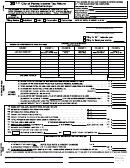

Motor Vehicle Personal Property Return Form - City Of Waynesboro - 2013 Page 2

ADVERTISEMENT

Does your vehicle qualify for Car Tax Relief?

If you can answer YES to any of the following questions, your motor vehicle is considered by State

Law to have a business use and does NOT qualify for Car Tax Relief.

Is more than 50% of mileage for the year used as a business expense for Federal Income Tax

*

purposes OR reimbursed by an employer?

Is more than 50% of the depreciation associated with the vehicle deducted as a business

*

expense for Federal Income Tax purposes?

Is the cost of the vehicle expensed pursuant to Section 179 of the Internal Revenue Service

*

Code?

Is the vehicle leased by an individual and the leasing company pays the tax without reimbursement

*

from the individual?

What is the Personal Property Tax Relief Act?

The Personal Property Tax Relief Act of 1998 provides tax relief for passenger cars, motorcycles, and pickup or panel trucks

having a registered gross weight of less than 7,501 pounds. To qualify, a vehicle must:

* Be owned by an individual or leased by an individual under a contract requiring the individual to pay the personal property tax;

AND:

* Be used less than 50% for business purposes.

Motor homes, trailers and farm use vehicles do not qualify for relief.

Please do NOT tear form - Return complete form.

Please fold this form so return address is visible in return window envelope.

Return to:

Commissioner of the Revenue

503 W. Main St., Room 107

Waynesboro VA 22980-4546

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2