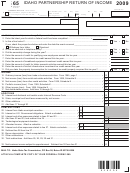

FO00201

Form ID K-1 Page 2

08-25-11

6. Interest expense and other expenses related to lines 3, 4, and 5.

a. Expenses related to non-Idaho interest and dividends included

in line 3 ............................................................................................ 6a

b. Expenses related to Idaho interest and dividends listed on line 4 ... 6b

c. Expenses related to U.S. Government obligations listed on line 5 .. 6c

7. Bonus depreciation deduction ..........................................................................................................

7

8. Idaho capital gain (loss) eligible for the Idaho capital gains deduction. Include schedule ..............

8

9. Idaho technological equipment donation .........................................................................................

9

10. Other Idaho additions. Include schedule ......................................................................................... 10

11. Other Idaho subtractions. Include schedule ....................................................................................

11

C. Pass-through Owner’s Share of Idaho Contributions. See instructions.

1. Contributions to Idaho educational entities ......................................................................................

1

2. Contributions to Idaho youth and rehabilitation facilities ..................................................................

2

D. Pass-through Owner’s Share of Idaho Credits and Credit Recapture. See instructions.

1. Investment tax credit .......................................................................................................................

1

2. Credit for production equipment using postconsumer waste ...........................................................

2

3. Promoter sponsored event credit .....................................................................................................

3

4. Credit for Idaho research activities .................................................................................................

4

5. Broadband equipment investment tax credit ....................................................................................

5

6. Incentive investment tax credit .........................................................................................................

6

7. Biofuel infrastructure investment tax credit ......................................................................................

7

8. Idaho small employer investment tax credit .....................................................................................

8

9. Idaho small employer real property improvement tax credit ............................................................

9

10. Idaho small employer new jobs tax credit ........................................................................................ 10

11. Recapture of investment tax credit ..................................................................................................

11

12. Recapture of broadband equipment investment credit .................................................................... 12

13. Recapture of biofuel infrastructure investment tax credit ................................................................. 13

14. Recapture of Idaho small employer investment tax credit ............................................................... 14

15. Recapture of Idaho small employer real property improvement tax credit ....................................... 15

16. Recapture of Idaho small employer new jobs tax credit .................................................................. 16

E. Supplemental Information.

1

1 2

2