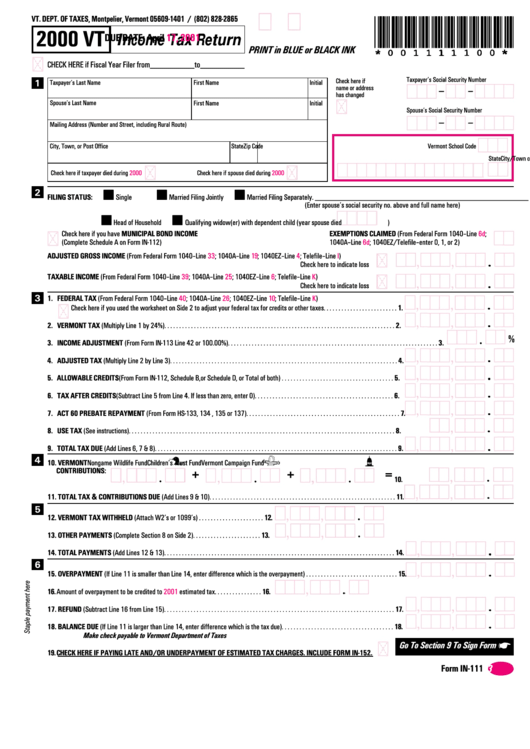

Form In-111 - Income Tax Return - 2000

ADVERTISEMENT

VT. DEPT. OF TAXES, Montpelier, Vermont 05609-1401 / (802) 828-2865

2000 VT

DUE DATE: April

17, 2001

Income Tax Return

PRINT in BLUE or BLACK INK

CHECK HERE if Fiscal Year Filer from__________ to __________

Taxpayer’s Social Security Number

Check here if

1

Taxpayer’s Last Name

First Name

Initial

name or address

has changed

Spouse’s Last Name

First Name

Initial

Spouse’s Social Security Number

Mailing Address (Number and Street, including Rural Route)

City, Town, or Post Office

State

Zip Code

Vermont School Code

City/Town of Legal Residence on

12/31/2000

State

Check here if taxpayer died during

2000

Check here if spouse died during

2000

2

FILING STATUS:

Single

Married Filing Jointly

Married Filing Separately. ______________________________________________________

(Enter spouse’s social security no. above and full name here)

Head of Household

Qualifying widow(er) with dependent child (year spouse died

)

Check here if you have MUNICIPAL BOND INCOME

EXEMPTIONS CLAIMED (From Federal Form 1040–Line 6d;

(Complete Schedule A on Form IN-112)

1040A–Line 6d; 1040EZ/Telefile–enter 0, 1, or 2)

ADJUSTED GROSS INCOME (From Federal Form 1040–Line 33; 1040A–Line 19; 1040EZ–Line 4; Telefile–Line I)

Check here to indicate loss

TAXABLE INCOME (From Federal Form 1040–Line 39; 1040A–Line 25; 1040EZ–Line 6; Telefile–Line K)

Check here to indicate loss

3

1. FEDERAL TAX (From Federal Form 1040–Line 40; 1040A–Line 26; 1040EZ–Line 10; Telefile–Line K)

Check here if you used the worksheet on Side 2 to adjust your federal tax for credits or other taxes . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. VERMONT TAX (Multiply Line 1 by 24%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

%

3. INCOME ADJUSTMENT (From Form IN-113 Line 42 or 100.00%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. ADJUSTED TAX (Multiply Line 2 by Line 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. ALLOWABLE CREDITS (From Form IN-112, Schedule B, or Schedule D, or Total of both) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. TAX AFTER CREDITS (Subtract Line 5 from Line 4. If less than zero, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. ACT 60 PREBATE REPAYMENT (From Form HS-133, 134 , 135 or 137) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. USE TAX (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. TOTAL TAX DUE (Add Lines 6, 7 & 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

4

10. VERMONT

Nongame Wildlife Fund

Children’s Trust Fund

Vermont Campaign Fund

CONTRIBUTIONS:

+

+

=

10.

11. TOTAL TAX & CONTRIBUTIONS DUE (Add Lines 9 & 10). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

5

12. VERMONT TAX WITHHELD (Attach W2’s or 1099’s) . . . . . . . . . . . . . . . . . . . . . . 12.

13. OTHER PAYMENTS (Complete Section 8 on Side 2) . . . . . . . . . . . . . . . . . . . . . . . 13.

14. TOTAL PAYMENTS (Add Lines 12 & 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

6

15. OVERPAYMENT (If Line 11 is smaller than Line 14, enter difference which is the overpayment) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. Amount of overpayment to be credited to

2001

estimated tax . . . . . . . . . . . . . . . . 16.

17. REFUND (Subtract Line 16 from Line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

18. BALANCE DUE (If Line 11 is larger than Line 14, enter difference which is the tax due) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

Make check payable to Vermont Department of Taxes

Go To Section 9 To Sign Form

19. CHECK HERE IF PAYING LATE AND/OR UNDERPAYMENT OF ESTIMATED TAX CHARGES. INCLUDE FORM IN-152.

Form IN-111

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2