Sales Tax Return Form - City Of Cherry Village

ADVERTISEMENT

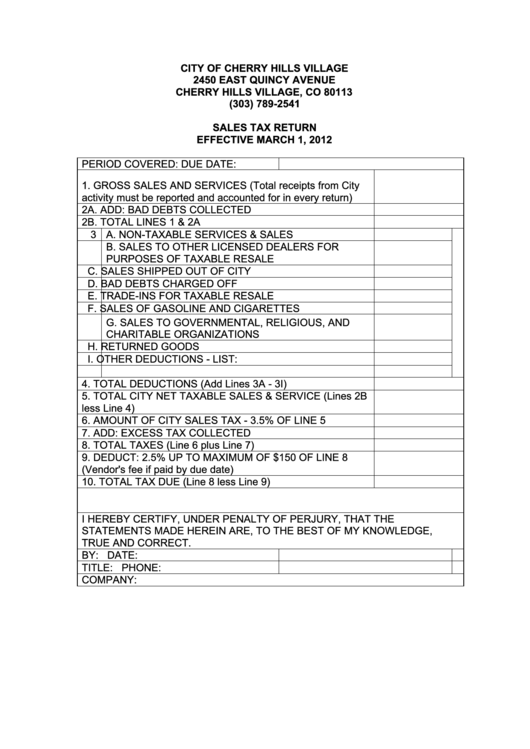

CITY OF CHERRY HILLS VILLAGE

2450 EAST QUINCY AVENUE

CHERRY HILLS VILLAGE, CO 80113

(303) 789-2541

SALES TAX RETURN

EFFECTIVE MARCH 1, 2012

PERIOD COVERED:

DUE DATE:

1. GROSS SALES AND SERVICES (Total receipts from City

activity must be reported and accounted for in every return)

2A. ADD: BAD DEBTS COLLECTED

2B. TOTAL LINES 1 & 2A

3 A. NON-TAXABLE SERVICES & SALES

B. SALES TO OTHER LICENSED DEALERS FOR

PURPOSES OF TAXABLE RESALE

C. SALES SHIPPED OUT OF CITY

D. BAD DEBTS CHARGED OFF

E. TRADE-INS FOR TAXABLE RESALE

F. SALES OF GASOLINE AND CIGARETTES

G. SALES TO GOVERNMENTAL, RELIGIOUS, AND

CHARITABLE ORGANIZATIONS

H. RETURNED GOODS

I. OTHER DEDUCTIONS - LIST:

4. TOTAL DEDUCTIONS (Add Lines 3A - 3I)

5. TOTAL CITY NET TAXABLE SALES & SERVICE (Lines 2B

less Line 4)

6. AMOUNT OF CITY SALES TAX - 3.5% OF LINE 5

7. ADD: EXCESS TAX COLLECTED

8. TOTAL TAXES (Line 6 plus Line 7)

9. DEDUCT: 2.5% UP TO MAXIMUM OF $150 OF LINE 8

(Vendor's fee if paid by due date)

10. TOTAL TAX DUE (Line 8 less Line 9)

I HEREBY CERTIFY, UNDER PENALTY OF PERJURY, THAT THE

STATEMENTS MADE HEREIN ARE, TO THE BEST OF MY KNOWLEDGE,

TRUE AND CORRECT.

BY:

DATE:

TITLE:

PHONE:

COMPANY:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1