Tire Fee Form Tr-2 - Ohio Tire Fee Return

ADVERTISEMENT

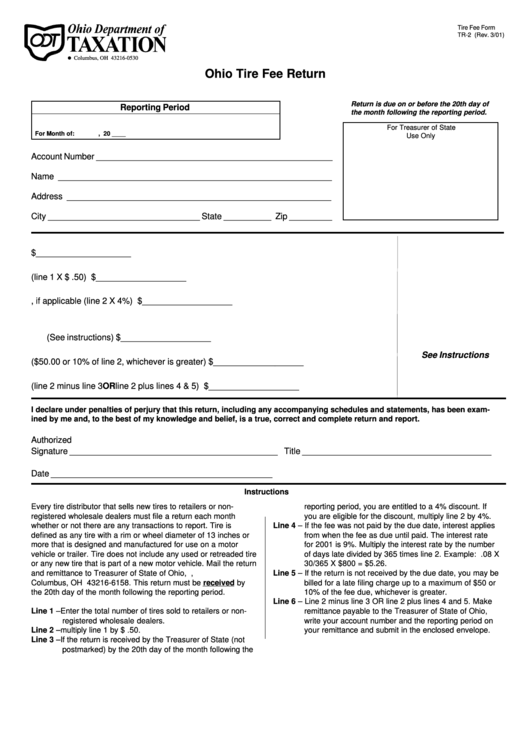

Tire Fee Form

TR-2 (Rev. 3/01)

P.O. Box 530= Columbus, OH 43216-0530

Ohio Tire Fee Return

Return is due on or before the 20th day of

Reporting Period

the month following the reporting period.

For Treasurer of State

For Month of:

, 20 ____

Use Only

Account Number __________________________________________________

Name __________________________________________________________

Address ________________________________________________________

City ________________________________ State __________ Zip _________

1. Tires sold ................................................................................................................................ $ ____________________

2. Liability (line 1 X $ .50) ............................................................................................................ $ ___________________

3. Less discount, if applicable (line 2 X 4%) ................................................................................ $ ___________________

4. Interest on late payment

(See instructions) .................................................................................................................... $ ___________________

See Instructions

5. Late filing charge ($50.00 or 10% of line 2, whichever is greater) ........................................... $ ___________________

6. Total amount due (line 2 minus line 3 OR line 2 plus lines 4 & 5) ............................................ $ ___________________

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has been exam-

ined by me and, to the best of my knowledge and belief, is a true, correct and complete return and report.

Authorized

Signature ____________________________________________ Title ________________________________________

Date _______________________________________________

Instructions

Every tire distributor that sells new tires to retailers or non-

reporting period, you are entitled to a 4% discount. If

registered wholesale dealers must file a return each month

you are eligible for the discount, multiply line 2 by 4%.

whether or not there are any transactions to report. Tire is

Line 4 – If the fee was not paid by the due date, interest applies

defined as any tire with a rim or wheel diameter of 13 inches or

from when the fee as due until paid. The interest rate

more that is designed and manufactured for use on a motor

for 2001 is 9%. Multiply the interest rate by the number

vehicle or trailer. Tire does not include any used or retreaded tire

of days late divided by 365 times line 2. Example: .08 X

or any new tire that is part of a new motor vehicle. Mail the return

30/365 X $800 = $5.26.

and remittance to Treasurer of State of Ohio, P.O. Box 16158,

Line 5 – If the return is not received by the due date, you may be

Columbus, OH 43216-6158. This return must be received by

billed for a late filing charge up to a maximum of $50 or

the 20th day of the month following the reporting period.

10% of the fee due, whichever is greater.

Line 6 – Line 2 minus line 3 OR line 2 plus lines 4 and 5. Make

Line 1 – Enter the total number of tires sold to retailers or non-

remittance payable to the Treasurer of State of Ohio,

registered wholesale dealers.

write your account number and the reporting period on

Line 2 – multiply line 1 by $ .50.

your remittance and submit in the enclosed envelope.

Line 3 – If the return is received by the Treasurer of State (not

postmarked) by the 20th day of the month following the

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1