Individual Income Tax Return - City Of Springboro - 2003 Page 2

ADVERTISEMENT

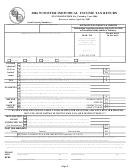

WORKSHEET A—ATTACH ALL W-2’S

Column 1

Column 2

Column 3

Column 4

Column 5

City of

Gross Salaries

Other City Tax

Lesser of Column 3 or

1.5 of Column 2

Employment

Wages Etc. (usually box 18)

Withheld

Column 4

Totals

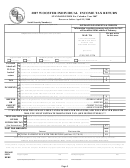

WORKSHEET B—OTHER ADJUSTMENTS

Any other deductions must be supported with documentation and calculation. Proration of income results in proration of other city credit.

Part-year residents must support deductions with copies of pay stubs or employer statements showing year-to-date gross wages as of the

date of move. If your income was earned in another municipality and was subject to their tax, and your reducing the reportable

amount, you must reduce the allowable other city credit accordingly.

AMOUNT OF DEDUCTIONS (PAGE, LINE 2)

MUST SUPPORT WITH DOCUMENTATION

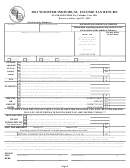

WORKSHEET C—OTHER INCOME

(From Schedules and attachments)

Not taxable income or gain

Not reportable loss from Federal

LOCATION

TYPE OF COMPENSATION

(Physical location—use complete address)

from Federal Schedule

Schedule

PROPRIETORSHIP INCOME

(Schedule C)

PARTNERSHIP INCOME

(Schedule E)

PARTNERSHIP INCOME

(Schedule E/K-1) See below

PARTNERSHIP INCOME

(Schedule F)

TOTAL FROM EACH COLUMN

NET PROFIT/LOSS FROM

ACTIVITIES REPORTED ABOVE

(Net on both total columns)

TRANSFER THE NET PROFIT (POSITIVE ) AMOUNT TO PAGE 1, LINE 4B AND THE LOSS (NEGATIVE) AMOUNT TO PAGE 1,

LINE 4A. A NEGATIVE AMOUNT WILL BE CARRIED FORWARD FOR USE ON FUTURE PROFIT FROM THE SAME SCHEDULE

ACTIVITIES FOR A PERIOD NOT TO EXCEED THREE YEARS. A NET LOSS CANNOT BE USED TO OFFSET W-2 INCOME.

NOTE: 1/2 Self-employment social security tax is not an allowable deduction. An individual who operates two or more sole proprietorships,

rentals, farms, or reportable partnerships may offset them against each other to arrive at a total reportable profit. A net loss cannot be used to offset

other income, such as W-2 wages. Partnerships are reportable on this return by residents of Springboro. Partnerships (or other business entities)

that are located in Springboro are required to file an income tax return with this municipality as an entity. A Business Income Tax Return for filing

entity tax returns can be obtained from the Income Tax Department.

PENALTY AND INTEREST WILL BE ASSESSED FOR FAILURE TO FILE AND FAILURE TO PAY QUARTERLY ESTIMATES BY

DUE DATE, FAILURE TO FILE A RETURN ON TIME AND/OR PAY THE TAX DUE ON TIME.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2