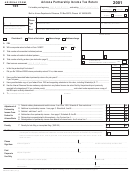

Arizona Form 165 - Arizona Partnership Income Tax Return - 2002 Page 2

ADVERTISEMENT

AZ Form 165 (2002) Page 2

Schedule A - Additions to Partnership Income

A1 Federal bonus depreciation allowed under IRC § 168(k) - see instructions .................................................................................... A1

00

A2 Non-Arizona municipal bond interest............................................................................................................................................... A2

00

A3 Capital investment by qualifi ed defense contractor ......................................................................................................................... A3

00

A4 Additions related to Arizona tax credits............................................................................................................................................ A4

00

A5 Other additions to partnership income............................................................................................................................................. A5

00

A6 Total additions to partnership income - add lines A1 through A5. Enter total here and on page 1, line 2 ........................................ A6

00

Schedule B - Subtractions From Partnership Income

B1 Arizona adjustment for IRC § 168(k) bonus depreciation - see instructions.................................................................................... B1

00

B2 Arizona depreciation adjustment for property sold or otherwise disposed of during the taxable year - see instructions................. B2

00

B3 Interest from U.S. government obligations ...................................................................................................................................... B3

00

B4 Difference in adjusted basis of property .......................................................................................................................................... B4

00

B5 Agricultural crops charitable contribution - see instructions............................................................................................................. B5

00

B6 Capital investment by qualifi ed defense contractor ......................................................................................................................... B6

00

B7 Sale of new energy effi cient residence(s) - see instructions............................................................................................................ B7

00

B8 Other subtractions from partnership income.................................................................................................................................... B8

00

B9 Total subtractions from partnership income - add lines B1 through B8. Enter total here and on page 1, line 4 .............................. B9

00

Schedule C - Apportionment Formula (Multistate Partnerships Only)

See instruction pages 6 and 7

NOTE: Qualifying air carriers must use Schedule ACA

C1 Property Factor

Column A

Column B

Column C

Value of real and tangible personal property (by averaging the value of

Total

Total Within

Ratio Within

owned property used at the beginning and end of the tax period; rented

Within

and

Arizona

property at capitalized value)

A ÷ B

Arizona

Without Arizona

a. Owned property (at original cost):

Inventories ............................................................................................

Depreciable assets ...............................................................................

Land......................................................................................................

Other assets - (describe) ___________________________________

(

)

(

)

Minus: Construction in progress (if included in above totals) ...............

(

)

(

)

Minus: Nonbusiness property (if included in above totals) ...................

Total of section a...................................................................................

b. Rented property (capitalize at 8 times net rental paid) .........................

•

c. Total owned and rented property (section a total plus section b)..........

C2 Payroll Factor

Total wages, salaries, commissions and other compensation to employees

•

(per federal Form 1065 or payroll reports) ...................................................

C3 Sales Factor

a. Sales delivered or shipped to Arizona purchasers................................

b. Other gross receipts .............................................................................

c. Total sales and other gross receipts .....................................................

X 2

d. Double weight Arizona sales and gross receipts ..................................

e. Sales factor (for column A - multiply item c by item d; for column B -

•

enter amount from item c).....................................................................

•

C4 Total ratio - add C1(c), C2 and C3(e) in column C............................................................................................................................

C5 Average apportionment ratio - divide C4 by four (4). Enter the result in column C and on the Arizona

•

Schedule K-1(NR) in column (b).........................................................................................................................................................

Schedule D - Business Information

Describe briefl y the nature and location(s) of the partnership’s Arizona business activities:

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

Describe briefl y the nature and location(s) of the partnership’s business activities outside of Arizona:

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

ADOR 91-0031 (02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2