Montana Form Nol Instructions - Montana Net Operating Loss (Nol) And Federal Nol - 2014

ADVERTISEMENT

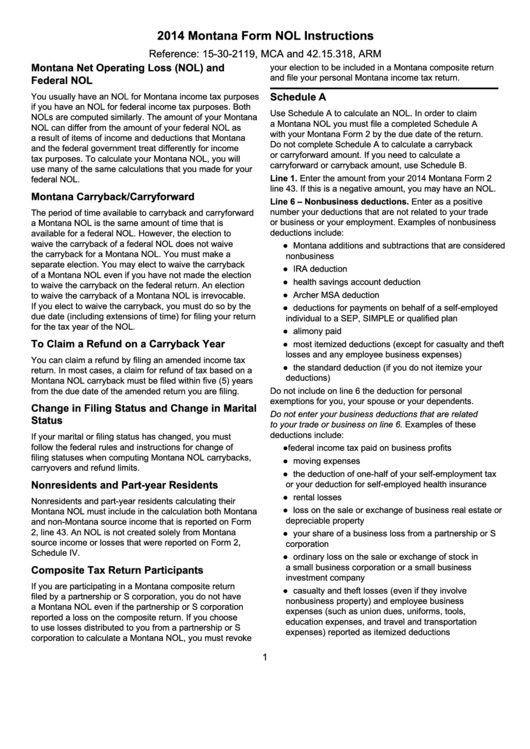

2014 Montana Form NOL Instructions

Reference: 15-30-2119, MCA and 42.15.318, ARM

Montana Net Operating Loss (NOL) and

your election to be included in a Montana composite return

and file your personal Montana income tax return.

Federal NOL

Schedule A

You usually have an NOL for Montana income tax purposes

if you have an NOL for federal income tax purposes. Both

Use Schedule A to calculate an NOL. In order to claim

NOLs are computed similarly. The amount of your Montana

a Montana NOL you must file a completed Schedule A

NOL can differ from the amount of your federal NOL as

with your Montana Form 2 by the due date of the return.

a result of items of income and deductions that Montana

Do not complete Schedule A to calculate a carryback

and the federal government treat differently for income

or carryforward amount. If you need to calculate a

tax purposes. To calculate your Montana NOL, you will

carryforward or carryback amount, use Schedule B.

use many of the same calculations that you made for your

Line 1. Enter the amount from your 2014 Montana Form 2

federal NOL.

line 43. If this is a negative amount, you may have an NOL.

Montana Carryback/Carryforward

Line 6 – Nonbusiness deductions. Enter as a positive

number your deductions that are not related to your trade

The period of time available to carryback and carryforward

or business or your employment. Examples of nonbusiness

a Montana NOL is the same amount of time that is

deductions include:

available for a federal NOL. However, the election to

waive the carryback of a federal NOL does not waive

● Montana additions and subtractions that are considered

the carryback for a Montana NOL. You must make a

nonbusiness

separate election. You may elect to waive the carryback

● IRA deduction

of a Montana NOL even if you have not made the election

● health savings account deduction

to waive the carryback on the federal return. An election

● Archer MSA deduction

to waive the carryback of a Montana NOL is irrevocable.

If you elect to waive the carryback, you must do so by the

● deductions for payments on behalf of a self-employed

due date (including extensions of time) for filing your return

individual to a SEP, SIMPLE or qualified plan

for the tax year of the NOL.

● alimony paid

To Claim a Refund on a Carryback Year

● most itemized deductions (except for casualty and theft

losses and any employee business expenses)

You can claim a refund by filing an amended income tax

● the standard deduction (if you do not itemize your

return. In most cases, a claim for refund of tax based on a

deductions)

Montana NOL carryback must be filed within five (5) years

Do not include on line 6 the deduction for personal

from the due date of the amended return you are filing.

exemptions for you, your spouse or your dependents.

Change in Filing Status and Change in Marital

Do not enter your business deductions that are related

Status

to your trade or business on line 6. Examples of these

deductions include:

If your marital or filing status has changed, you must

follow the federal rules and instructions for change of

● federal income tax paid on business profits

filing statuses when computing Montana NOL carrybacks,

● moving expenses

carryovers and refund limits.

● the deduction of one-half of your self-employment tax

Nonresidents and Part-year Residents

or your deduction for self-employed health insurance

● rental losses

Nonresidents and part-year residents calculating their

● loss on the sale or exchange of business real estate or

Montana NOL must include in the calculation both Montana

depreciable property

and non-Montana source income that is reported on Form

2, line 43. An NOL is not created solely from Montana

● your share of a business loss from a partnership or S

source income or losses that were reported on Form 2,

corporation

Schedule IV.

● ordinary loss on the sale or exchange of stock in

a small business corporation or a small business

Composite Tax Return Participants

investment company

If you are participating in a Montana composite return

● casualty and theft losses (even if they involve

filed by a partnership or S corporation, you do not have

nonbusiness property) and employee business

a Montana NOL even if the partnership or S corporation

expenses (such as union dues, uniforms, tools,

reported a loss on the composite return. If you choose

education expenses, and travel and transportation

to use losses distributed to you from a partnership or S

expenses) reported as itemized deductions

corporation to calculate a Montana NOL, you must revoke

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5