Form 20 - Oregon Corporation Excise Tax Return - 2002 Page 2

ADVERTISEMENT

Page 2—Form 20 2002

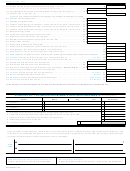

16. Oregon taxable income (carried forward from page 1, line 15) .................................................................... 16

17.

Excise tax (6.6 percent of line 16) (minimum tax is $10)

......................................... 17

•

18. Tax adjustment for interest on certain installment sales (see instructions) ................ 18

19. Total tax (line 17 plus line 18) ....................................................................................................................... 19

CREDITS

[see circular Tax Credits for Corporations (150-102-694) for information on credits]

•

20. Pollution control facility credit .................................................................................... 20

•

21. Pollution prevention credit ......................................................................................... 21

•

22. Lender’s credit: Energy conservation—Loans after 12-31-81 (Form 150-102-125) ... 22

•

23. Lender’s credit: Affordable housing—Loans after 12-31-89 (Form 150-102-125) ..... 23

•

24. Lender’s credit: Farmworker housing—Loans after 12-31-89 (Form 150-102-125) ... 24

•

25. Business energy credit .............................................................................................. 25

•

26. Farmworker housing project investment credit .......................................................... 26

•

27. Dependent care credit (Form 150-102-032) .............................................................. 27

•

28. Qualified research activities credit (Form 150-102-128) ............................................ 28

•

29. Other credits. Identify: _____________________________________________ ..... 29

30. Total credits (add lines 20 through 29) .......................................................................................................... 30

31. Excise tax after credits (line 19 minus line 30) (not less than $10) ............................................................... 31

•

32. Tax adjustment for LIFO benefit recapture (see instructions) ....................................................................... 32

<

>

•

33. Net excise tax* (line 31 minus line 32) (but not less than $10) ..................................................................... 33

•

34. 2002 estimated tax payments from Schedule ES.

...... 34

Include payments made with extension (see instructions)

•

35.

Tax Due.

Is line 33 more than line 34? If so, line 33 minus line 34 .............................................

Tax Due

35

•

36.

Overpayment.

Is line 33 less than line 34? If so, line 34 minus line 33 .............................

Overpayment

36

37. Penalty due with this return (see instructions) ........................................................... 37

38. Interest due with this return (see instructions) ........................................................... 38

•

39. Interest on underpayment of estimated tax (see instructions). Attach Form 37 ....... 39

40. Total penalty and interest (add lines 37 through 39) ..................................................................................... 40

41.

Total due

(line 35 plus line 40) (see instructions) ......................................................................

Total Due

41

42.

Refund

available (line 36 minus line 40) ......................................................................................

Refund

42

•

43. Amount of refund to be credited to 2003 estimated tax .........................................................

2003 Credit

43

44.

Net Refund

(line 42 minus line 43) .......................................................................................

Net Refund

44

*If the amount on line 33 is $500 or more, see the instructions for interest on underpayment of estimated tax.

SCHEDULE ES — ESTIMATED TAX PAYMENTS OR OTHER PREPAYMENTS

(see instructions)

Date of Payment

Voucher

Month

Day

Year

Amount Paid

1. Voucher 1

1

1

2. Voucher 2

2

2

3. Voucher 3

3

3

4. Voucher 4

4

4

5. Overpayment of last year’s tax elected as a credit against this year’s tax ................................................ 5

6. Payments made with extension or other prepayments for this tax year (date paid _____/_____/_____) ... 6

7. Claim of right tax credit (attach computation and explanation) .................................................................. 7

8. Total prepayments (carry to line 34) .......................................................................................................... 8

9. Last year’s net excise tax .............................................................................. 9

Under penalties of false swearing, I declare that I have examined this return, including accompanying schedules and statements, and

to the best of my knowledge and belief it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration

is based on all information of which the preparer has any knowledge.

•

SIGN

Signature of officer

Date

Signature of preparer other than taxpayer

HERE

Title

Address

Mail refund returns and no tax due returns to:

Mail tax-to-pay returns to:

Refund, PO Box 14777, Salem OR 97309-0960

Oregon Department of Revenue, PO Box 14790, Salem OR 97309-0470

150-102-020 (Rev. 1-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4