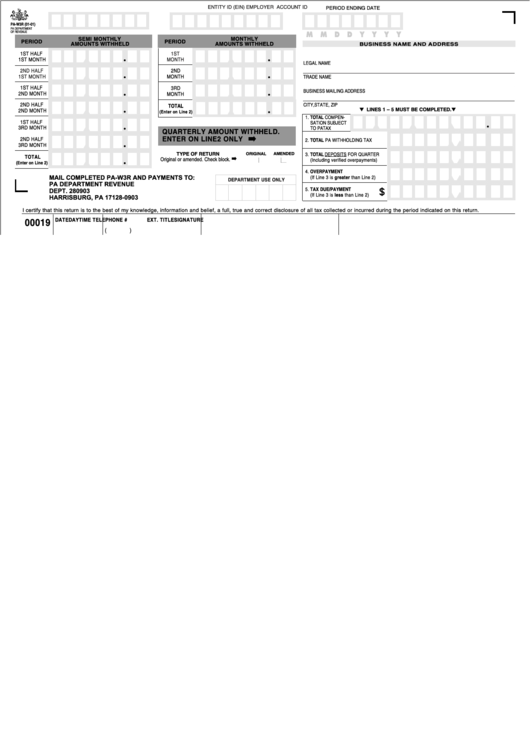

Form Pa-W3r - Employer Quarterly Reconciliation Return Of Income Tax Withheld-Replacement Coupon

ADVERTISEMENT

EMPLOYER ACCOUNT ID

ENTITY ID (EIN)

PERIOD ENDING DATE

PA-W3R (01-01)

PA DEPARTMENT

OF REVENUE

M M D D Y Y Y Y

SEMI MONTHLY

MONTHLY

PERIOD

PERIOD

AMOUNTS WITHHELD

BUSINESS NAME AND ADDRESS

AMOUNTS WITHHELD

1ST HALF

1ST

L

L

1ST MONTH

MONTH

G

G

LEGAL NAME

2ND HALF

2ND

L

L

1ST MONTH

MONTH

TRADE NAME

G

G

1ST HALF

3RD

L

L

BUSINESS MAILING ADDRESS

2ND MONTH

MONTH

G

G

2ND HALF

CITY, STATE, ZIP

TOTAL

L

L

M LINES 1 – 5 MUST BE COMPLETED. M

2ND MONTH

G

(Enter on Line 2)

G

1. TOTAL COMPEN-

1ST HALF

L

L

L

SATION SUBJECT

L

G

3RD MONTH

TO PA TAX

G

QUARTERLY AMOUNT WITHHELD.

➡

ENTER ON LINE 2 ONLY

2ND HALF

L

L

2. TOTAL PA WITHHOLDING TAX

L

3RD MONTH

G

G

TYPE OF RETURN

ORIGINAL

AMENDED

3. TOTAL DEPOSITS FOR QUARTER

➡

TOTAL

L

L

L

Original or amended. Check block.

(Including verified overpayments)

G

(Enter on Line 2)

G

4. OVERPAYMENT

L

L

MAIL COMPLETED PA-W3R AND PAYMENTS TO:

(If Line 3 is greater than Line 2)

G

DEPARTMENT USE ONLY

PA DEPARTMENT REVENUE

5. TAX DUE/PAYMENT

$

DEPT. 280903

L

L

(If Line 3 is less than Line 2)

G

HARRISBURG, PA 17128-0903

I certify that this return is to the best of my knowledge, information and belief, a full, true and correct disclosure of all tax collected or incurred during the period indicated on this return.

DATE

DAYTIME TELEPHONE #

EXT.

TITLE

SIGNATURE

00019

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2