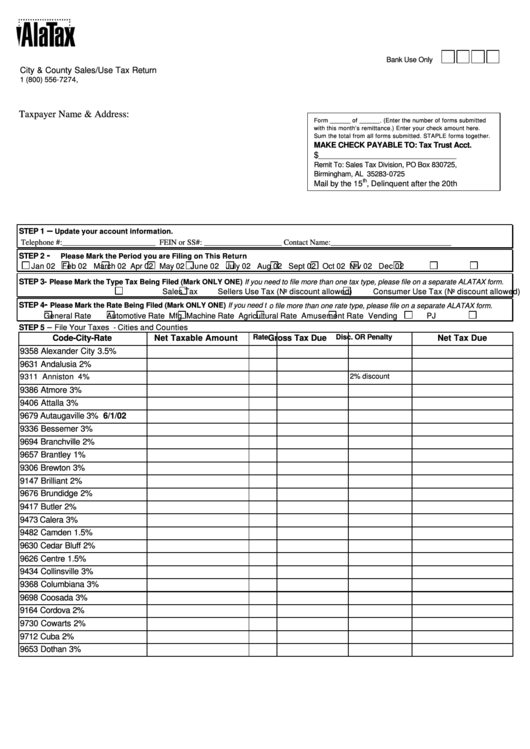

Alatax City And County Sales/use Tax Return Form

ADVERTISEMENT

Bank Use Only

City & County Sales/Use Tax Return

1 (800) 556-7274,

Taxpayer Name & Address:

Form ______ of ______. (Enter the number of forms submitted

with this month’s remittance.) Enter your check amount here.

Sum the total from all forms submitted. STAPLE forms together.

MAKE CHECK PAYABLE TO: Tax Trust Acct.

$

__________________________________________

Remit To: Sales Tax Division, PO Box 830725,

Birmingham, AL 35283-0725

th

Mail by the 15

, Delinquent after the 20th

–

STEP 1

Update your account information.

Telephone #:________________________ FEIN or SS#: ____________________ Contact Name:_______________________________

-

STEP 2

Please Mark the Period you are Filing on This Return

Jan 02

Feb 02

March 02

Apr 02

May 02

June 02

July 02

Aug 02

Sept 02

Oct 02

Nov 02

Dec 02

STEP 3-

Please Mark the Type Tax Being Filed (Mark ONLY ONE) If you need to file more than one tax type, please file on a separate ALATAX form.

Sales Tax

Sellers Use Tax (No discount allowed)

Consumer Use Tax (No discount allowed)

-

STEP 4

Please Mark the Rate Being Filed (Mark ONLY ONE) If you need to file more than one rate type, please file on a separate ALATAX form.

General Rate

Automotive Rate

Mfg. Machine Rate

Agricultural Rate

Amusement Rate

Vending

PJ

–

STEP 5

File Your Taxes - Cities and Counties

Rate

Disc. OR Penalty

Code-City-Rate

Net Taxable Amount

Gross Tax Due

Net Tax Due

9358 Alexander City 3.5%

9631 Andalusia 2%

9311 Anniston 4%

2% discount

9386 Atmore 3%

9406 Attalla 3%

9679 Autaugaville 3% 6/1/02

9336 Bessemer 3%

9694 Branchville 2%

9657 Brantley 1%

9306 Brewton 3%

9147 Brilliant 2%

9676 Brundidge 2%

9417 Butler 2%

9473 Calera 3%

9482 Camden 1.5%

9630 Cedar Bluff 2%

9626 Centre 1.5%

9434 Collinsville 3%

9368 Columbiana 3%

9698 Coosada 3%

9164 Cordova 2%

9730 Cowarts 2%

9712 Cuba 2%

9653 Dothan 3%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4