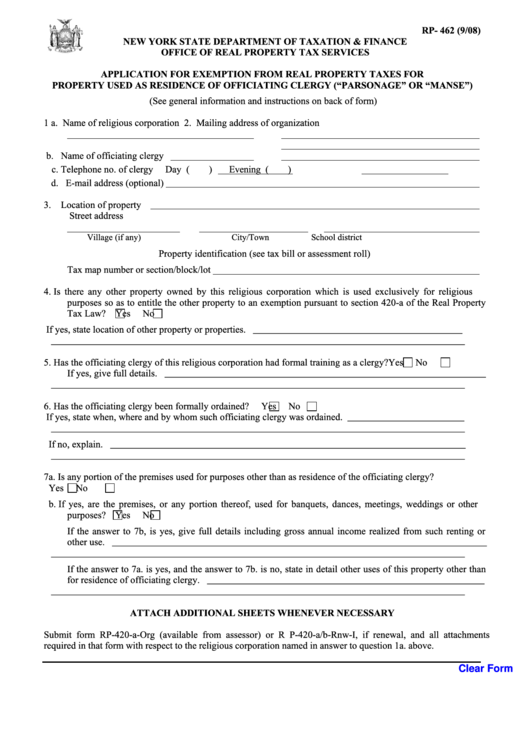

RP- 462 (9/08)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR EXEMPTION FROM REAL PROPERTY TAXES FOR

PROPERTY USED AS RESIDENCE OF OFFICIATING CLERGY (“PARSONAGE” OR “MANSE”)

(See general information and instructions on back of form)

1 a. Name of religious corporation

2. Mailing address of organization

b. Name of officiating clergy

c. Telephone no. of clergy

Day (

)

Evening (

)

d. E-mail address (optional)

3.

Location of property

Street address

Village (if any)

City/Town

School district

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot

4.

Is t here a ny ot her p roperty ow ned by t his r eligious c orporation w hich i s used e xclusively f or r eligious

purposes so as to entitle the other property to an exemption pursuant to section 420-a of the Real Property

Tax Law?

Yes

No

If yes, state location of other property or properties. ___________________________________________

_____________________________________________________________________________________

5.

Has the officiating clergy of this religious corporation had formal training as a clergy?

Yes

No

If yes, give full details. __________________________________________________________________

_____________________________________________________________________________________

6.

Has the officiating clergy been formally ordained?

Yes

No

If yes, state when, where and by whom such officiating clergy was ordained. ________________________

_____________________________________________________________________________________

If no, explain. _________________________________________________________________________

_____________________________________________________________________________________

7a.

Is any portion of the premises used for purposes other than as residence of the officiating clergy?

Yes

No

b.

If yes, are the p remises, or any por tion thereof, used f or b anquets, dances, meetings, weddings or ot her

purposes?

Yes

No

If t he a nswer t o 7b, i s yes, give f ull de tails i ncluding gross a nnual i ncome r ealized f rom s uch r enting or

other use. _____________________________________________________________________________

_____________________________________________________________________________________

If the answer to 7a. is yes, and the answer to 7b. is no, state in detail other uses of this property other than

for residence of officiating clergy. _________________________________________________________

_____________________________________________________________________________________

ATTACH ADDITIONAL SHEETS WHENEVER NECESSARY

Submit f orm R P-420-a-Org ( available f rom assess or) or R P-420-a/b-Rnw-I, i f r enewal, a nd a ll a ttachments

required in that form with respect to the religious corporation named in answer to question 1a. above.

Clear Form

1

1 2

2