of Purchaser

Seller’s Information

Name of Seller (Print)

Date of Sale

Sales Price (Attach Documentation)

Address of Seller

Notary Information

Attesting Official

Title

Subscribed and sworn to before me this __________ day of ______________________________, 20 ____.

My commission expires ___________________________________________________________________.

Note to Taxpayer: Retain a copy of this form, along with your registration receipt document, for proof of use tax paid, or exemption claimed.

TO BE COMPLETED BY COUNTY CLERK

County _________________________

Use Tax Collected $____________________

s not collected, check one of the following:

If use tax i

Code U1 (Occasional Sale) —KRS 139.010(15)

Code U2 (Resale Certificate)—Attach Form 51A105.

Code U3 (Purchase Exemption)—Attach completed Form 51A126.

Code U4 (Agricultural Exemption)—Attach completed Form 51A158.

Code U5 (Fifth Wheel Trailer)—KRS 139.470(21)–Trailer mounted in a truck bed and designed for carrying freight

> 1,000 lbs.; does not include bumper hitch trailers.

If a use tax credit was given, check one of the following:

Code U8 (Credit for sales tax paid to another state)—Attach copy of receipt.

Code UC (Credit for Kentucky use tax previously reported and paid)—Attach copy of receipt.

Note to County Clerk: Any and all sales and use tax documents associated with the above transactions must be attached and submitted to the

Motor Vehicle Usage Tax Section, bundled separately from other usage tax documents currently supplied.

COPY DISTRIBUTION:

WHITE—Department of Revenue

CANARY—County Clerk

PINK—Taxpayer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1