Form Tr-2 - Ohio Tire Fee Return

ADVERTISEMENT

Tire Fee Form

TR-2 Rev. 12/02

P.O. Box 530= Columbus, OH 43216-0530

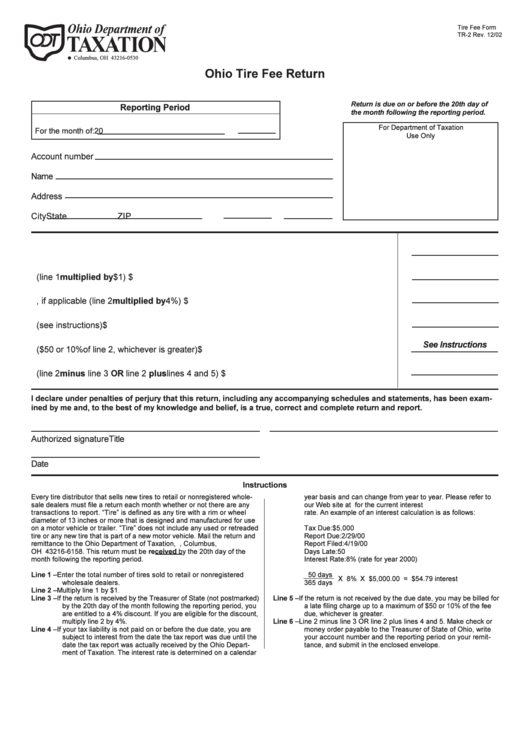

Ohio Tire Fee Return

Return is due on or before the 20th day of

Reporting Period

the month following the reporting period.

For Department of Taxation

For the month of:

20

Use Only

Account number

Name

Address

City

State

ZIP

1. Tires sold ...............................................................................................................................

2. Liability (line 1 multiplied by $1) ..........................................................................................

$

3. Less discount, if applicable (line 2 multiplied by 4%) ...........................................................

$

4. Interest on late payment (see instructions) ............................................................................

$

See Instructions

5. Late filing charge ($50 or 10% of line 2, whichever is greater) .................................................

$

6. Total amount due (line 2 minus line 3 OR line 2 plus lines 4 and 5).......................................

$

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has been exam-

ined by me and, to the best of my knowledge and belief, is a true, correct and complete return and report.

Authorized signature

Title

Date

Instructions

Every tire distributor that sells new tires to retail or nonregistered whole-

year basis and can change from year to year. Please refer to

sale dealers must file a return each month whether or not there are any

our Web site at for the current interest

transactions to report. “Tire” is defined as any tire with a rim or wheel

rate. An example of an interest calculation is as follows:

diameter of 13 inches or more that is designed and manufactured for use

on a motor vehicle or trailer. “Tire” does not include any used or retreaded

Tax Due:

$5,000

tire or any new tire that is part of a new motor vehicle. Mail the return and

Report Due:

2/29/00

remittance to the Ohio Department of Taxation, P.O. Box 16158, Columbus,

Report Filed:

4/19/00

OH 43216-6158. This return must be received by the 20th day of the

Days Late:

50

month following the reporting period.

Interest Rate:

8% (rate for year 2000)

Line 1 – Enter the total number of tires sold to retail or nonregistered

50 days

X 8% X $5,000.00 = $54.79 interest

wholesale dealers.

365 days

Line 2 – Multiply line 1 by $1.

Line 3 – If the return is received by the Treasurer of State (not postmarked)

Line 5 – If the return is not received by the due date, you may be billed for

by the 20th day of the month following the reporting period, you

a late filing charge up to a maximum of $50 or 10% of the fee

are entitled to a 4% discount. If you are eligible for the discount,

due, whichever is greater.

multiply line 2 by 4%.

Line 6 – Line 2 minus line 3 OR line 2 plus lines 4 and 5. Make check or

Line 4 – If your tax liability is not paid on or before the due date, you are

money order payable to the Treasurer of State of Ohio, write

subject to interest from the date the tax report was due until the

your account number and the reporting period on your remit-

date the tax report was actually received by the Ohio Depart-

tance, and submit in the enclosed envelope.

ment of Taxation. The interest rate is determined on a calendar

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1