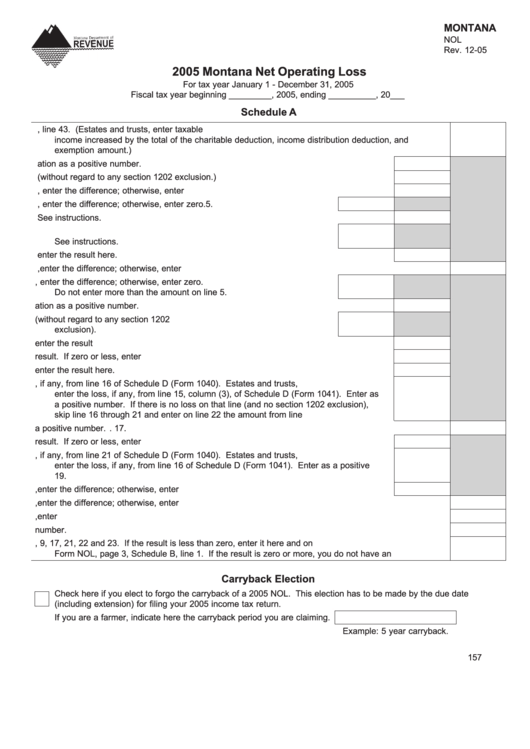

MONTANA

NOL

Rev. 12-05

2005 Montana Net Operating Loss

For tax year January 1 - December 31, 2005

Fiscal tax year beginning _________, 2005, ending __________, 20___

Schedule A

1.

Enter the amount from your 2005 Montana Form 2, line 43. (Estates and trusts, enter taxable

income increased by the total of the charitable deduction, income distribution deduction, and

exemption amount.) .............................................................................................................................. 1.

2.

Enter non-business capital losses before limitation as a positive number. .................... 2.

3.

Enter non-business capital gains (without regard to any section 1202 exclusion.) ........ 3.

4.

If line 2 is more than line 3, enter the difference; otherwise, enter zero. ....................... 4.

5.

If line 3 is more than line 2, enter the difference; otherwise, enter zero. 5.

6.

Enter non-business deductions. See instructions. ........................................................ 6.

7.

Enter non-business income other than capital gains.

See instructions. ..................................................................................... 7.

8.

Add lines 5 and 7 and enter the result here. .................................................................. 8.

9.

If line 6 is more than line 8, enter the difference; otherwise, enter zero. .............................................. 9.

10. If line 8 is more than line 6, enter the difference; otherwise, enter zero.

Do not enter more than the amount on line 5. ...................................... 10.

11. Enter business capital losses before limitation as a positive number. ......................... 11.

12. Enter business capital gains (without regard to any section 1202

exclusion). ............................................................................................ 12.

13. Add lines 10 and 12 and enter the result here. ............................................................ 13.

14. Subtract line 13 from line 11 and enter the result. If zero or less, enter zero. ............ 14.

15. Add lines 4 and 14 and enter the result here. .............................................................. 15.

16. Enter the loss, if any, from line 16 of Schedule D (Form 1040). Estates and trusts,

enter the loss, if any, from line 15, column (3), of Schedule D (Form 1041). Enter as

a positive number. If there is no loss on that line (and no section 1202 exclusion),

skip line 16 through 21 and enter on line 22 the amount from line 15. ........................ 16.

17. Enter section 1202 exclusion as a positive number. ........................................................................... 17.

18. Subtract line 17 from line 16 and enter the result. If zero or less, enter zero. ............ 18.

19. Enter the loss, if any, from line 21 of Schedule D (Form 1040). Estates and trusts,

enter the loss, if any, from line 16 of Schedule D (Form 1041). Enter as a positive

number. ........................................................................................................................ 19.

20. If line 18 is more than line 19, enter the difference; otherwise, enter zero. ................. 20.

21. If line 19 is more than line 18, enter the difference; otherwise, enter zero. ........................................ 21.

22. Subtract line 20 from line 15 and enter the result. If zero or less, enter zero. ................................... 22.

23. Enter NOL deduction for losses from other years as a positive number. ............................................ 23.

24. NOL. Combine lines 1, 9, 17, 21, 22 and 23. If the result is less than zero, enter it here and on

Form NOL, page 3, Schedule B, line 1. If the result is zero or more, you do not have an NOL. ....... 24.

Carryback Election

Check here if you elect to forgo the carryback of a 2005 NOL. This election has to be made by the due date

(including extension) for filing your 2005 income tax return.

If you are a farmer, indicate here the carryback period you are claiming.

Example: 5 year carryback.

157

1

1 2

2 3

3 4

4 5

5