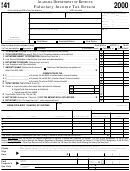

Form In-111 - Income Tax Return - 2000 Page 2

ADVERTISEMENT

Staple W-2/1099’s here

FEDERAL TAX

7

The following lines reference the Federal Form 1040A:

1a. Federal Tax (Line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a.

2a. Credit for Child and Dependent Care Expenses (Line 27) . . . . . . . . . . . . . . . . . . . . 2a.

3a. Credit for the Elderly or the Disabled (Line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a.

4a. TOTAL FEDERAL ADJUSTED TAX (Line 1a minus Line 2a minus Line 3a) Enter here and on Side 1 Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a.

The following lines reference the Federal Form 1040:

6. Credit for Child and Dependent Care

1. Federal Tax (Line 40) . . . . . . . . . . . . . . . . . 1.

Expenses (Line 44) . . . . . . . . . . . . . . . . . . . . 6.

7. Credit for the Elderly or the Disabled

2. Alternative Minimum Tax (Line 41) . . . . . 2.

(Line 45) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

3. Tax on Qualified Retirement Plans

(including IRAs) and MSAs (Line 54) . . . 3.

8. Investment Tax Credit. . . . . . . . . . . . . . . . . . 8.

4. Recapture of Investment Tax Credit . . . . . 4.

9. Alternative Minimum Tax Credit . . . . . . . . . 9.

5. TOTAL (Add Lines 1–4). . . . . . . . . . . . . . . 5.

10. TOTAL (Add Lines 6–9). . . . . . . . . . . . . . . 10.

11. TOTAL FEDERAL ADJUSTED TAX (Line 5 minus Line 10) Enter here and on Side 1 Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

OTHER PAYMENTS

8

1. Vermont Real Estate Withholding (See Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Non-resident partner, shareholder payments (From Form WH-435) . . . . . . . . . . . . . 2.

3.

2000

Estimated Tax or Extension Payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Renter Rebate (From Form PR-141, Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Homeowner Act 60 Benefit and Rebate (From Form HS-133, 134 or 135). . . . . . . . . . . . . . . . . . . . 5.

6. Earned Income Credit (From Form IN-112, Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. TOTAL PAYMENTS (Add Lines 1–6) Enter result here and on Side 1, Line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

9

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

SIGN

they are true, correct and complete. Preparers cannot use return information for purposes other than preparing returns.

HERE

Your signature

Date

Your occupation

Check if age Telephone Number (optional)

65 or older

Keep

a copy

for your

Spouse’s signature. If a joint return, BOTH must sign.

Date

Spouse’s occupation

records.

Check here if authorizing the Vermont Department of Taxes to discuss this return and attachments with your preparer.

Preparer’s signature

Date

Check if self-employed

Preparer’s SSN or PTIN

Paid

Preparer’s

Firm’s name (or yours if self-employed) and address

EIN

Use Only

ZIP code

14

Form IN-111

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2