Montana Form Nol Instructions - Montana Net Operating Loss (Nol) And Federal Nol - 2011

ADVERTISEMENT

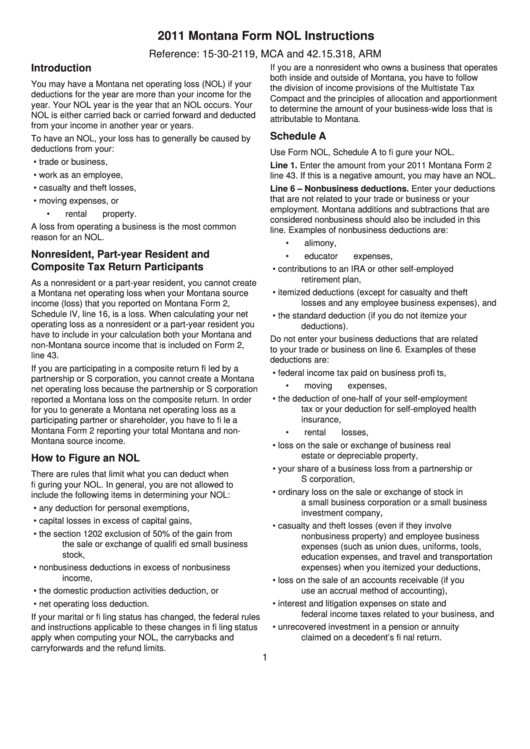

2011 Montana Form NOL Instructions

Reference: 15-30-2119, MCA and 42.15.318, ARM

Introduction

If you are a nonresident who owns a business that operates

both inside and outside of Montana, you have to follow

You may have a Montana net operating loss (NOL) if your

the division of income provisions of the Multistate Tax

deductions for the year are more than your income for the

Compact and the principles of allocation and apportionment

year. Your NOL year is the year that an NOL occurs. Your

to determine the amount of your business-wide loss that is

NOL is either carried back or carried forward and deducted

attributable to Montana.

from your income in another year or years.

Schedule A

To have an NOL, your loss has to generally be caused by

deductions from your:

Use Form NOL, Schedule A to fi gure your NOL.

•

trade or business,

Line 1. Enter the amount from your 2011 Montana Form 2

•

work as an employee,

line 43. If this is a negative amount, you may have an NOL.

•

casualty and theft losses,

Line 6 – Nonbusiness deductions. Enter your deductions

that are not related to your trade or business or your

•

moving expenses, or

employment. Montana additions and subtractions that are

•

rental property.

considered nonbusiness should also be included in this

A loss from operating a business is the most common

line. Examples of nonbusiness deductions are:

reason for an NOL.

•

alimony,

Nonresident, Part-year Resident and

•

educator expenses,

Composite Tax Return Participants

•

contributions to an IRA or other self-employed

retirement plan,

As a nonresident or a part-year resident, you cannot create

•

itemized deductions (except for casualty and theft

a Montana net operating loss when your Montana source

losses and any employee business expenses), and

income (loss) that you reported on Montana Form 2,

Schedule IV, line 16, is a loss. When calculating your net

•

the standard deduction (if you do not itemize your

operating loss as a nonresident or a part-year resident you

deductions).

have to include in your calculation both your Montana and

Do not enter your business deductions that are related

non-Montana source income that is included on Form 2,

to your trade or business on line 6. Examples of these

line 43.

deductions are:

If you are participating in a composite return fi led by a

•

federal income tax paid on business profi ts,

partnership or S corporation, you cannot create a Montana

•

moving expenses,

net operating loss because the partnership or S corporation

•

the deduction of one-half of your self-employment

reported a Montana loss on the composite return. In order

tax or your deduction for self-employed health

for you to generate a Montana net operating loss as a

insurance,

participating partner or shareholder, you have to fi le a

Montana Form 2 reporting your total Montana and non-

•

rental losses,

Montana source income.

•

loss on the sale or exchange of business real

estate or depreciable property,

How to Figure an NOL

•

your share of a business loss from a partnership or

There are rules that limit what you can deduct when

S corporation,

fi guring your NOL. In general, you are not allowed to

•

ordinary loss on the sale or exchange of stock in

include the following items in determining your NOL:

a small business corporation or a small business

•

any deduction for personal exemptions,

investment company,

•

capital losses in excess of capital gains,

•

casualty and theft losses (even if they involve

•

the section 1202 exclusion of 50% of the gain from

nonbusiness property) and employee business

the sale or exchange of qualifi ed small business

expenses (such as union dues, uniforms, tools,

stock,

education expenses, and travel and transportation

•

nonbusiness deductions in excess of nonbusiness

expenses) when you itemized your deductions,

income,

•

loss on the sale of an accounts receivable (if you

use an accrual method of accounting),

•

the domestic production activities deduction, or

•

interest and litigation expenses on state and

•

net operating loss deduction.

federal income taxes related to your business, and

If your marital or fi ling status has changed, the federal rules

and instructions applicable to these changes in fi ling status

•

unrecovered investment in a pension or annuity

apply when computing your NOL, the carrybacks and

claimed on a decedent’s fi nal return.

carryforwards and the refund limits.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5