Virginia Egg Excise Tax Return and Worksheet Instructions

General: A tax is levied on shell eggs and egg products sold or

A copy of each form should be kept in your records for a period

consumed in Virginia. The handler of such eggs is responsible

of three years. Also, bills of lading and other sales reports should

for payment of the tax.

be retained for your records.

For purposes of this tax, “handler” includes:

Declaration and Signature: Be sure to sign, date and enter your

phone number in the space provided on Form EG-1.

1. Any person who operates a grading station, a packer, a

huckster, a distributor, or other person who purchases, sells or

Where to File: Mail Form EG-1, with payment, to the Department

handles eggs that are used at the wholesale level for consumption

of Taxation.

in Virginia, or a farmer who packs, processes or otherwise

The monthly return on Form EG-1 and the payment of tax are to

performs the functions of a handler; or

be postmarked no later than the 20th day of the following month

2. Any person in Virginia who purchases eggs, or the liquid

and mailed to:

equivalent thereof, from anyone other than a registered handler

Department of Taxation

for use or consumption at wholesale in Virginia. Generally, the last

P.O. Box 2185

handler who sells eggs or egg products to a retailer or food service

Richmond, Virginia 23218- 2185

establishment located in Virginia is responsible for collecting and

remitting the tax to the Department of Taxation.

A return must be filed each month even if there is no tax due.

The term “registered handler” means any person who has

Change of Ownership: If there has been a change of ownership,

registered with the Tax Commissioner for receiving monthly return

do not use the return with the name and account number of the

forms and reporting the egg excise tax. Eggs shall be deemed to

former owner. Use the Department’s online services at

be used in Virginia if, at a Virginia location, they are incorporated

virginia.gov to register a new business and update registration

into another product so as to lose their character as eggs. Eggs

information. If you prefer to register by mail, forms are available

shall be deemed to be consumed in Virginia if they are actually

online for download or by calling (804) 367-8037. File Form R-1

consumed in Virginia or sold at a location in Virginia.

to register a new business or location.

Every person, whether in-state or out-of-state, who engages in

Change of Address or Out-of-Business: If you change your

business in the Commonwealth as a handler is required to register

business mailing address or discontinue your business, use Form

unless exempt from the tax.

R-3, or send a letter to the Virginia Department of Taxation, P.O.

Exemptions: Any handler selling less than 500 30-dozen cases

Box 1114, Richmond, Virginia 23218-1114.

per year (equivalent to 15,000 dozen), or the liquid equivalent

Questions: Call (804) 786-2450 or write the Virginia Department

thereof, is exempt from the tax and is not required to be registered.

of Taxation, P.O. Box 715, Richmond, VA 23218-0715. If you

Eggs sold between registered handlers are exempt from the tax.

have Internet access, you can obtain most Virginia tax forms

from the Department’s website: virginia.gov. Additional

Filing Procedure: Use Form EG-2, Worksheet and Conversion

information may also be obtained by writing the Virginia Egg Board,

Calculations for Egg Products to convert egg products into pounds

911 Saddleback Court, McLean, Virginia 22102 or by telephoning

of liquid equivalent for the computation of the tax for unshelled

(703) 790-1984.

eggs.

Transfer items indicated by the arrows on the worksheet, EG-2,

to the Virginia Egg Excise Tax Return, Form EG-1.

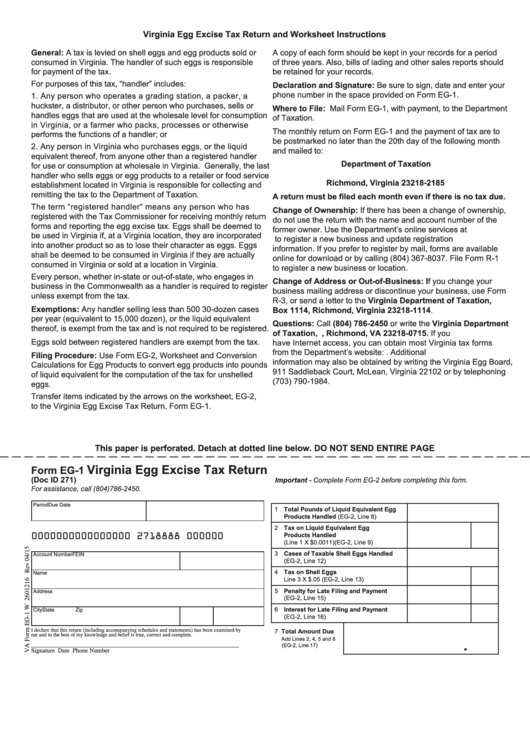

This paper is perforated. Detach at dotted line below. DO NOT SEND ENTIRE PAGE

Virginia Egg Excise Tax Return

Form EG-1

(Doc ID 271)

Important - Complete Form EG-2 before completing this form.

For assistance, call (804)786-2450.

Period

Due Date

1 Total Pounds of Liquid Equivalent Egg

Products Handled (EG-2, Line 8)

2 Tax on Liquid Equivalent Egg

0000000000000000 2718888 000000

Products Handled

(Line 1 X $0.0011)(EG-2, Line 9)

3 Cases of Taxable Shell Eggs Handled

Account Number

FEIN

(EG-2, Line 12)

4 Tax on Shell Eggs

Name

Line 3 X $.05 (EG-2, Line 13)

5 Penalty for Late Filing and Payment

Address

(EG-2, Line 15)

6 Interest for Late Filing and Payment

City

State

Zip

(EG-2, Line 16)

I declare that this return (including accompanying schedules and statements) has been examined by

7 Total Amount Due

me and to the best of my knowledge and belief is true, correct and complete.

Add Lines 2, 4, 5 and 6

.

(EG-2, Line 17)

Signature

Date

Phone Number

1

1 2

2 3

3