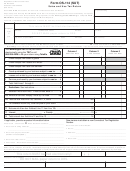

Form RMFT-5 Page 2

Follow our instructions for each column.

Column 1

Column 2

Column 3

Gasoline &

Special fuel except

combustible gases

dyed diesel fuel

Dyed diesel fuel

Step 6: Figure your tax

19 Figure your gross tax due. If the amount on Line 18 is greater than zero, enter

the amount from Line 18 on the line provided below and multiply by the tax rate

provided. Otherwise, enter “0” on Lines 19 - 21 within the column.

a

X 0.19. Enter the result in Column 1, Line 19.

Column 1, Line 18

b

X 0.215. Enter the result in Column 2, Line 19.

19 $

$

//////////////////////

Column 2, Line 18

20 If you are filing this return on time and paying your tax due in full, figure your

1.75% collection discount. If Line 19 is greater than zero, subtract Line 17 from

Line 13. If the difference is zero or less, enter “0” on Line 20 within the

appropriate column. Otherwise, enter the difference on the line provided below

and complete the formula.

a

X 0.19 X 0.0175. Enter the result in Column 1, Line 20.

Col. 1, Line 13 - Line 17

b

20 $

X 0.215 X 0.0175. Enter the result in Column 2, Line 20.

$

//////////////////////

Col. 2, Line 13 - Line 17

//////////////////////

21 Subtract Line 20 from Line 19. This is your net tax due by fuel type.

21 $

$

22 Add Column 1, Line 21 and Column 2, Line 21. This is your tax due.

22 $

Step 7: Figure the amount you owe

23 Enter the amount of credit you wish to apply. (See instructions.)

23 $

24 Subtract Line 23 from Line 22. This is the amount you owe. Make your check

payable to “Illinois Department of Revenue.”

24 $

Step 8: Sign and date your return

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and

complete.

Signature of person, other than taxpayer, who prepared this return

Date

Taxpayer’s name

Preparer’s phone number

Signature and title of taxpayer

Date

Mail this return and payment to: Illinois Department of Revenue, PO Box 19019, Springfield, IL 62794-9019

Print

Reset

RMFT-5 Page 2 (R-06/15)

1

1 2

2