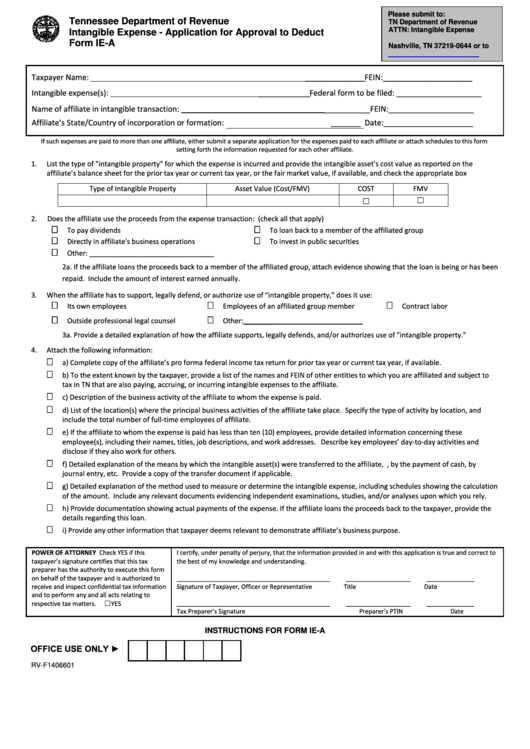

Form Ie-A - Intangible Expense - Application For Approval To Deduct

ADVERTISEMENT

Please submit to:

Tennessee Department of Revenue

TN Department of Revenue

ATTN: Intangible Expense

Intangible Expense - Application for Approval to Deduct

P.O. Box 190644

Form IE-A

Nashville, TN 37219-0644 or to

Intangible.Expense@tn.gov

Taxpayer Name:

______________FEIN:_____________________

Intangible expense(s):

____________Federal form to be filed: ____________________

Name of affiliate in intangible transaction:

___________FEIN:____________________

Affiliate’s State/Country of incorporation or formation:

_______ Date:_____________________

If such expenses are paid to more than one affiliate, either submit a separate application for the expenses paid to each affiliate or attach schedules to this form

setting forth the information requested for each other affiliate.

1.

List the type of "intangible property" for which the expense is incurred and provide the intangible asset’s cost value as reported on the

affiliate’s balance sheet for the prior tax year or current tax year, or the fair market value, if available, and check the appropriate box

Type of Intangible Property

Asset Value (Cost/FMV)

COST

FMV

☐

☐

2.

Does the affiliate use the proceeds from the expense transaction: (check all that apply)

To pay dividends

To loan back to a member of the affiliated group

Directly in affiliate's business operations

To invest in public securities

Other: ________________________________

2a. If the affiliate loans the proceeds back to a member of the affiliated group, attach evidence showing that the loan is being or has been

repaid. Include the amount of interest earned annually.

3.

When the affiliate has to support, legally defend, or authorize use of "intangible property," does it use:

Its own employees

Employees of an affiliated group member

Contract labor

Outside professional legal counsel

Other: _______

3a. Provide a detailed explanation of how the affiliate supports, legally defends, and/or authorizes use of "intangible property."

4.

Attach the following information:

a) Complete copy of the affiliate’s pro forma federal income tax return for prior tax year or current tax year, if available.

b) To the extent known by the taxpayer, provide a list of the names and FEIN of other entities to which you are affiliated and subject to

tax in TN that are also paying, accruing, or incurring intangible expenses to the affiliate.

c) Description of the business activity of the affiliate to whom the expense is paid.

d) List of the location(s) where the principal business activities of the affiliate take place. Specify the type of activity by location, and

include the total number of full-time employees of affiliate.

e) If the affiliate to whom the expense is paid has less than ten (10) employees, provide detailed information concerning these

employee(s), including their names, titles, job descriptions, and work addresses. Describe key employees’ day-to-day activities and

disclose if they also work for others.

f) Detailed explanation of the means by which the intangible asset(s) were transferred to the affiliate, e.g., by the payment of cash, by

journal entry, etc. Provide a copy of the transfer document if applicable.

g) Detailed explanation of the method used to measure or determine the intangible expense, including schedules showing the calculation

of the amount. Include any relevant documents evidencing independent examinations, studies, and/or analyses upon which you rely.

h) Provide documentation showing actual payments of the expense. If the affiliate loans the proceeds back to the taxpayer, provide the

details regarding this loan.

i) Provide any other information that taxpayer deems relevant to demonstrate affiliate’s business purpose.

POWER OF ATTORNEY Check YES if this

I certify, under penalty of perjury, that the information provided in and with this application is true and correct to

taxpayer’s signature certifies that this tax

the best of my knowledge and understanding.

preparer has the authority to execute this form

on behalf of the taxpayer and is authorized to

_____________________________________________

___________________

______________

receive and inspect confidential tax information

Signature of Taxpayer, Officer or Representative

Title

Date

and to perform any and all acts relating to

☐ YES

respective tax matters.

_____________________________________________

___________________

______________

Tax Preparer’s Signature

Preparer’s PTIN

Date

INSTRUCTIONS FOR FORM IE-A

OFFICE USE ONLY ►

RV-F1406601

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1