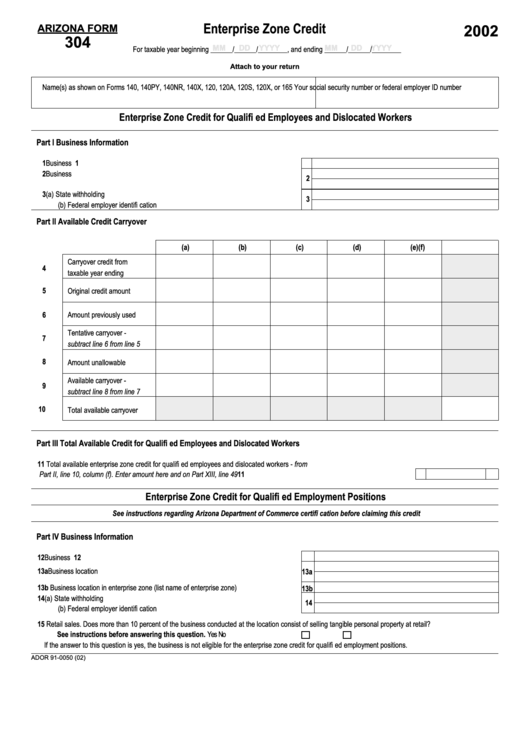

Arizona Form 304 - Enterprise Zone Credit - 2002

ADVERTISEMENT

Enterprise Zone Credit

ARIZONA FORM

2002

304

MM

MM

DD

DD

YYYY

YYYY

MM

MM

DD

DD

YYYY

YYYY

For taxable year beginning ______/______/________, and ending ______/______/________

Attach to your return

Name(s) as shown on Forms 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X, or 165

Your social security number or federal employer ID number

Enterprise Zone Credit for Qualifi ed Employees and Dislocated Workers

Part I

Business Information

1

Business name .............................................................................................................

1

2

Business location..........................................................................................................

2

3

(a) State withholding number........................................................................................

3

(b) Federal employer identifi cation number ..................................................................

Part II

Available Credit Carryover

(a)

(b)

(c)

(d)

(e)

(f)

Carryover credit from

4

taxable year ending

5

Original credit amount

6

Amount previously used

Tentative carryover -

7

subtract line 6 from line 5

8

Amount unallowable

Available carryover -

9

subtract line 8 from line 7

10

Total available carryover

Part III

Total Available Credit for Qualifi ed Employees and Dislocated Workers

11

Total available enterprise zone credit for qualifi ed employees and dislocated workers - from

Part II, line 10, column (f). Enter amount here and on Part XIII, line 49 ....................................................................................

11

Enterprise Zone Credit for Qualifi ed Employment Positions

See instructions regarding Arizona Department of Commerce certifi cation before claiming this credit

Part IV Business Information

12

Business name .............................................................................................................

12

13a

Business location address ............................................................................................

13a

13b Business location in enterprise zone (list name of enterprise zone).............................

13b

14

(a) State withholding number........................................................................................

14

(b) Federal employer identifi cation number ..................................................................

15

Retail sales. Does more than 10 percent of the business conducted at the location consist of selling tangible personal property at retail?

See instructions before answering this question.

Yes

No

If the answer to this question is yes, the business is not eligible for the enterprise zone credit for qualifi ed employment positions.

ADOR 91-0050 (02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6