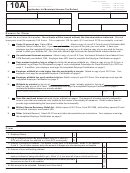

Form 37 - Regional Income Tax Agency - Cleveland - 2003 Page 2

ADVERTISEMENT

*FORM37F03B*

Section B

FORM37F03B

,

,

.00

a. Total W-2 Wages (From Section A, Row 1)

,

,

1a

a. Total W-2 Wages (From Section A, Column 1)

1.

,

,

.00

b. Total Schedule J Income (From Line 31)

(Cannot be less than zero)

,

,

1b

,

,

.00

Total of all Taxable Income (Add lines 1a and 1b)

,

,

2

2.

,

.00

Multiply Line 2 by Tax Rate of residence city

,

3

3.

,

.00

a. Tax withheld for all cities other than your residence city

,

4a

4.

,

b. Direct Payments (From line 35)

,

.00

4b

,

.00

a. Add lines 4a and 4b

,

5a

5.

b. Complete Worksheet 2 – enter total on line 5b

,

.00

Credit Limit for your residence city

(SEE INSTRUCTIONS)

,

5b

,

.00

c. Enter the amount From Line 5a or 5b whichever is less

,

5c

,

Multiply Line 5c by Tax Credit of residence city

.00

,

6

6.

,

.00

a. Tax withheld for your residence city

(SEE INSTRUCTIONS)

,

7a

7.

,

.00

b. Tax paid by your Partnership/S Corporation to any RITA MUNICIPALITY

,

7b

,

.00

Total credits allowable. (Add Lines 6, 7a and 7b)

,

8

8.

,

Subtract Line 8 from Line 3

.00

,

9

9.

,

.00

Tax on non withheld wages (from Line 32, Schedule K)

,

10

10.

Skip Lines 10 & 11 unless

,

Schedule K was used

Tax on Schedule J Income (from Line 36, Schedule K)

.00

,

11

11.

,

TOTAL TAX DUE RITA (Add lines 9, 10, and 11. Cannot be less than zero.) TOTAL DUE

.00

,

12.

12

,

.00

2002 Estimated Tax payments made to RITA

13.

2003 Estimated Tax payments made to RITA

,

13

,

.00

Credit carried forward from 2001

,

Credit carried forward from 2002

14

14.

,

TOTAL CREDITS (Add Lines 13 and 14)

.00

,

15.

15

,

If Line 15 is LESS than Line 12, enter the difference, which is the 2002 BALANCE DUE.

.00

16.

If Line 15 is LESS than Line 12, enter the difference, which is the 2003 BALANCE DUE.

16

,

If you owe less than $1.00 (For Bedford Hts. $5.00), you do not have to pay this amount.

If you owe less than $1.00 (For Bedford Hts. $5.00), you do not have to pay this amount.

,

.00

If Line 15 is GREATER than 12, enter the OVERPAYMENT

,

(may not be split between credit & refund)

17

17.

,

18. Amount to be CREDITED

.00

18

,

REFUNDS OF TAXES WITHHELD FROM YOUR WAGES AS SHOWN

ON FORM W-2 MUST BE APPLIED FOR ON AN APPLICATION

,

FOR MUNICIPAL TAX REFUND, FORM 10A.

.00

19. Amount to be REFUNDED

,

19

,

a. Enter 2003 Estimated Tax in Full (see instructions)

ESTIMATE

.00

,

20a

20a.

NOTE: IF LINE 20a IS LEFT BLANK, RITA WILL CALCULATE AN ESTIMATE FOR YOU.

,

.00

b. Enter full estimate (line 20a) or first quarter 2003 estimate (1/4 of Line 20a)

,

20b.

Enter full estimate (line 20a) or first quarter 2004 estimate (1/4 of Line 20a)

20b

,

Subtract Line 18 from Line 20b

.00

,

21

21.

TOTAL DUE by April 30, 2003

(Bexley, Galena, Martins Ferry, Marysville, Milan, Milford Ctr., Mt. Gilead, Mt. Sterling,

TOTAL DUE by April 30, 2004

22.

(Bexley, Galena, Martins Ferry, Marysville, Milan, Milford Center, Mount Sterling,

New Albany, Plymouth, Powell, Reynoldsburg, Shawnee Hills, Steubenville and

New Albany, Plymouth, Powell, Reynoldsburg, Shawnee Hills, Steubenville and

,

Toronto – April 15)

Toronto – April 15)

.00

Add Lines 16 and 21

,

22

Pay in full – Make check or money order payable to R.I.T.A.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3