Peanut Excise Tax Return Instructions

General Liability: An excise tax is levied on peanuts grown and sold

Questions: Call (804) 786-2450 or write the Virginia Department of

in Virginia for processing. The processor is liable for the payment of the

Taxation, P.O. Box 715, Richmond, VA 23218-0715. You can obtain

tax on all peanuts such processor purchases. A processor is defined

most Virginia tax forms from the Department’s website at

as any person, individual, corporation, partnership, trust, association,

virginia.gov.

cooperative, and any and all other business units, devices and

Tax Rate: For filing periods through June 30, 2010, the rate is $.15 per

arrangements that clean, shell or crush peanuts.

100 pounds. Multiply Line 1 below by .0015.

Filing Procedure: The Peanut Excise Tax return must be filed by the

For filing periods beginning July 1, 2010, through June 30, 2016, the

processor with the Virginia Department of Taxation on a semi-annual

rate is $0.30 per 100 pounds. Multiply Line 1 below by .0030.

basis. The semi-annual periods for the returns run from January 1

For the filing periods beginning July 1, 2016, and thereafter, the peanut

through June 30, and July 1 through December 31. The returns for

excise tax will return to $.15 per 100 pounds. Multiply Line 1 below by

each period are due and the tax payable on July 10 and February 15,

.0015.

respectively.

Send completed return below to:

Penalties and Interest: If the tax is not paid when due, a penalty of

5% of the tax due will be added to the tax, and the Virginia Department

Virginia Department of Taxation Virginia

of Taxation will notify the taxpayer of such delinquency. If the tax

PO Box 2185

and penalty are not paid within 30 days of the notification, interest at

Richmond VA 23218-2185

the underpayment rate established by Section 6621 of the Internal

It is Important to Keep Your Information Current: Enroll in

Revenue Code, plus 2%, will be added on both the tax and penalty.

Business iFile at virginia.gov/iFile to manage your

Declaration and Signature: Be sure to sign, date and enter your

account and update your account registration information. If

phone number on the return in the space indicated.

you are unable to use our online services, you can change your

registration information by filing Form R-3. Send the form or a

letter requesting a registration change to the Virginia Department

of Taxation, P.O. Box 1114, Richmond, Virginia 23218-1114.

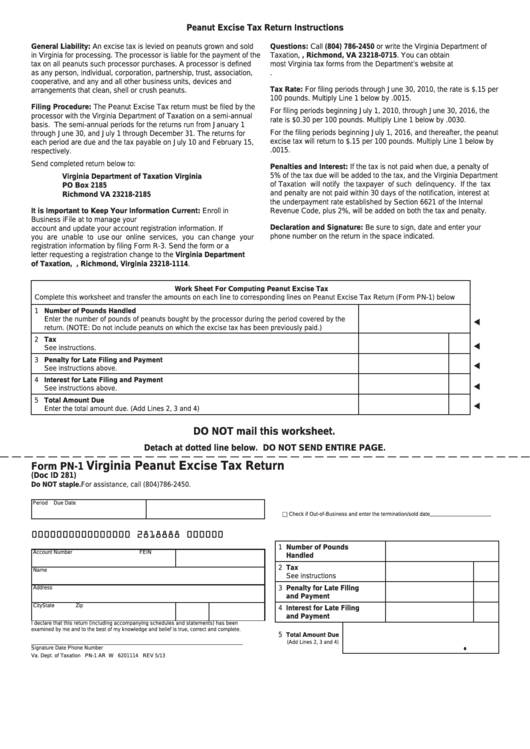

Work Sheet For Computing Peanut Excise Tax

Complete this worksheet and transfer the amounts on each line to corresponding lines on Peanut Excise Tax Return (Form PN-1) below

1 Number of Pounds Handled

Enter the number of pounds of peanuts bought by the processor during the period covered by the

return. (NOTE: Do not include peanuts on which the excise tax has been previously paid.)

2 Tax

See instructions.

3 Penalty for Late Filing and Payment

See instructions above.

4 Interest for Late Filing and Payment

See instructions above.

5 Total Amount Due

Enter the total amount due. (Add Lines 2, 3 and 4)

DO NOT mail this worksheet.

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Virginia Peanut Excise Tax Return

Form PN-1

(Doc ID 281)

Do NOT staple.

For assistance, call (804)786-2450.

Period

Due Date

h Check if Out-of-Business and enter the termination/sold date

0000000000000000 2818888 000000

1 Number of Pounds

Account Number

FEIN

Handled

2 Tax

Name

See instructions

3 Penalty for Late Filing

Address

and Payment

City

State

Zip

4 Interest for Late Filing

and Payment

I declare that this return (including accompanying schedules and statements) has been

examined by me and to the best of my knowledge and belief is true, correct and complete.

5

Total Amount Due

.

(Add Lines 2, 3 and 4)

Signature

Date

Phone Number

Va. Dept. of Taxation PN-1 AR W 6201114 REV 5/13

1

1