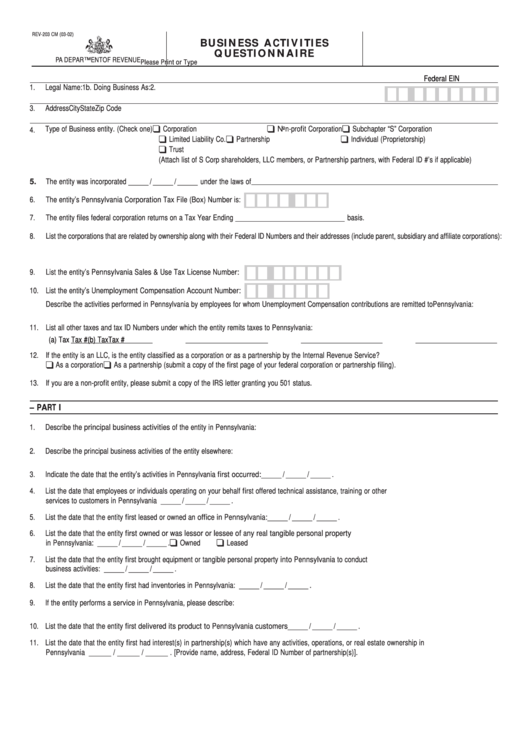

Business Activities Questionnaire - Pa Department Of Revenue - 2002

ADVERTISEMENT

REV-203 CM (03-02)

BUSINESS ACTIVITIES

QUESTIONNAIRE

PA DEPARTMENT OF REVENUE

Please Print or Type

A. GENERAL INFORMATION

Federal EIN

1.

Legal Name:

1b. Doing Business As:

2.

3.

Address

City

State

Zip Code

Type of Business entity. (Check one)

Corporation

Non-profit Corporation

Subchapter “S” Corporation

4.

Limited Liability Co.

Partnership

Individual (Proprietorship)

Trust

(Attach list of S Corp shareholders, LLC members, or Partnership partners, with Federal ID #’s if applicable)

The entity was incorporated ______ / ______ / ______ under the laws of

5.

6.

The entity’s Pennsylvania Corporation Tax File (Box) Number is:

7.

The entity files federal corporation returns on a Tax Year Ending _________________________________ basis.

8.

List the corporations that are related by ownership along with their Federal ID Numbers and their addresses (include parent, subsidiary and affiliate corporations):

9.

List the entity’s Pennsylvania Sales & Use Tax License Number:

10. List the entity’s Unemployment Compensation Account Number:

Describe the activities performed in Pennsylvania by employees for whom Unemployment Compensation contributions are remitted to Pennsylvania:

11. List all other taxes and tax ID Numbers under which the entity remits taxes to Pennsylvania:

(a) Tax

Tax #

(b) Tax

Tax #

12. If the entity is an LLC, is the entity classified as a corporation or as a partnership by the Internal Revenue Service?

As a corporation

As a partnership (submit a copy of the first page of your federal corporation or partnership filing).

13. If you are a non-profit entity, please submit a copy of the IRS letter granting you 501 status.

B. PENNSYLVANIA BUSINESS ACTIVITIES – PART I

1.

Describe the principal business activities of the entity in Pennsylvania:

2.

Describe the principal business activities of the entity elsewhere:

3.

Indicate the date that the entity’s activities in Pennsylvania first occurred: ______ / ______ / ______ .

4.

List the date that employees or individuals operating on your behalf first offered technical assistance, training or other

services to customers in Pennsylvania ______ / ______ / ______ .

5.

List the date that the entity first leased or owned an office in Pennsylvania: ______ / ______ / ______ .

6.

List the date that the entity first owned or was lessor or lessee of any real tangible personal property

in Pennsylvania: ______ / ______ / ______ .

Owned

Leased

7.

List the date that the entity first brought equipment or tangible personal property into Pennsylvania to conduct

business activities: ______ / ______ / ______ .

8.

List the date that the entity first had inventories in Pennsylvania: ______ / ______ / ______ .

9.

If the entity performs a service in Pennsylvania, please describe:

10. List the date that the entity first delivered its product to Pennsylvania customers ______ / ______ / ______ .

11. List the date that the entity first had interest(s) in partnership(s) which have any activities, operations, or real estate ownership in

Pennsylvania ______ / ______ / ______ . [Provide name, address, Federal ID Number of partnership(s)].

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2