Instructions - Cca Form 120-18 Page 2

ADVERTISEMENT

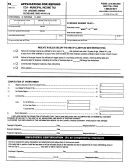

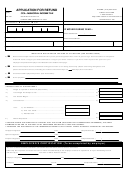

INSTRUCTIONS - CCA FORM 120-18

W ho M ay U se T his Fo rm: P er son s seek in g a r ef un d of m un ic ip al tax p aid to a C C A m em b er cit y. T h e lis t of m em b er cit ies ac c om p an ies th is f or m .

NOTE:

If the am ount of overpaymen t is less than $ 1.00 , the am ount w ill not be refun ded. T he c ities of G rand R apids and M edina

have ord inan ces w hic h s pec ify th at an y am oun t les s than $5 .00 will n ot be ref un ded . T he IR S mus t be notified by

CC A of all refunds in excess of $10.00.

Year of Return: Enter the year for which this claim covers in the upper left-hand corner of this form. A separate return is required for each year filed.

NOTE:

The Statute of Limitations for refunds is three (3) years. The City of Painesville’s Statute of Limitations for refunds is five (5) years.

Social Security Nu mbe r:

Enter your social security number clearly. If you are filing a joint return, include your spous e’s social security numb er.

Name & Ad dress:

En ter your nam e and ad dres s in th e sp ace pr ovided. If you m oved dur ing the year, ind icate the d ate moved an d s how your form er

address.

Kind of Claim Filed:

M ark the box for the type of refund claim you are filing.

A.

Under the age limit to pay tax - A r ead ab le c op y of th e b ir th c er tif ic at e or dr iver ’s lic en s e m u s t ac c om p an y th e f or m .

NOTE:

G rand R iver, Medin a, Metam ora, and P ainesville use 1 6 as the m inimu m ag e.

Cr eston u ses 19 as the m inimu m ag e.

If you reached the minimum age to pay tax during the year, your employer must complete the employer’s certification and

provide a break down of how mu ch was earned b efore the b irthdate and how m uc h was earned af ter the birth date.

Pay stubs can be submitted in lieu of the employer’s certification.

B.

Tim e out o f the em ploy me nt city - Must be documented with a travel log showing the date, place and business

purpose of travel. The employer’s certification must be signed. The following formula is used to arrive at the percentage of

inc om e to b e exc lud ed f rom tax:

Days W orked O ut of th e City X L ocal W ages = A mou nt E xclud ed

Total W orking Days (260)

Satu rdays , Su ndays , sic k days , vacation days and h olidays are not to be c ounted as d ays wor ked out of the city.

T otal working days s hould b e 260 , unles s you w orked a p artial year. On th e incom e earned w hile traveling, you will owe

resid enc e tax to your home c ity at the full perc entage rate. C CA mem ber c ity residents will have to file CC A F orm 1 20- 16.

Non -C CA mem ber res idents may be as ked to s how p roof of f iling with th eir city of res idenc e.

C .

Unreim burs ed E mp loyee Busine ss Ex pens es - You must explain in detail and document claim. Federal forms

2106 and Schedule A, must be submitted for business expenses. For municipal income tax purposes,

the deduction is limited to unreimbursed em ployee expenses less 2 % of F ederal Adjusted G ross incom e (“AG I”).

D.

Other - You must explain in detail and document the claim. Federal form 3903 must be submitted for moving expenses.

Co mp utation o f ove r pay me nt:

Line 1:

Enter the amount of local wages that your employer showed on your W -2 Form. W ages that are deferred for Federal and

State purposes must be included in Local W ages. All W -2 Forms, 1099's and statements showing reimbursements

must be attached. If more than one employer, use the worksheet on the reverse side to total your wages.

Line 2:

Enter th e am oun t of wag es that are to be exclu ded from tax.

Line 3:

Subtract the amount on line 2 from the amount shown on line 1.

Line 4:

T he c orre ct ed tax is fou nd by m ultip lying the net taxab le inc om e tim es the tax rate for th e city that you are p aying tax.

Line 5:

Th e amount of tax withheld by your employer.

Line 6:

A p rior year amoun t taken as a cred it.

Line 7:

Es timated payments m ade directly to CC A during the year.

Line 8:

Enter the total credits on line 8.

Line 9:

T he am ount of your refu nd req ues t is fou nd b y sub tracting the am ount on line 8 from the line 4 am ount.

Sign Your Return: Your return is not complete if it is not signed. On a joint return, both husband and wife must sign. If you are filing

t his f or m on beh alf of an ot her per son , a P ow er of A tt or ney f or m m us t ac c om p an y th is f or m .

Em ploy er’s Ce rtification: T he E mp loyer’s C ertification m us t be sig ned b y the emp loyee’s sup ervisor or other r esp ons ible repres entative

of the employer who has knowledge that the information given is true and correct. If more than one employer, each employer must sign

a separate employer’s certification.

Penalties for filing a F raud ulent R eturn: Pers ons filing a fr audu lent return sh all be guilty of a m isdem eanor and sh all be fined n ot

more th an Five H und red D ollars ($5 00.0 0) im pris oned n ot more th an s ix (6) m onths or both, f or each offen se.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2