Instructions For The Completion Of Form Pa-W3r Employer Quarterly Reconciliation Return Of Income Tax Withheld - State Of Pennsylvania

ADVERTISEMENT

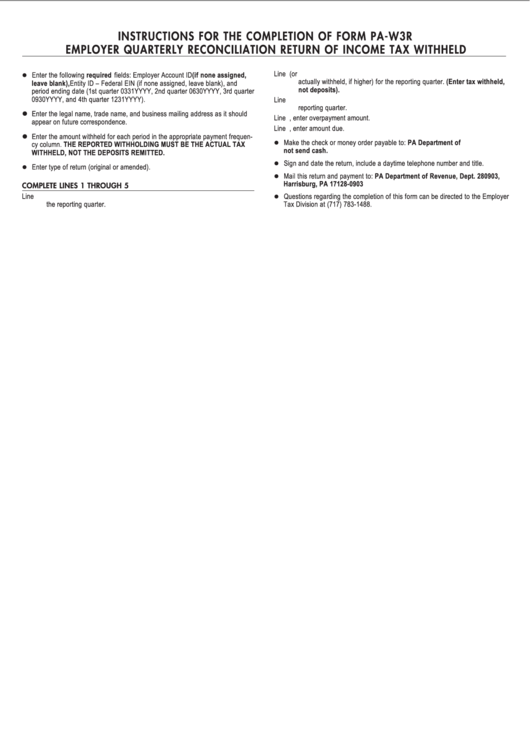

INSTRUCTIONS FOR THE COMPLETION OF FORM PA-W3R

EMPLOYER QUARTERLY RECONCILIATION RETURN OF INCOME TAX WITHHELD

Line 2. Enter the total amount of PA withholding tax required to be withheld (or

Enter the following required fields: Employer Account ID (if none assigned,

actually withheld, if higher) for the reporting quarter. (Enter tax withheld,

leave blank), Entity ID – Federal EIN (if none assigned, leave blank), and

not deposits).

period ending date (1st quarter 0331YYYY, 2nd quarter 0630YYYY, 3rd quarter

0930YYYY, and 4th quarter 1231YYYY).

Line 3. Enter the amount of PA withholding tax paid to the Commonwealth for the

reporting quarter.

Enter the legal name, trade name, and business mailing address as it should

Line 4. If line 3 is greater than line 2, enter overpayment amount.

appear on future correspondence.

Line 5. If Line 3 is less than line 2, enter amount due.

Enter the amount withheld for each period in the appropriate payment frequen-

Make the check or money order payable to: PA Department of Revenue. Do

cy column. THE REPORTED WITHHOLDING MUST BE THE ACTUAL TAX

not send cash.

WITHHELD, NOT THE DEPOSITS REMITTED.

Sign and date the return, include a daytime telephone number and title.

Enter type of return (original or amended).

Mail this return and payment to: PA Department of Revenue, Dept. 280903,

Harrisburg, PA 17128-0903

COMPLETE LINES 1 THROUGH 5

Line 1. Enter the total amount of compensation subject to PA withholding tax for

Questions regarding the completion of this form can be directed to the Employer

the reporting quarter.

Tax Division at (717) 783-1488.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1